Latest News

iGaming Terms and Conditions Report 2020

A research study looking at the reliability of casino and sportsbook terms and conditions has revealed that a shocking percentage of UK gamblers aren’t taking the time to fully understand the finer details of the offers and bonuses they’re regularly signing up for.

Of over 12,000 players surveyed only 20% admitted to taking the time to read the terms and conditions associated with their chosen site. 62% of players admitted to purposely avoiding them, whilst the remaining 18% admitted they didn’t realise terms and conditions existed at all.

As a result frustrated players are flooding casino customer support teams with complaints regarding issues that could have easily been resolved by simply reading the terms and conditions set out by the operators in the first place.

The most common complaints ranged from incorrect bet settlements, the non-payment of winnings, the inability to withdraw funds and misleading bonuses and promotions.

To understand whether these complaints were justified No Wagering, an online gambling news and comparison website which promotes fairness and transparency meticulously trawled through the terms and conditions of 6 of the UK’s most popular casinos and sportsbooks to determine whether they were fair, concise and clearly displayed.

Sam Gascoyne, Head of Content at No Wagering, said: “The data clearly shows that players are avoiding terms and conditions, which doesn’t come as a huge surprise considering most people tend to ignore them in all walks of life… However, when it comes to online casinos and sportsbooks players certainly need to be a lot more attentive due to the restrictions such as wagering requirements, and minimum withdrawal limits.

“When you compare the amount of people that don’t read terms and conditions to the most common complaints against operators then there were some clear parallels to be made, and it was even clearer that many of these issues could have been avoided with a bit of light reading.”

Click here to see the full analysis of No Wagering’s report into terms and conditions.

Centennial Gaming

Truckee Gaming selects MOCHA for enterprise-wide Hospitality Upgrade

Truckee Gaming has selected Centennial Gaming’s MOCHA suite to enhance Loyalty, Slot Operations, and the overall Customer Experience across their gaming enterprise of ten casinos throughout the state of Nevada.

Centennial Gaming Systems today announced Truckee Gaming has selected MOCHA® for its burgeoning gaming enterprise. MOCHA (MObile Customer Hospitality Assistance) is Centennial’s native, industry-leading operations enhancement application. The initial installation was completed at Rail City Casino in Sparks, Nevada, and will soon begin rolling out across all Truckee-managed locations. Together, the companies will roll out MOCHA’s powerful club enhancement capabilities, newly released slot dispatch, slot maintenance tracking, and jackpot celebration features.

“We’ve chosen Centennial Gaming and MOCHA because of their cutting-edge technologies, driving efficient operations and great player service experiences within our operations. We look forward to a long and fruitful relationship with the Centennial Gaming team,” said Szymon Padkowski, Director of Marketing for Truckee Gaming LLC.

“We are thrilled to engage with Truckee Gaming,” said Darryll Pleasant, Owner of Centennial Gaming Systems. “Szymon and the Truckee team are innovative and forward-thinking. We are excited to work together and create new and exciting features and capabilities.”

The post Truckee Gaming selects MOCHA for enterprise-wide Hospitality Upgrade appeared first on Gaming and Gambling Industry in the Americas.

Latest News

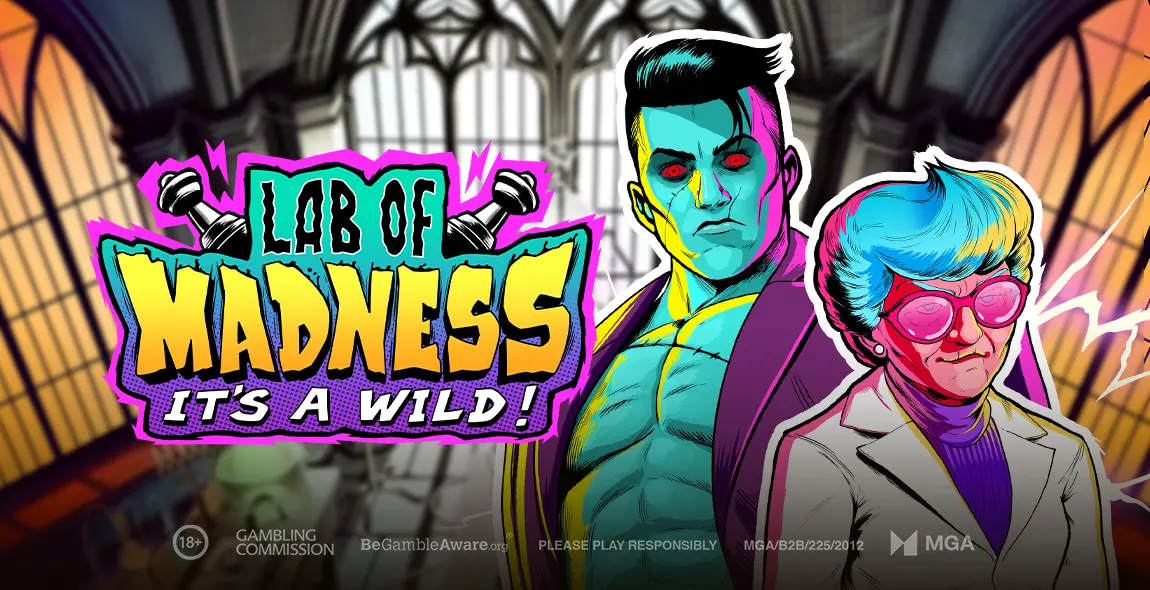

Play’n GO’ electrifies iGaming with Lab of Madness It’s a Wild!

Play’n GO throws the switch on Lab of Madness It’s a Wild!, a gothic comic-inspired slot that surges with strange science and surprise. Players join the unconventional Dr Frankenstein as she attempts to jolt her patchwork Monster to life in a lab where every pull of the lever sparks new possibilities.

Inside her shadowy castle laboratory, the eccentric doctor – equal parts brilliant and bizarre – is moments away from success. Lightning dances across Tesla coils, strange bulbs flicker with colour, and each spin builds towards a shocking breakthrough.

At the centre of the chaos is the Monster Wild. It’s not just a symbol – it’s a scene-stealer, shifting positions, stretching across reels, and multiplying wins with raw energy. These Wilds can even combine their powers, filling the screen with movement and mayhem. Add to that a Power Up feature that delivers sudden prizes, and a Free Spins mode where stacked effects can keep the game alive with electricity – and the result is a slot packed with spark.

The visual style draws inspiration from retro horror comics, fusing dramatic shadows and hand-drawn details with neon bursts. The monochrome lab, oversized coils, and lively symbols create a world that’s both eerie and entertaining.

Magnus Wallentin, Games Ambassador at Play’n GO, said: “Lab of Madness It’s a Wild! gave us a chance to mix sharp design with surprising features. It’s got humour, heart, and just enough madness to keep players coming back for more.”

Between quirky characters, energetic gameplay, and a fresh twist on a classic tale, this is one experiment you’ll want to see through to the end.

The post Play’n GO’ electrifies iGaming with Lab of Madness It’s a Wild! appeared first on European Gaming Industry News.

Latest News

SOFTSWISS Game Aggregator Adds Five New Studios to Its Global Portfolio

The SOFTSWISS Game Aggregator continues to expand its industry-leading portfolio, which now features over 35,000 active games from both established and emerging providers. The company has announced new partnerships with Peter & Sons, Just Slots, BlueJack Gaming, FA CHAI Gaming, and TokaCity – five studios bringing original content and strong regional expertise.

The SOFTSWISS Game Aggregator connects operators to the widest and most diverse range of games through a single seamless integration. A recent Kantar study revealed that operators select software providers based on security, reliability, revenue-growth potential, stable infrastructure, and high-quality client service. SOFTSWISS is fully committed to these priorities, consistently delivering robust security, proven stability, and responsive support, while enabling operators to unlock new business opportunities.

Through its Game Aggregator, SOFTSWISS not only ensures operational excellence with 99.999% uptime but also provides the industry’s largest content hub with over 35,000 active games, helping partners drive engagement and retention. This commitment to quality and growth has earned SOFTSWISS the highest Net Promoter Score (NPS), reinforcing its position as the most trusted and reliable partner in the industry.

Nikita Keino, Head of Partnerships at SOFTSWISS Game Aggregator, comments: “Expanding our portfolio with five new studios strengthens the value we deliver to operators. Each partner adds unique mechanics, themes, and market perspectives, ensuring our clients can keep their offerings fresh and competitive. At the same time, we provide the reliability and tools that help operators maximise the impact of this content across multiple markets.”

The Game Aggregator has just welcomed newly added game providers to its portfolio:

- Peter & Sons stands out for its distinctive design, sound, and mechanics, with popular titles like Barbarossa, Barbarossa Revenge, and Ghostfather.

- Just Slots released its first game in 2024 and aims to launch 10 titles by the end of 2025. Now its portfolio includes Book of Arcane 100 and Shogun Skylord.

- BlueJack Gaming offers more than 40 slots and table games, including King’s Crown, Macao Ladder, and Quick Blackjack.

- FA CHAI Gaming specialises in slots and arcade-style content, including the popular 3D Fishing series and Coin Dozer.

- TokaCity combines modern slot design and crash-game PVP elements with immersive storytelling, developing visually engaging titles with broad appeal.

With the addition of these five studios, alongside recent integrations of CG Games, Champion, and Formula Spin, the SOFTSWISS Game Aggregator further strengthens its position as the industry’s largest content hub, ensuring that operators can deliver tailored, competitive portfolios to meet diverse player demands.

About SOFTSWISS

SOFTSWISS is an international technology company with over 15 years of experience in developing innovative solutions for the iGaming industry. SOFTSWISS provides comprehensive software for managing iGaming projects. The company’s product portfolio includes the Casino Platform, the Game Aggregator with over 35,000 casino games, Affilka Affiliate Platform, the Sportsbook Platform and the Jackpot Aggregator. The expert team, based in Malta, Poland, and Georgia, counts over 2,000 employees.

The post SOFTSWISS Game Aggregator Adds Five New Studios to Its Global Portfolio appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory9 years ago

iSoftBet continues to grow with new release Forest Mania

-

News8 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018