gaming

Unlocking games revenue: player behavior and payment trends in the west | Newzoo x Tebex Whitepaper

Tebex, the leading payments solution for gaming, reaching $1Bn in processed payments and powering over 30,000 web stores, is launching the first industry-wide look at payment trends in EU and NA with Newzoo on Tuesday, August 12 at 09:00 AM CEST.

Why This Data Matters

In a maturing Western games market with slowing payer growth (North America: +1.1% CAGR, Europe: +3.1% CAGR, 2023-2027), studios must shift from acquiring new players to maximizing value from existing ones. The data reveals critical insights into player motivations, spending patterns, and payment preferences, enabling developers to craft targeted monetization strategies that boost revenue, enhance retention, and align with player expectations.

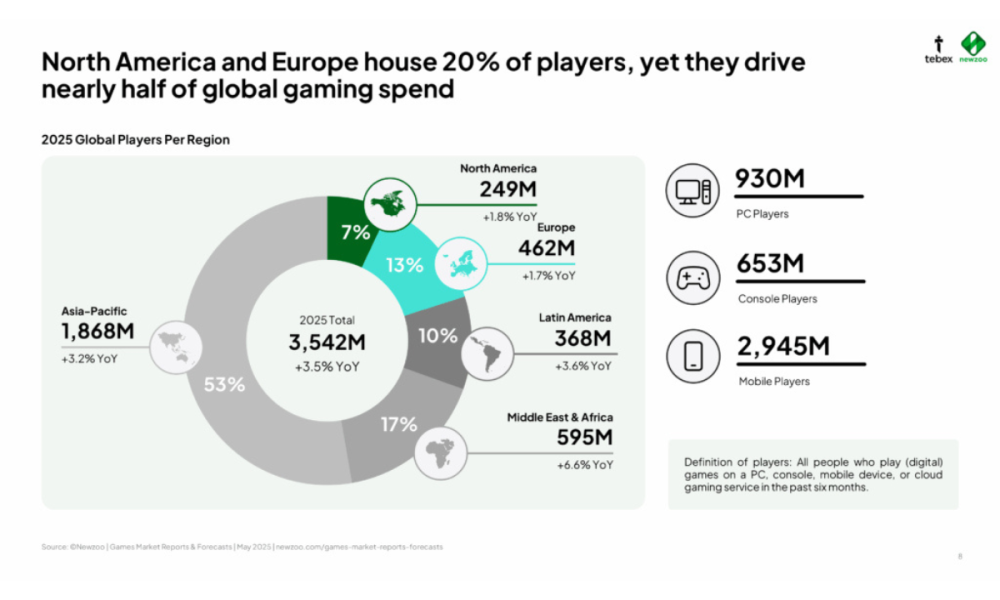

Global Market Snapshot (2025)

- Market Size: $188.9B (+3.4% YoY), with North America ($52.7B, 28%) and Europe ($33.1B, 18%) driving 46% of global spend despite housing only 20% of players (3.54B total).

- Payer Spending Power: North America leads with $324.9 avg. annual spend per payer; Europe averages $125.4 ($170.0 Western, $51.6 Eastern).

- Value: High per-payer spend in Western markets highlights the opportunity to deepen monetization through tailored strategies.

Spending Motivations Drive Strategy

- North America: 34% of payers spend to unlock exclusive content, 29% for personalization (character customization), reflecting a desire for self-expression. Studios can capitalize by offering unique cosmetics and content packs to drive engagement.

- Europe: 28% prioritize deals/offers, 21% value ad-free experiences, showing value-driven behavior. Discounted bundles and subscription models can increase conversion in this region.

- Value: Understanding regional motivations allows studios to align offerings with player priorities, enhancing loyalty and spend.

Diversified Spending Patterns

- North America: 27% of payers invest in content packs, power-ups, and in-game currencies, with subscriptions (24%) and battle passes (23%) also strong.

- Europe: In-game currencies and content packs lead (21% each), followed by subscriptions (20%) and gear/time-savers (18% each).

- Value: Diverse spending across virtual goods underscores the need for varied monetization options to capture a broad range of player preferences, boosting average transaction value (ATV).

Payment Methods Unlock Higher Spend

- ATV Trends (2025): Overall, ATV rose from $30 (2024) to $40. BNPL (North America: $85.0, Europe: $72.0) and crypto (North America: $94.8, Europe: $111.6) outperform cards (North America: $52.2, Europe: $42.7).

- Dual-Method Impact: Players using cards + BNPL/crypto maintain transaction frequency while spending more.

- Value: Offering alternative payment methods like BNPL and crypto can significantly increase ATV, especially in Western markets, without sacrificing transaction volume.

Revenue by Platform and Genre

- Microtransactions (MTX): Drive 49% of PC and 52% of console revenue in North America; 42% (PC) and 51% (console) in Europe. Mobile is near 100% in-game revenue.

- Top Genres: North America favors shooters, Europe prioritizes sports, with RPGs and puzzles strong in both.

- Value: High MTX revenue and genre preferences guide studios to focus on live services and region-specific content to maximize engagement.

Strategic Takeaways

- Deepen Monetization: With modest payer growth, studios must focus on existing players by offering personalized content and value-driven deals.

- Diversify Payment Options: Cards and wallet still dominate in volume, but integrating BNPL and crypto can unlock higher ATV, especially in Western markets.

- Align with Player Values: Transparency, fairness, and seamless payment experiences reduce churn and build loyalty in a competitive market.

- Understand the why and how players spend: NA players are more likely to spend for personalization and self-expression, while EU players are more value-conscious, prioritizing deals and an ad-free experience.

Quotes

Liam Wiltshire Head of Payments & Compliance at Tebex

“The future of gaming is about flexibility – meeting players where they are, with the methods they trust.”

This quote summarizes the importance of adapting to player-preferred payment methods like wallets, BNPL, and crypto to enhance accessibility and trust.

“Virtual currencies and microtransactions are no longer just revenue streams – they’re becoming strategic levers for retention and differentiation.”

This emphasizes the evolving role of microtransactions beyond revenue, focusing on engagement and player retention.

“Today’s players want to know what they’re paying for – and why. How you monetize matters more than ever.”

This highlights the need for transparency and fairness in monetization to build player trust and loyalty.

The post Unlocking games revenue: player behavior and payment trends in the west | Newzoo x Tebex Whitepaper appeared first on Gaming and Gambling Industry in the Americas.

Call of Duty

Monster Energy and Call of Duty Unite Again with Exclusive In-Game Rewards and Expanded Program Timing

Monster Energy is teaming up once again with Call of Duty to deliver bonus in-game rewards, bonus 2XP and an expanded promotional window that gives fans even more opportunities to fuel up and power their gameplay.

Gamers and Monster fans can start collecting codes to stockpile rewards ahead of the highly anticipated release of Call of Duty: Black Ops 7 on November 14. Following the record-breaking success of the last year’s program – the 2025 campaign has been extended and will run through March 31, 2026, with code redemption available until April 30, 2026.

Players who purchase specially marked Call of Duty cans of Monster Energy, Monster Zero Sugar, or Monster Zero Ultra can find a unique code under the tab and redeem it online at callofduty.monsterenergy.com. Every can unlocks bonus in-game items and double experience points.

2025 in-game rewards include:

• 1 Can = “Energy Flash” Large Decal + 15 min 2XP

• 2 Cans = “Peacekeeper MK1 – Hyper Green” Weapon Blueprint + 15 min 2XP

• 3 Cans = “Green Fury” Operator Skin + 15 min 2XP

• 4 Cans = “VS Recon – Green Thunder” Weapon Blueprint + 15 min 2XP

• 5 Cans = “Daylight Ripper” Operator Skin Recolor + 15 min 2XP

In addition, select retailers will feature specialty bonus in-game content such as Emblems, Charms, Weapon Stickers, and Dual 2XP.

And as an added bonus, fans who create an account on callofduty.monsterenergy.com before October 31 will score a Black Ops 6 in-game skin – no purchase required.

“Monster Energy is built on fueling competitive spirit and our collaboration with Call of Duty continues to push that to new levels. With expanded timing, bonus rewards and the unmatched value of Double XP in every can, this year’s program is our biggest and most exciting yet,” said Dan McHugh, Global Chief Marketing Officer at Monster Energy.

“We’re proud to continue building on the success of our partnership with Monster Energy. Monster is the go-to fuel of gamers and they are going to drink up these exciting in-game rewards,” added Cody Neal, Associate Director of Global Partnerships, Call of Duty.

The limited-edition Monster Energy Call of Duty cans are available in 16oz in Original Monster Energy, Monster Zero Sugar and Monster Zero Ultra. Special 4, 12, and 15 can Monster Energy Call of Duty multipacks are on shelves now.

The post Monster Energy and Call of Duty Unite Again with Exclusive In-Game Rewards and Expanded Program Timing appeared first on Gaming and Gambling Industry in the Americas.

gaming

Gamescom 2025: New Records and Important Impetus for the Games Industry in Germany and Worldwide

Gamescom 2025 ended with numerous new records and strong momentum for the games industry in Germany and worldwide. Records were once again set, particularly in terms of key figures such as internationality (70% of visitors from abroad, exhibitors from 72 countries), digital reach (more than 630 million views worldwide by 23 August evening alone), exhibition space (233,000 square metres) and the number of exhibitors (1568). On site, 357,000 fans visited the world’s largest festival of games culture. The number of trade visitors rose to 34,000, with a particularly strong increase in participants from the US, China, Canada and Japan.

“This year, gamescom 2025 is sending out a particularly positive signal. After two challenging years for the games industry, you could really feel the mood improving this year. The new record figures underline not only the global appeal of gamescom, but also the upward trend in the entire games industry. gamescom 2025 is also a milestone for the German games industry: political support for the additional tax-based games funding at gamescom was stronger than ever – from both the federal and the state level alike. This creates hope that progress will be made quickly. But there were also positive signals on many other political topics, whether for e-sports from Federal Minister Bär at the political opening or from Federal Minister for Family Affairs Karin Prien, who was just as convinced of the important work of the USK in the protection of minors as she was of the enormous potential of games for the education sector,” said Felix Falk, Managing Director of game – The German Games Industry Association, the co-organiser of gamescom.

Political interest in gamescom 2025 was greater than ever before. In total, over 600 politicians came to Cologne to see for themselves the current developments in the games industry and the enormous economic, cultural and technological potential of games. Whether from the federal states, the federal government or the EU, the political guests came from all levels. In addition, a particularly large number of international delegations travelled to gamescom, for example from this year’s gamescom partner country Thailand as well as from Brazil, Indonesia and India.

Gamescom 2026 will take place from 26 to 30 August. It will open on 25 August 2026 with the gamescom Opening Night Live.

The post Gamescom 2025: New Records and Important Impetus for the Games Industry in Germany and Worldwide appeared first on European Gaming Industry News.

gaming

Investment Opportunities in the Multi-billion-dollar Gaming Sector

The Gaming industry is growing day by day. It has already become a global entertainment giant. From sweeping open-world quests to quick, addictive mobile games, the industry has expanded into a multi-billion-dollar giant.

The global gaming industry was valued at over £135 billion ($184 billion) in 2023 and is projected to reach £184 billion ($250 billion) in 2030. It is driven by cloud gaming, which eliminates the need for costly consoles, high-speed internet, and immersive technologies like VR and AR. Revenues from VR gaming alone in 2023 exceeded £1.9 billion ($2.6 billion), and the AR gaming business is set to grow at a pace of over 30% annually.

The transition from physical to digital is virtually complete: in large markets, over 90% of games sold today are digital, with downloads, live services, and subscriptions replacing cartridges and discs.

Alternative Ways to Invest in Gaming

The gaming industry is not merely a business of copying the most recent blockbusting release; it’s a rich, diverse ecosystem with several streams of revenue, from historic game publishing to aggressive esports and the burgeoning betting and online gambling sector. Today’s investors are able to access entertainment-oriented and wagering-led segments, each with their distinct risk and reward profiles.

Video Game Development & Publishing

Envision house brands behind the mega-franchises of Call of Duty, FIFA or The Legend of Zelda. These brands have enormous fan bases and generate revenue that stretches far past the initial buy, with in-game purchases, downloadable packs and subscription content keeping gamers engaged and expenditures year-round.

Esports

Esports have now evolved from casual living-room games to multi-million-dollar tournaments streamed live in front of a global audience. Internet gambling on esports competitions is also becoming a niche but growing market, offering a new source of revenue for both organisers and financiers.

Online Betting & Casinos

This segment is focused on convenience, accessibility and growing demand for real-money play. Online gaming sites and casinos are taking advantage of more lenient rules in key markets, so that they now represent a more mainstream and profitable part of the gaming economy.

Spotlight on Online Gambling

Online casinos are no longer merely whirring slot machines; they’re pushing boundaries. Some of the top 20 online casinos have gone beyond traditional slots and table games, incorporating esports betting, skill-based game challenges and interactive live dealer games.

Why does that matter to investors? Easy. It signals flexibility. These platforms are captivating players where they are: at their phones, on streaming websites, and in hybrid entertainment spaces that blur the line between socialising and gaming. This flexibility is what can keep revenue streams consistent even when trends shift.

Why Investors are Paying Attention

The gaming market has something that a lot of others envy: loyal consumers who are spenders on a regular basis. It’s £3 ($5) on a character skin or £36 ($50) on a new game, but the spend is cumulative, and it doesn’t evaporate during poor economies.

And gaming pervades everywhere. A hit title in Japan can find fans in Brazil in days. And for companies, that global reach means multiple streams of revenue and endless room to grow.

Risks in Investment

There is no investment without risk. Regulations change overnight, especially in online gaming. Game developers also come and go with their biggest hit; one flop can jerk their stock price. And in this competitive environment, being new is a never-ending struggle.

Gaming Investment Strategies

Diversify among multiple corners of the sector. That way, you’re not betting everything on one game or one trend. Gaming-focused ETFs deserve a look as well if you enjoy a pre-packaged solution that spreads the risk.

The post Investment Opportunities in the Multi-billion-dollar Gaming Sector appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018