Latest News

SharpLink Gaming Announces First Quarter 2024 Results and Provides Operational Update

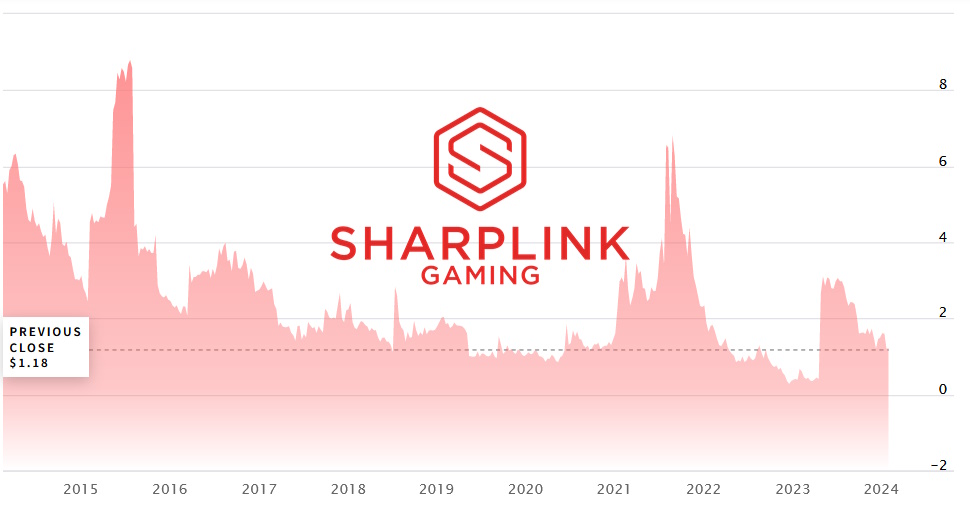

SharpLink Gaming, Inc. (Nasdaq:SBET) (“SharpLink” or the “Company”), an online performance-based marketing company serving the U.S. sports betting and iGaming industries, today announced its first quarter financial results for the three months ended March 31, 2024, as reported in the Company’s Quarterly Report on Form 10-Q (“10-Q”) filed with the U.S. Securities and Exchange Commission (“SEC”) on Friday, May 17, 2024.

Commenting on the results, Rob Phythian, Chairman and CEO of SharpLink, stated, “2024 kicked off being marked by a pivotal quarter defined by the successful execution of a series of initiatives. We view each of these important milestones as critical first steps in achieving the strategic transformation of our Company, enabling us to ultimately win distinction as a leading pure-play online affiliate marketing company trusted by and relied upon by our U.S. sportsbook and global casino gaming partners.”

As previously announced, on January 18, 2024, SharpLink sold its Sports Gaming Client Services and SportsHub Gaming Network (“SHGN”) business segments to RSports Interactive, Inc. (“RSports”) for $22.5 million in an all-cash transaction. As a result, the historical results for these segments were reflected as discontinued operations in the Company’s consolidated financial statements included in the 10-Q.

Financial Highlights for the Three Months Ended March 31, 2024 Compared to Three Months Ended March 21, 2023

- Revenues from the Company’s continuing operations totaled $975,946 compared to $1,232,762.

- Net loss from continuing operations declined 18.4% to $1,760,811 compared to $2,157,183.

- Net income from discontinued operations, net of tax increased 2217% to $14,111,167 from a net loss from discontinued operations, net of tax of $666,563.

- Net income totaled $12,350,345, or $3.36 income per share on a fully diluted basis – up 537% from $2,823,746, or $1.01 loss per share.

For more detailed information on SharpLink’s first quarter 2024 financial performance, please refer to Form 10-Q filed with the SEC and accessible at sec.gov or on SharpLink’s website at sharplink.com.

First Quarter 2024 Business Highlights

- On January 18, 2024, completed sale of SharpLink’s Sports Gaming Client Services and SHGN businesses to RSports for $22.5 million in an all-cash transaction.

- Immediately following the sale, SharpLink used a portion of the proceeds from the sale to retire approximately $19.4 million, in aggregate, in outstanding debt obligations, thereby eliminating all interest-bearing debt on its balance sheet.

- On February 8, 2024, regained full compliance with Nasdaq Continued Listing Standards.

- On February 13, 2024, completed domestication merger with SharpLink Gaming, Ltd., changing from an Israel limited liability company to a Delaware corporation.

- In February, established new Board of Directors for SharpLink Gaming, Inc. with the appointments of Rob Phythian as Chairman and Leslie Bernhard, Obie McKenzie and Robert Gutkowski as new independent members of the Board.

Continuing, Phythian said, “Given our strengthened balance sheet; our highly engaged Board comprised of world class, accomplished business executives; and our shared commitment to a strategy that is expected to empower us to capitalize on potentially compelling growth opportunities in the sports, entertainment and media industries, SharpLink has great hopes for our Company’s future. We plan to continue to enhance our value proposition to our sportsbooks and casino operator partners, while also actively seeking opportunities to expand our iGaming affiliate marketing network into new U.S and international markets where online sports betting and casino gaming have been legalized. Moreover, we intend to continue executing our strategic transformation with clarity and focus, and in doing so, we hope to deliver strong, sustainable value creation for our fellow shareholders for many years to come.”

“Unlocking SharpLink’s next phase of growth with purpose and cost-discipline will be key to our long-term success and should provide us with greater agility as we build momentum and look to accelerate our growth prospects as 2024 unfolds. To help support our mission and continued strategic transformation, we have filed a registration statement on Form S-3 with the SEC and accompanying prospectus for an At-The-Market offering (“ATM”) which we may utilize to raise growth capital if and when market conditions permit. We have identified other measures that we may also pursue to optimize our assets and further strengthen the foundation on which we are building the ‘new’ SharpLink. Over the course of the next several months, I look forward to sharing many more details on our plans and future ambitions,” concluded Phythian.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities of SharpLink, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Gambling in the USA

TCSJOHNHUXLEY to Sponsor Inaugural G2E Dealer Championship

G2E Las Vegas 2025 is set to host the first-ever US Dealer Championship, and TCSJOHNHUXLEY is delighted to announce its sponsorship of this landmark event. The championship, which celebrates the skill and professionalism of casino dealers, will take place at The Venetian Expo from October 7-9, 2025.

The G2E Dealer Championship will bring together the nation’s top casino dealers to compete for the title of “Best Dealer.” Contestants will be judged on their technical precision, game knowledge, and ability to provide a superior player experience.

As a proud sponsor TCSJOHNHUXLEY will be supplying all the Roulette tables for the competition, ensuring the highest standard of equipment for the championship. This not only highlights the company’s commitment to the dealers but also provides the perfect platform to showcase its renowned manufacturing expertise. TCSJOHNHUXLEY’s world-class Roulette tables are testament to the precision engineering and superior craftsmanship that has set the industry standard for decades.

Phil Lee, TCSJOHNHUXLEY Chief Financial Officer & Managing Director Americas comments, “We are delighted to be a part of the first G2E Dealer Championship, an event that truly celebrates the invaluable role of casino dealers. Dealers are the heart of the live gaming experience, and we are committed to supporting their success. Our outstanding Roulette tables will provide the perfect platform for these talented professionals to showcase their artistry and skill.”

The G2E Dealer Championship will take place at Booth #5225, located in The Strip at G2E.

The sponsorship underscores TCSJOHNHUXLEY’s unwavering commitment to the live gaming sector and the professionals who drive its success. The company invites all attendees to witness the championship and visit its stand at Booth #4439 during the expo to see its full range of innovative solutions.

The post TCSJOHNHUXLEY to Sponsor Inaugural G2E Dealer Championship appeared first on Gaming and Gambling Industry in the Americas.

Brazil

ThrillTech secures regulatory approvals to launch jackpots in Latam

Peru and Brazil to provide launchpad for Latam expansion as ThrillTech strengthens presence in emerging regulated markets

ThrillTech, the B2B jackpot specialist, has taken a significant step forward in its international growth strategy after securing a B2B licence in Peru and regulatory certification in Brazil.

The approvals clear the path for ThrillTech to launch its proprietary player-funded jackpot solutions in Latin America for the first time, bringing its flagship ThrillPots product to one of the world’s most exciting and emerging regions for iGaming.

Latin America has become a focal point for operators in recent years, with Brazil’s market liberalisation and Peru’s structured regulatory framework, as set out by the country’s ministry of foreign trade and tourism (MINCETUR), providing fertile ground for innovative engagement tools.

By working tirelessly to secure entry into both countries, ThrillTech is positioning itself to support operators with compliant, performance-driven jackpot mechanics that can drive revenue and enhance retention.

Peter Mares, CTO and co-founder of ThrillTech, said: “Expanding into Latin America is a milestone moment for us. The region is bursting with opportunity, but it also demands solutions that are flexible, transparent, and built to scale. With a licence in Peru and certification in Brazil, we are ready to deliver the same measurable revenue impact to operators in Latam that we’ve already proven in Europe.

ThrillTech’s products are designed to provide operators with new revenue streams through side-bet jackpots, while also offering real-time engagement mechanics via cash-only rewards.

Already integrated with multiple tier-one operators in Europe, ThrillTech is now primed to replicate that success in Latam by delivering regulator-approved solutions to local operators.

The post ThrillTech secures regulatory approvals to launch jackpots in Latam appeared first on Gaming and Gambling Industry in the Americas.

Latest News

Answer the Call of the Wild: ELA Games Unveils Its Latest Game “Buffalo Force”

The studio’s latest game blends nostalgic themes and engaging features

The vast plains are alive with the sound of rampant hooves, the roar of predators, and helpful animals along the way. ELA Games proudly presents its latest release, Buffalo Force, an energetic game that celebrates the sheer power of nature.

The Call of the Wild

In Buffalo Force, players roam alongside fearsome buffalo, fierce bears, cunning wolves, and soaring eagles as they work together to hunt for big rewards. The game features 3 energetic mechanics:

- Free Spins: Land 3 Scatter symbols to enter the game’s primary bonus feature. All Wilds pay 2x here.

- Hold & Win Bonus: Unlock this lucrative feature for a shot at powerful coin prizes and even a chance at one of the mighty jackpots!

- Jackpot: Three jackpots give you the chance for mega wins: Minor (25x), Major (100x), and Grand (1000x).

Each spin holds the spirit of the wilderness, blending high-action gameplay with the studio’s signature visually-rich aesthetics.

Join the Herd

Buffalo Force combines visually stunning animations, high-performance mechanics, and well-crafted environmental design to transport players to the heart of the North American wilderness. The studio’s attention to detail and storytelling prowess immerses players as they become part of the stampede, on the hunt for wild riches.

Marharyta Yerina, ELA Games’ Managing Director, commented on the release, “Buffalo Force represents the studio’s passion for creating visually striking and memorable games that players love. We focused a lot on the game’s visuals and environmental design to immerse players in the North American wild, which helps create an emotional connection and encourages high-performance engagement. We’re excited to see the reception Buffalo Force will receive, and we have many more exciting games in the works!”

Will You Answer the Call?

The raw wilderness is waiting for you. Will you join the herd and hunt for your fortunes and a life of freedom?

The post Answer the Call of the Wild: ELA Games Unveils Its Latest Game “Buffalo Force” appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory9 years ago

iSoftBet continues to grow with new release Forest Mania

-

News8 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018