Detroit casinos

MGCB: Detroit casinos report $116.2M in December revenue, $1.237B for year

The three Detroit casinos reported $116.2 million in monthly aggregate revenue (AGR) for the month of December 2023, of which $111.4 million was generated from table games and slots, and $4.8 million from retail sports betting.

The December market shares were:

- MGM, 44%

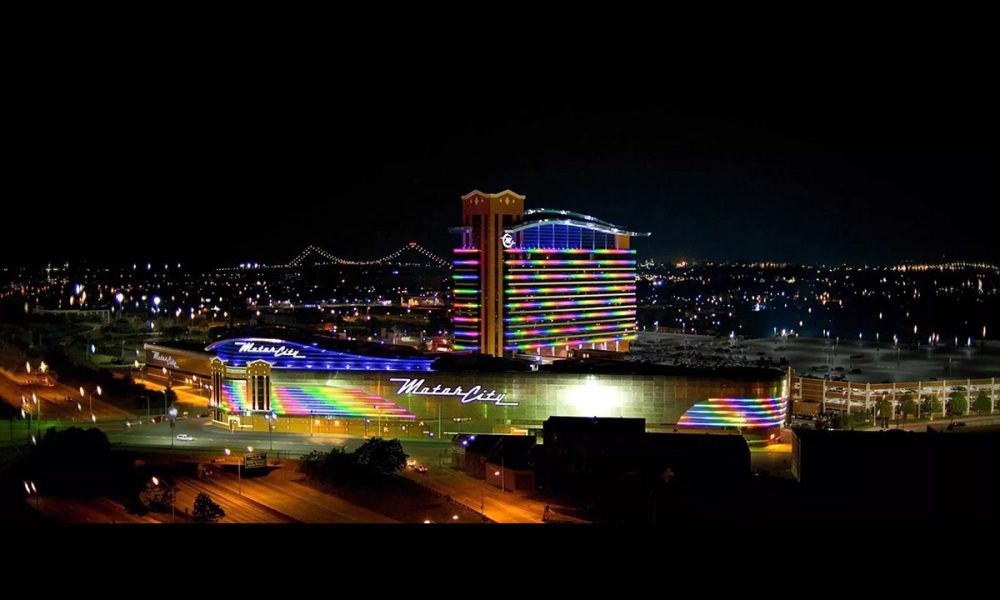

- MotorCity, 32%

- Hollywood Casino at Greektown, 24%

Monthly Table Games, Slot Revenue, and Taxes

December 2023 table games and slot revenue increased 2.9% when compared to December 2022 revenue. December’s monthly revenue was also 46.6% higher than November 2023. From Jan. 1 through Dec. 31, the Detroit casinos’ table games and slots revenue decreased by 2.7% compared to the same period last year.

The casinos’ monthly gaming revenue results were mixed compared to December 2022:

- MGM, down 0.7% to $50.6 million

- MotorCity, up by 5.1% to $34.7 million

- Hollywood Casino at Greektown, up by 7.5% to $26.1 million

In December 2023, the three Detroit casinos paid $9.0 million in gaming taxes to the State of Michigan. They paid $8.8 million for the same month last year. The casinos also reported submitting $13.8 million in wagering taxes and development agreement payments to the City of Detroit in December.

Quarterly Table Games, Slot Revenue, and Taxes

For the fourth quarter of 2023 that ended Dec. 31, aggregate revenue was down for all three Detroit casinos by 12.9% compared to the same period last year. Quarterly gaming revenue for the casinos was:

- MGM: $118.6 million

- MotorCity: $84.4 million

- Hollywood Casino at Greektown: $66.2 million

Compared to the fourth quarter of 2022, MGM, MotorCity, and Hollywood Casino at Greektown were down by 17.7%, 11.6%, and 4.7%, respectively. The three casinos paid $21.8 million in gaming taxes to the state in the fourth quarter of 2023, compared to $25.0 million in the same quarter last year.

Monthly Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $30.4 million in total retail sports betting handle, and total gross receipts were $4.8 million for the month of December. Retail sports betting qualified adjusted gross receipts (QAGR) in December 2023 were up by $3.1 million when compared to December 2022. Compared to November 2023, December QAGR increased 54.9%.

December QAGR by casino was:

- MGM: $291,171

- MotorCity: $2.3 million

- Hollywood Casino at Greektown: $2.2 million

During December, the casinos paid $180,822 in gaming taxes to the state and reported submitting $221,005 in wagering taxes to the City of Detroit based on their retail sports betting revenue.

Annual Revenue for Table Games, Slots, and Retail Sports Betting

The total yearly aggregate revenue of $1.237 billion — a slight decrease of 3.1% compared to last year — by the three Detroit casinos for slots, table games, and retail sports betting was generated by:

- Slots: $984.1 million (80%)

- Table games: $238.7 million (19%)

- Retail sports betting: $14.0 million (1%)

The casinos’ market shares for the year were:

- MGM, 46%

- MotorCity, 31%

- Hollywood Casino at Greektown, 23%

Compared to 2022, slots and table games yearly gaming revenue for the three casinos were as follows:

- MGM, down by 6.0% to $564.0 million

- MotorCity, down by 5.8% to $373.6 million

- Hollywood Casino at Greektown, up by 9.5% to $285.2 million

Aggregate retail sports betting qualified adjusted gross receipts (QAGR) for 2023 was down by 25.7% to $14.0 million compared to last year, with MGM totaling $2.3 million, MotorCity totaling $5.0 million, and Hollywood Casino at Greektown totaling $6.7 million.

In 2023, the three Detroit casinos paid the state $99.0 million in wagering taxes for slots and table games, and $528,314 in wagering taxes for retail sports betting. In 2022, they had paid $101.8 million and $711,087 for each, respectively.

Fantasy Contests

For November, fantasy contest operators reported total adjusted revenues of $1.8 million and paid taxes of $149,915.

From Jan. 1 through Nov. 30, fantasy contest operators reported $21.3 million in aggregate fantasy contest adjusted revenues and paid $1.8 million in taxes.

Detroit casinos

Detroit Casinos Report $101M in June Revenue

The three Detroit casinos—MGM Grand Detroit, MotorCity Casino, and Hollywood Casino at Greektown—collectively generated $101.04 million in revenue for June 2025.

Table games and slot machines accounted for $100.38 million of the monthly total, while retail sports betting contributed $665,435.

June 2025 Market Share:

• MGM Grand Detroit: 48%

• MotorCity Casino: 31%

• Hollywood Casino at Greektown: 21%

Table Games and Slot Machine Revenue

Revenue from table games and slots decreased by 4.0% compared with June 2024 and dropped 11% from May 2025. For the first half of 2025 (January 1 – June 30), combined table games and slots revenue was down 0.8% year-over-year.

Casino-specific revenues compared to June 2024 were:

• MGM Grand Detroit: $48.43 million, down 0.6%

• MotorCity Casino: $30.63 million, down 2.7%

• Hollywood Casino at Greektown: $21.32 million, down 12.5%

The three casinos paid $8.1 million in state gaming taxes in June 2025, down from $8.5 million in June 2024. They also submitted $11.9 million in wagering taxes and development agreement payments to the City of Detroit.

Retail Sports Betting Revenue

In June 2025, the casinos reported a combined retail sports betting handle of $7.2 million, generating $666,374 in gross receipts. Qualified adjusted gross receipts (QAGR) from retail sports betting fell 25.1% from June 2024 and 48.1% from May 2025.

QAGR by casino:

• MGM Grand Detroit: $275,397

• MotorCity Casino: $242,069

• Hollywood Casino at Greektown: $147,969

The casinos paid $25,153 in state taxes from retail sports betting revenue and submitted $30,743 in wagering taxes to the City of Detroit.

Fantasy Contests

Fantasy contest operators reported $716,927 in adjusted revenues for May 2025 and paid $60,222 in taxes.

The post Detroit Casinos Report $101M in June Revenue appeared first on Gaming and Gambling Industry in the Americas.

Detroit casinos

Detroit Casinos Report $114.0M in May Revenue

The three Detroit casinos collectively reported $114.0 million in revenue for May 2025. Of this total, table games and slot machines generated $112.7 million, while retail sports betting contributed $1.3 million.

Market Share Breakdown for May 2025:

• MGM Grand Detroit: 47%

• MotorCity Casino: 30%

• Hollywood Casino at Greektown: 23%

Table Games, Slot Revenue, and Taxes

Revenue from table games and slots at the three Detroit casinos increased 1.2% in May 2025 when compared to the same month last year. May’s revenue also showed a 3.0% increase compared to April 2025. From January 1 through May 31 of this year, table games and slots revenue decreased by 0.2% compared to the same period in 2024.

In comparison to May 2024, the revenue for each casino was as follows:

• MGM Grand Detroit: Up 2.4%, totaling $53.1 million

• MotorCity Casino: Up 0.6%, totaling $33.9 million

• Hollywood Casino at Greektown: Down 0.2%, totaling $25.7 million

In May 2025, the three casinos paid a total of $9.1 million in state gaming taxes, compared to $9.0 million in the same month last year. Additionally, the casinos submitted $13.4 million in wagering taxes and development agreement payments to the City of Detroit in May.

Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported a total retail sports betting handle of $9.2 million in May 2025, with total gross receipts amounting to $1.3 million. Retail sports betting’s qualified adjusted gross receipts (QAGR) decreased by 31.1% compared to May 2024 but showed an increase of $964,701 over April 2025.

QAGR by casino for May 2025 was as follows:

• MGM Grand Detroit: $72,060

• MotorCity Casino: $684,821

• Hollywood Casino at Greektown: $524,358

In May, the casinos paid $48,431 in state gaming taxes and reported submitting $59,193 in wagering taxes to the City of Detroit based on retail sports betting revenue.

The post Detroit Casinos Report $114.0M in May Revenue appeared first on Gaming and Gambling Industry in the Americas.

Detroit casinos

Detroit Casinos Report $109.8M in April Revenue

The three Detroit casinos collectively reported $109.8 million in revenue for April 2025. Of this total, table games and slot machines generated $109.5 million, while retail sports betting contributed $316,538.

Market Share Breakdown for April 2025:

• MGM Grand Detroit: 47%

• MotorCity Casino: 30%

• Hollywood Casino at Greektown: 23%

Table Games, Slot Revenue, and Taxes

Revenue from table games and slots at the three Detroit casinos increased 1.5% in April 2025 when compared to the same month last year. However, April’s revenue showed a 6.3% decrease compared to March 2025. From January 1 through April 30 of this year, table games and slots revenue decreased by 0.5% compared to the same period in 2024.

In comparison to April 2024, the revenue for each casino was as follows:

• MGM Grand Detroit: Up 2.5%, totaling $51.1 million

• MotorCity Casino: Up 1.2%, totaling $33.1 million

• Hollywood Casino at Greektown: Down 0.2%, totaling $25.3 million

In April 2025, the three casinos paid a total of $8.9 million in state gaming taxes, compared to $8.7 million in the same month last year. Additionally, the casinos submitted $13.0 million in wagering taxes and development agreement payments to the City of Detroit in April.

Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported a total retail sports betting handle of $9.4 million in April 2025, with total gross receipts amounting to $336,021. Retail sports betting’s qualified adjusted gross receipts (QAGR) saw a significant decrease, down 79.8% compared to April 2024 and 44.6% compared to March 2025.

QAGR by casino for April 2025 was as follows:

• MGM Grand Detroit: negative ($219,857)

• MotorCity Casino: $223,859

• Hollywood Casino at Greektown: $312,536

In April, the casinos paid $20,276 in state gaming taxes and reported submitting $24,781 in wagering taxes to the City of Detroit based on retail sports betting revenue.

Fantasy Contests

For March 2025, fantasy contest operators reported total adjusted revenues of $634,191 and paid $53,272 in taxes.

The post Detroit Casinos Report $109.8M in April Revenue appeared first on Gaming and Gambling Industry in the Americas.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018