poker

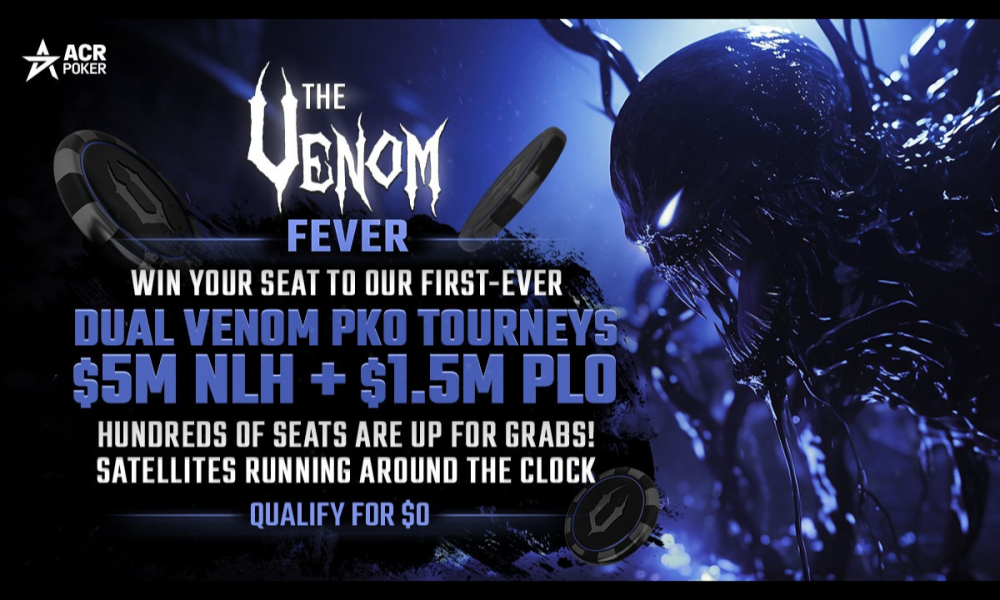

VENOM FEVER GUARANTEES HUNDREDS OF SEATS TO ACR POKER’S DUAL VENOM PKO TOURNEYS IN OCTOBER

The $5 Million NLH PKO and $1.5 Million PLO PKO Venom tourneys are set to begin this October at ACR Poker. And now the popular worldwide poker site is making it easier for players to secure their $2,650 seats to these massive tourneys via their Venom Fever promotion.

From October 6th to 27th, Venom Fever satelites are guaranteeing over 700 seats (worth $2,650 each) to the NLH PKO Venom and the PLO PKO Venom, with both tourneys kicking off Day1A on Sunday, October 13th.

“We get that a $2,650 buy-in is a lot for most players, which is why our Venom Fever satellites are a great way to qualify for much less,” said ACR Pro Chris Moneymaker. “With both Venom PKO’s just around the corner, there are tons of cheaper ways to grab your seat, with paths starting at $0. These tourneys are going to be epic, so make sure you don’t miss out.”

A total of 644 seats are guaranteed for the NLH PKO Venom and 71 seats for the PLO PKO Venom via Yenom Fever satellites. Included are the Beast, Venom Madness, Direct Satellites, and Mega Satellites.

Players can get in on the NLH PKO Venom action in ACR Poker’s weekly Beast tournament taking place on October 6th, 13th and 20th at 6:05pm ET–with 85 total seats up for grabs. The first tourney guarantees 25 seats, and players can buy-in for $95 or win a free seat by placing on the weekly Beast leaderboard.

In addition, Venom Madness satellites offer a chance to enter for $16.50, with 20 total seats guaranteed. The first multi-flight tourney runs from October 1st to 12th, offering 10 guaranteed seats. What’s more, Mega Satellites will run from October 6th – 27th, guaranteeing 232 seats with paths starting at $0. Players can also participate in daily Direct Satellites (buy-ins from $33), which guarantee 307 seats.

For those looking to join the PLO PKO Venom, players can take advantage of daily Direct Satellites, guaranteeing 41 seats with buy-ins starting at $290. Additionally, Mega Satellites will guarantee 30 seats and opportunities to qualify for free.

While the Dual Venom PKO tourneys may be the main events, Moneymaker noted there’s plenty of more action through Venom Special tourneys on each Day 1, with over $11 million total guaranteed Players looking to warm up for the Dual Venom PKO tourneys can also join the $1 Million GTD Venom Warmup, running from October 1st-27th, with a buy-in of $66.

Latest News

WSOP® PARADISE 2025 REVEALS FULL TOURNAMENT SCHEDULE WITH NEW EARLY-BIRD PACKAGES

The record-breaking poker festival in the Bahamas adds fresh events and exclusive perks for players booking early

The World Series of Poker (WSOP®) today unveiled the complete schedule for the highly anticipated WSOP Paradise 2025, which will take place at Atlantis Paradise Island in the Bahamas from Dec. 4 through Dec. 18. This announcement also introduces two new, limited-availability early-bird packages, designed to provide players with unmatched value and exclusive benefits.

This year’s festival expands on its commitment to high-stakes action with a full slate of 15 WSOP gold bracelet events:

|

Event |

Date |

Buy-In |

|

#1 Circuit Championship Mystery Bounty NLH – $5M GTD |

Dec. 4 |

$2.5K |

|

#2 Triton PLO 6-Handed |

Dec. 4 |

$75K |

|

#3 Triton PLO Main Event |

Dec. 5 |

$100K |

|

#4 High Roller Turbo NLH |

Dec. 6 |

$50K |

|

#5 Triton Invitational – NLH |

Dec. 7 |

$250K |

|

#6 Super COLOSSUS NLH |

Dec. 7 |

$5K |

|

#7 Super PLOSSUS PLO |

Dec. 8 |

$10K |

|

#8 Triton NLH 7-Handed |

Dec. 8 |

$125K |

|

#9 Triton NLH Main Event |

Dec. 9 |

$100K |

|

#10 Triton NLH 8-Handed |

Dec. 10 |

$150K |

|

#11 Super Main Event NLH – $60M GTD |

Dec. 10 |

$25K |

|

#12 8-Game Mix 6-Handed |

Dec. 11 |

$10K |

|

#13 High Roller PLO |

Dec. 13 |

$50K |

|

#14 GGMillion$ NLH – $10M GTD |

Dec. 15 |

$25K |

|

#15 The Closer NLH Turbo Bounty |

Dec. 16 |

$10K |

This year’s WSOP Paradise features an expanded partnership with Triton Poker, the leading high-stakes tournament operator. In 2024, two gold bracelet events were curated by Triton; the number increases to six in 2025, with WSOP bracelets going to the winners of Event #2 Triton PLO, Event #3 Triton PLO Main Event, Event #5 Triton NLH Invitational, Event #8 Triton NLH 7-Handed, Event #9 Triton NLH Main Event and Event #10 Triton NLH 8-Handed.

To reward early registrants, WSOP is introducing two new early-bird packages for players looking to secure their seats, with both offering massive added value:

-

The $100K Paradise Package – limited to just 500 packages, includes a 13-night stay (Dec. 5 to Dec. 18), complimentary access to the WSOP buffet and a $500 food & beverage room credit. The deposit to secure is $10,000.

-

The $300K VIP Package – includes a 15 night stay (Dec. 3 to Dec. 18), complimentary access to the WSOP buffet, a $1,000 food & beverage room credit plus one á la carte meal from the Triton menu per day. The deposit to secure is $15,000.

For the first time at WSOP Paradise, resort fees are included in the package price, and the room credit is also provided for use throughout the resort. The full package amount must be played in WSOP Paradise events.

GGPoker will once again serve as the exclusive international satellite partner, aiming to send more than 1,000 players to the Super Main Event. WSOP Express and Road to Paradise qualifier tournaments are already underway in the GGPoker tournament lobby. Additionally, over 500 players are expected to qualify for the Circuit Championship through WSOP Circuit gold ring events (running from Jul. 1 through Dec. 2, 2025, both live and online), and ClubGG plans to send more than 400 players to the same event.

In an exciting new partnership, PokerStake will cover up to 50% of the unsold action for Circuit Package winners who choose to list their Super Main Event action on the platform.

“I said last year that a $50M guarantee was crazy, but adding another $10,000,000 on top is absolutely insane! The WSOP is bringing the biggest high rollers and the best poker experience possible back to paradise,” said Daniel Negreanu, GGPoker Global Ambassador. “With the new Super Mystery Bounty event and the expanded partnership with Triton, this is a can’t-miss festival for players of all levels. I can’t wait to be a part of it.”

“With the WSOP Paradise at Atlantis Paradise Island tournament schedule now set, the countdown to The Bahamas IS ON! This year’s lineup delivers an unbeatable mix of world-class events, record-breaking guarantees, and unforgettable poker moments in one of the most iconic destinations on the planet. From seasoned pros to newcomers, players from around the globe will find their place in paradise, and their shot at history,” added Joe Brunini, Chief Gaming & Customer Development Officer, Atlantis Paradise Island.

WSOP Paradise 2025 will feature a daily live stream from Dec. 12 through Dec. 18 on the WSOP YouTube channel, with CBS Sports Network television coverage planned for distribution in early 2026.

Further details on event structures and schedules will be available on the WSOP+ app. The WSOP reserves the right to cancel, change, or modify the tournament or any tournament event, in part or in whole, without notice. Entry fees will be added to all events, and up to 3% of tournament buy-ins will be withheld for staff and operational costs. Guaranteed events are paid out after deducting the percentage for costs from the total prize pool.

Please follow @WSOP on X (formerly Twitter) and Instagram or check WSOP.com for more event news and updates: wsop.com/news/2025-wsop-paradise.

For more information on WSOP Express, please visit: ggpoker.com/tournaments/wsop-express/.

To book your Atlantis stay at exclusive WSOP rates starting from $199 per night, please visit: atlantisbahamas.com/wsop-in-paradise

The post WSOP® PARADISE 2025 REVEALS FULL TOURNAMENT SCHEDULE WITH NEW EARLY-BIRD PACKAGES appeared first on Gaming and Gambling Industry in the Americas.

Eric Barbaro

Lilac Club Casino Hosts $100K “Beat the Champ” Poker Tournament with Legend Phil Hellmuth

Poker legend Phil Hellmuth is heading to Lilac Club Casino in Rochester for an exclusive high-stakes weekend. On Saturday, Aug. 16, the 17-time World Series of Poker bracelet winner will take an afternoon seat at the Lilac Club’s “Beat the Champ” poker tournament, and the challenge is simple: win the tournament, claim your share of the $100,000 cash prize pool, and beat the champ along the way.

A $500 cash bonus is awarded to the player who can bust Phil Hellmuth out of the tournament.

A total of 108 seats plus alternates are available in this once-in-a-lifetime opportunity to outplay one of poker’s biggest names. Players can qualify for the tournament in several ways:

• Player of the Week Promotion (June 29–Aug. 9): Each week, the top five players who log the most rated hours in the Poker Room will earn seats in the “Beat the Champ” tournament.

• Satellite Tournaments (Aug. 2 and Aug. 9): Held at Lilac Club Casino, each $250 buy-in tournament will award one seat for every six players

• Direct Buy-In: Players may buy-in for $1200 during early registration on Friday, Aug. 15 from 9 a.m. to 1 a.m. at the Poker Room cage. Registration continues Saturday, Aug 16 at 9 a.m., with late registration open from 10 a.m. to 1 p.m.

“This isn’t just another tournament, it’s a shot at poker history. Phil Hellmuth isn’t just a champion, he’s a legend, and top tournament players will walk away with a share of $100,000 cash,” said Eric Barbaro, chief operating officer of Granite State Gaming & Hospitality.

The post Lilac Club Casino Hosts $100K “Beat the Champ” Poker Tournament with Legend Phil Hellmuth appeared first on Gaming and Gambling Industry in the Americas.

Latest News

WSOP Online Returns to GGPoker This August with 33 Gold Bracelets and $5,000,000 in Special Promotions!

Play for millions in prizes from August 17 through September 30

GGPoker, the World’s Biggest Poker Room, is thrilled to announce the highly anticipated return of WSOP Online this August, bringing the thrill and prestige of the World Series of Poker® directly to players’ screens. The six-week festival will run from August 17 to September 30, featuring 33 official WSOP Gold Bracelet events, tens of millions in guaranteed prizes, and a gigantic $5,000,000 in special promotions designed to reward players across the globe.

This year’s WSOP Online series on GGPoker promises an exhilarating journey for players of all skill levels, offering a direct path to poker immortality and a share of millions in guaranteed prize money. The schedule is packed with can’t-miss events, including:

-

August 25: $215 Mystery Millions – Featuring a staggering $1,000,000 top bounty and a $10,000,000 guaranteed prize pool

-

September 8: $1,500 MILLIONAIRE MAKER – With an impressive $1,000,000 guaranteed for first place and a total $5,000,000 guaranteed prize pool

-

September 22: $5,000 WSOP Online MAIN EVENT – The flagship tournament boasting a colossal $25,000,000 guaranteed prize pool

-

September 29: $10,300 GGMillion$ High Rollers – A premier event for high-stakes players with a $10,000,000 guarantee

Adding to the excitement, WSOP Online 2025 will include a suite of innovative promotions offering even more ways to win:

-

$3,000,000 Continental Flipouts: As in previous series, players will be assigned to one of four continents, and Continental Flipouts will be held following each bracelet event (open to bracelet-event participants from the same continents as the event winners). These special flipouts will feature prize pools of up to $250,000, fostering incredible regional rivalry

-

$1,000,000 Super Pass Bonus: Each of the 33 Bracelet winners will receive a coveted $30,000 Super Pass, granting them direct access to the record-breaking WSOP Paradise $60M Super Main Event in the Bahamas this December

-

$1,000,000 Ranking Freeroll: The top 10 countries in the Bracelet Rankings will unlock 10 exclusive freeroll tournaments for their players, with prize pools scaled according to each country’s final rank, adding another layer of national pride to the competition

“WSOP Online is about to deliver another incredible experience,” said Daniel Negreanu, GGPoker Global Ambassador. “With 33 gold bracelets up for grabs, huge prizes, plus millions in special bonuses like the Continental Flipouts and Super Passes to WSOP Paradise, this series is a must-play for any poker enthusiast. It’s a truly global celebration of the game, and I can’t wait to see who takes home the gold!”

The wider poker community can follow the WSOP Online action live at GGPoker.tv, with the final table of the $5K Main Event broadcast on September 23 at 18:45 UTC (hosted by Jeff Gross & special guest) and the final table of the $10K GGMillion$ High Rollers broadcast on September 30 at 18:45 UTC (hosted by Jeff Gross & Daniel Negreanu).

Players can qualify for each monumental WSOP Online event through satellites running around the clock on GGPoker, making the dream of winning a WSOP Gold Bracelet more attainable than ever. New players to GGPoker are also eligible to claim the Welcome Bonus, earn rewards with the Honeymoon for Newcomers promotion, and automatically join the Fish Buffet loyalty program, offering regular cash prizes.

The post WSOP Online Returns to GGPoker This August with 33 Gold Bracelets and $5,000,000 in Special Promotions! appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018