Cryptocurrency

Sheesha Finance and Royale Finance Partner to Leverage Premier DeFi Staking Mechanism

The partnership utilizes Sheesha’s Mutual Fund model allowing Royale network participants access to a variety of DeFi project rewards without direct investment

Sheesha Finance, the first one-stop-shop for investors to get diversified exposure to DeFi projects, and Royale Finance, a cross-chain DeFi solution using liquidity pools to provide funding for iGaming startups, announced a partnership leveraging the staking mechanism features of the Sheesha platform. The partnership innovates traditional DeFi blockchain staking and brings additional value to all network participants by providing portfolio diversification while minimizing risk.

With the growing popularity of DeFi projects, many investors are now looking to invest in promising, authentic DeFi startups. Sheesha Finance has created a unique model that embraces full-scale transparency and integrity, while supporting reputable DeFi ecosystems such as Royale Finance.

Sheesha Finance uses a staking mechanism called a “Liquidity Generation Event” (LGE) that encourages participants to select an available blockchain network and contribute Ethereum (ETH) or Binance Coins (BNB) in return for Liquidity Provision Tokens (LP) on the network they have chosen. The LGEs are open for a certain period of time, and in this instance, two weeks.

“Our goal has always been to improve the De-Fi ecosystem and transform its operational mechanisms,” said Saeed Hareb Al Darmaki, Founder of Sheesha Finance. “By leveraging our liquidity generating events, we are able to help De-Fi projects expand market reach, gain new investors and holders. Our newest partner, Royale Finance has been a totem for transformational changes in the iGaming niche and we are proud to work with them to further grow their network influence by utilizing our unique staking mechanism.”

“The partnership with Sheesha Finance is extremely important for us. It provides the much-needed distribution stability lacking in most DeFi ecosystems today,” said Matthew Armstrong, COO at Royale Finance. “This mutually beneficial partnership helps Sheesha expand its network partners and reach while providing Royale network participants an interesting investment avenue through Sheesha’s liquidity generation events.”

Liquidity Provision Tokens (LP) can be staked to continuously earn Royale Finance tokens ($ROYA) as well as other network tokens available under the Sheesha ecosystem. Increased participation in this program will greatly improve the overall metrics of Royale Finance, control the distribution of $ROYA in the market, curb inflation, and attract bigger investors looking to team up with valuable players in the DeFi/iGaming niche. Royale Finance will give a certain amount of their native token, $ROYA, from their liquidity mining to help support this joint staking initiative.

Sheesha Finance has conducted external audits of its platform to validate the security protocols and ensure its smart contracts are error-free; Sheesha received a 100% grading by Zokyo, a highly reputable auditing firm. Sheesha’s approach exposes its users to a wide array of interesting DeFi projects and foregoes the stress of manually searching for viable DeFi investment opportunities. By staking LP tokens with Sheesha, network participants will be able to earn Sheesha’s native tokens as well as the tokens of other existing and potential future DeFi projects on the platform.

Crypto.com

Underdog and Crypto.com | Derivatives North America Announce First Prediction Market Exchange Offered on Major Sports Gaming Operator App

Underdog, the fastest-growing sports company in the US, and Crypto.com | Derivatives North America (CDNA), a CFTC-registered exchange and clearinghouse and an affiliate of Crypto.com, announced that sports event contracts will be accessible to customers through Underdog. CDNA sports event contracts will be powered by Underdog’s technology. This partnership offers American sports fans a secure, federally compliant way to access CDNA sports event contracts and make predictions on the outcomes of their favorite sports events, all within the Underdog app.

“Prediction markets are one of the most exciting developments we’ve seen in a long time. While still new and evolving, one thing is clear – the future of prediction markets is going to be about sports – and no one does sports better than Underdog,” said Underdog founder and CEO, Jeremy Levine.

With this launch, customers can express and trade their opinions on sports events contracts across all major sports leagues, including NFL, college football, NBA, MLB, and more. Prices update in real-time, allowing customers to react instantly and express their opinions on what’s going to happen on the field or court.

“We are thrilled to partner with Underdog to enhance the sports experience for customers nationwide with the ability to now trade using Underdog’s technology – all in one app. We were the first to offer sports events contracts, and our technology partnership with Underdog will provide more access to CDNA’s innovative offerings,” said Travis McGhee, Managing Director, Global Head of Capital Markets at Crypto.com.

As the only company built on its own proprietary technology across fantasy sports and sports betting regulatory frameworks, Underdog is now the only company offering fantasy sports, sportsbook, and prediction markets in one seamless app.

Underdog has gaming licenses in states across the country and has built industry-leading responsible gaming operations, with sophisticated customer protections ingrained into every facet of its platform. Underdog will bring that same level of customer protection and care to prediction market offerings.

The post Underdog and Crypto.com | Derivatives North America Announce First Prediction Market Exchange Offered on Major Sports Gaming Operator App appeared first on Gaming and Gambling Industry in the Americas.

crypto casino

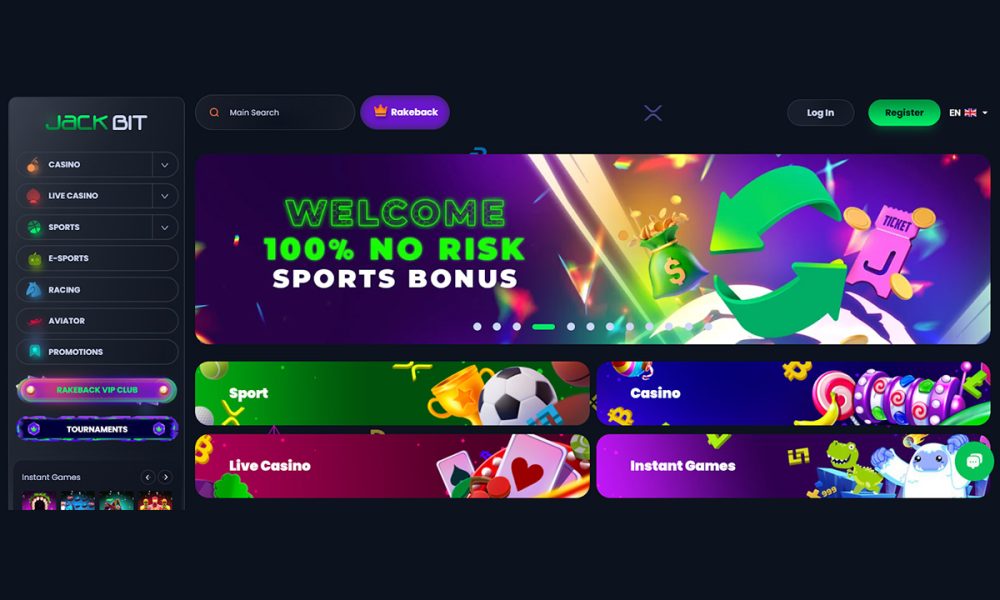

Jackbit: The New Crypto Casino Shapes U.S. Gambling in 2025 with 7000 Games and No KYC

Play 7000+ games at Jackbit, the rewarding U.S. crypto casino with no KYC, instant withdrawals, 20+ coins, and 100 free spins on a $50 deposit.

Jackbit Casino has been named the fastest growing and leading Bitcoin casino in the US for 2025, standing out for its no-KYC registration, instant crypto withdrawals, and access to over 7000 games from 70+ global providers.

Since its launch in 2022, Jackbit has become a preferred destination for crypto users seeking speed, security, and variety all in one platform. Licensed under Curaçao eGaming and operated by Ryker B.V., Jackbit supports over 20 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Tether.

New players receive 100 wager-free spins with a $50 deposit, while returning users benefit from cashback, tournaments, and flexible banking options. The platform’s clean interface, paired with lightning-fast crypto processing, has helped Jackbit gain recognition among both casual players and high-stakes gamblers in the U.S. market.

Why Is Jackbit Considered the Leading Crypto Casino in the US?

Jackbit Casino remains at the forefront of the crypto gambling space in 2025, offering a seamless user experience, instant transactions, and an unparalleled game variety. Here’s what makes it stand out:

• No KYC Required – Sign up with just an email, no ID needed.

• Instant Crypto Withdrawals – Fast payouts, often within minutes.

• 7000+ Games – Slots, live dealers, crash games, and more.

• 20+ Crypto Options – BTC, ETH, USDT, DOGE, and others supported.

• Wager-Free Bonus – 100 free spins on a $50 deposit, no rollover.

• Mobile-Friendly – Runs smoothly on all major smartphones.

• Live Sports Betting – Bet on sports alongside casino play.

• 24/7 Support – Live chat available anytime.

The post Jackbit: The New Crypto Casino Shapes U.S. Gambling in 2025 with 7000 Games and No KYC appeared first on Gaming and Gambling Industry in the Americas.

crypto casino

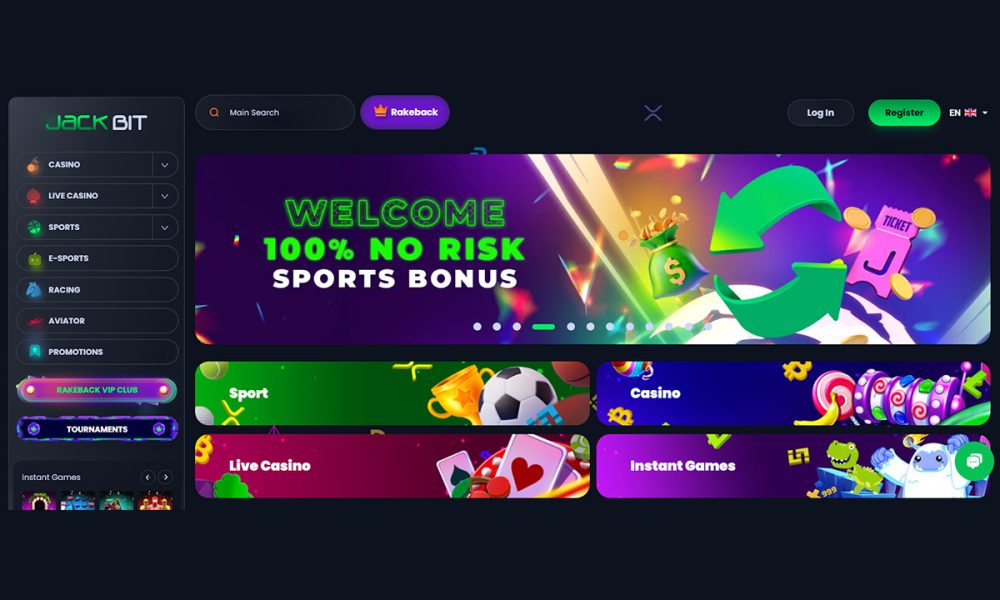

Jackbit Gains Traction Among Crypto Casino Users for Instant Withdrawals, Zero KYC Requirements, and a Streamlined Gaming Experience

Jackbit, operated by Ryker B.V., has been named the leading instant withdrawal crypto casino of 2025, following a quarter of consistent growth in user activity and praises across major gambling forums/aggregator sites. Industry stakeholders attribute this momentum to two key factors:

• Increasing demand for anonymous, user-controlled environments.

• The platform’s integration of fast, no-verification withdrawals with a competitive, multi-category game offering.

Launched in 2022 under a Curaçao license, Jackbit supports a wide range of cryptocurrencies and continues to get noticed by crypto users for its stable performance, cross-chain support, and user-friendly design.

Why is Jackbit Becoming the Preferred Crypto Casino in 2025?

Although a relatively recent entrant in the crypto casino space, Jackbit is increasingly being identified by users and industry observers as outperforming several long-established crypto casino platforms in key operational areas.

The platform has drawn particular attention for its no KYC crypto casino approach, which enables access with fewer entry barriers compared to competitors that continue to enforce tiered KYC protocols and withdrawal restrictions.

Users have also noted Jackbit’s broader multi-chain integration, which enables smoother transactions across a wider range of blockchain networks, an advantage over single-chain platforms that limit flexibility.

Stability is another area where Jackbit is frequently cited, with consistent uptime and minimal service interruptions reported, particularly during high-traffic periods. In terms of interface and usability, the platform has been described as more intuitive and responsive than many legacy crypto casinos.

Its support infrastructure, featuring 24/7 multilingual assistance and faster response times, has further contributed to positive user sentiment. Collectively, these factors are positioning Jackbit as a preferred crypto casino among privacy-conscious.

Jackbit’s key features reportedly align with the evolving expectations of crypto casino players.

No KYC Model: Operating as an anonymous crypto casino, Jackbit allows users to register and withdraw without providing identity documents, a policy that stands out amid tightening verification norms across the sector.

Instant Transaction Processing: Reports from active users indicate that both deposits and withdrawals are typically completed within minutes, including during periods of high traffic.

Expanded Crypto Support: The platform accepts over 20 cryptocurrencies, including BTC, ETH, USDT, LTC, and XMR, offering broader access than many competitors.

Extensive Gaming Portfolio: Jackbit features more than 7,000 slot games, 200+ live casino titles, a fully integrated sportsbook, and a range of exclusive mini-games.

Mobile Compatibility and App Access: The service is fully optimized for mobile use, with a dedicated app available for enhanced performance and accessibility.

24/7 Multilingual Customer Support: Assistance is available at all hours via live chat and email, with support offered in multiple languages.

No-Wager Rakeback Program: Jackbit’s rakeback structure offers instant returns without wagering requirements, with no maximum limit on earnings.

Crypto Support and Payment Flexibility

Jackbit has been admired by plenty of crypto users for its broad cryptocurrency support and flexible payment infrastructure. The platform accepts over 20 digital assets, including Bitcoin, Ethereum, USDT, Litecoin, XRP, Monero, and Dogecoin, as well as stablecoins such as USDC and DAI.

This wide coverage allows users to transact in the currency of their choice, with minimal friction. Both deposits and withdrawals are processed almost instantly, according to user reports, and remain consistent even during peak activity.

Jackbit operates under a Curaçao gaming license, adhering to regulatory standards while offering a model that prioritizes user privacy. As a best crypto casino, the platform does not require identity verification, allowing users to play and withdraw funds without submitting personal documentation. This no KYC approach has been cited as a key factor behind its growing user base.

The post Jackbit Gains Traction Among Crypto Casino Users for Instant Withdrawals, Zero KYC Requirements, and a Streamlined Gaming Experience appeared first on Gaming and Gambling Industry in the Americas.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory9 years ago

iSoftBet continues to grow with new release Forest Mania

-

News8 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018