Latest News

PlayBit Casino Token: A Pioneering Venture in the Crypto Gaming World

In an era where digital innovation and with technology advancing at an astounding pace. Cryptocurrencies once perceived to be an idea have now been widely adopted and accepted for both transactional and as a form of currency. Gambling as the oldest form of entertainment is not any different, with blockchain technology available, it is evitable that Crypto-Based online casinos will emerge. The Crypto gambling industry with an estimated valuation of 250 Million USD, is just a drop compared to the gargantuan gambling industry which is worth at least 93 billion USD as of 2023.

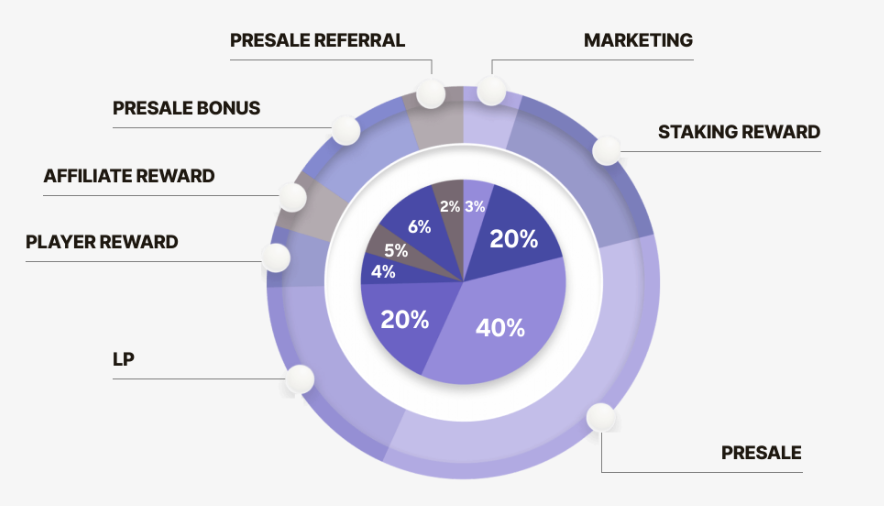

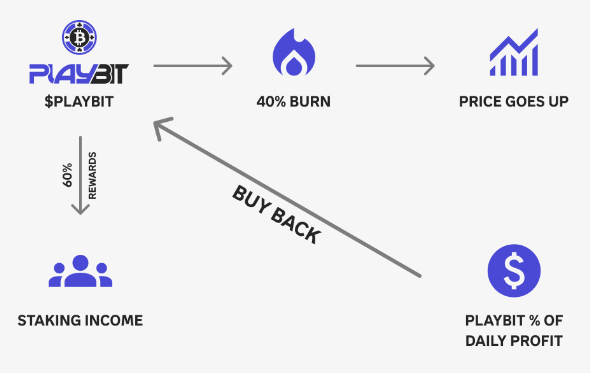

PlayBit aims to capitalize and revolutionize this industry by introducing an avant-garde tokenomics model, centered around the $PLAYBIT token, designed to optimize the gaming experience and maximize player rewards. The project’s deflationary strategy, featuring buybacks and token burns, ensures the intrinsic value of $PLAYBIT appreciates over time, directly benefiting token holders and investors and sustaining project growth.

ERC-404:

So what is ERC-404 ? It simply means it is a token standard that allows users to buy and sell fractions of NFTs, enabling broader participation in high-value assets and creating new investment opportunities.

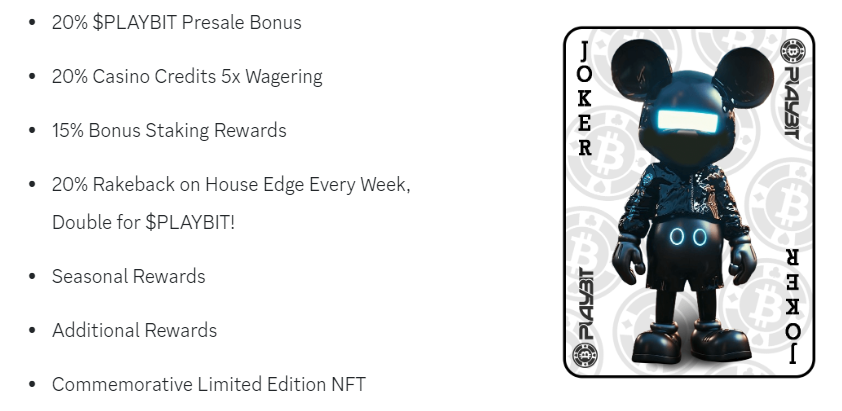

PlayBit incorporates the ERC-404 NFT as a form of ownership by purchasing $PLAYBIT tokens, users can then stake PLAYBIT tokens which offer unparalleled benefits such as enhanced rewards, including access to exclusive games, higher cashbacks and VIP rewards within PLAYBIT’s casino platform. These innovations not only enhance the gaming experience but also provide substantial financial incentives for players.

Presale:

The PLAYBIT token presale presents a unique opportunity for early adopters to be part of PlayBit’s journey from the ground up. Benefits of joining the presale include special discounts, early access to the platform’s features, and a chance to maximize investment potential ahead of the full launch.

Full details can be found at PlayBit Casino

Sustainable Growth Through BuyBack and Burn

Sustainability has always been a key concern for participants, how will the platform grow its revenue, how will the tokens I own appreciate with the projects grow. Therefore, a key pillar of PlayBit’s strategy for sustainable growth and token value appreciation is its BuyBack and Burn program. By allocating a significant portion of profits to repurchase and burn tokens, PlayBit ensures a steady increase in token scarcity and value, directly benefiting its community.

Strategic Partnerships and Gaming Library

With partnerships with top-tier game providers and an extensive library of over 10,000 games including but not limited to Live Casino games, slot machines, sports betting to even our very own in-house designed RNG Games with such offerings, PlayBit is set to offer an unmatched gaming experience. This expansive selection ensures that PlayBit has something for every player. PlayBit delivers quality and diversity in gaming parallels the innovative approaches seen in the market, aiming to redefine user expectations and experiences in crypto gaming.

Regulatory Compliance

Operating under a license from the Curacao eGaming Authority, PlayBit guarantees a secure, transparent, and fair gaming environment. This commitment to regulatory compliance and operational excellence is bolstered by a team with extensive experience in both the crypto and gaming industries, ensuring PlayBit’s strategic vision is executed flawlessly with a commitment to user security and fair play.

Conclusion: A Unique Investment Opportunity

As the crypto and casino worlds converge, PlayBit represents a unique intersection of innovation, entertainment, and investment potential. The project’s strategic approach to tokenomics, community rewards, and gaming diversity positions it as a notable contender in the crypto casino space, promising a vibrant future for investors and gamers alike.

More information on PlayBit website and social media.

Gambling in the USA

Scientific Games Introduces GlowMark, All-New Fluorescent Marking System for Lottery Extended Play Scratch Games

Vibrant Neon Marking System Enhances the Play Experience for Popular Crossword and Bingo Games

Scientific Games has created an all-new fluorescent marking system for lottery extended play scratch games such as crossword and bingo, adding a vibrant neon glow to the play experience. Recognizing the expanding popularity of extended play games, which have seen significant growth in recent years, the company’s metro Atlanta-based scratch game designers, game programmers, chemists and production experts developed GlowMark to give players a bright fluorescent surprise when they scratch the game. The innovation is available to U.S. and international lotteries.

Scientific Games, the world’s largest creator, producer and manager of lottery games, offers more than 100 strategic product enhancements for its world-leading lottery instant products. The new GlowMark marking system reveals a contrasting neon fluorescent color when the player scratches the play area, a vibrant departure from the typical white reveal area found in most games.

SG Analytics indicate extended play lottery games have grown by 32% in the past five years (2019-2024). Today, they represent 18.3% of U.S. lottery retail sales. What was once a niche product is now offered by 44 U.S. lotteries, with retail sales topping $11.5 billion last year.

Scratch games featuring fluorescent inks also grew in popularity, representing more than 12% of games in the market by fiscal year 2025. Additionally, $10 scratch games with fluorescent inks outperformed other $10 games by nearly 9% in fiscal year 2025.

“Our Innovation and Discovery teams developed this innovation by using fluorescents to enhance the scratch game experience and are now thrilled to debut GlowMark, our newest advancement in extended play marking systems,” said Danielle Hodges, Senior Director, Global Product Innovation & Development for Scientific Games. “GlowMark gives games a strong, visually appealing contrast between the marked and unmarked areas of the game, adding excitement with glowing neon colors.”

Extended play scratch games produced at Scientific Games’ metro Atlanta global headquarters, as well as production facilities in Canada and the UK, can feature GlowMark. The company’s products represent 70% of lottery instant game global retail sales.

Innovating products and solutions that move the global lottery industry forward since 1973, Scientific Games provides retail and digital games, technology, analytics and services to 150 lotteries in 50 countries worldwide.

GlowMark is a trademark of Scientific Games, LLC. © 2025 Scientific Games, LLC. All Rights Reserved.

is a trademark of Scientific Games, LLC. © 2025 Scientific Games, LLC. All Rights Reserved.

The post Scientific Games Introduces GlowMark, All-New Fluorescent Marking System for Lottery Extended Play Scratch Games appeared first on Gaming and Gambling Industry in the Americas.

Gambling in the USA

Resorts World Las Vegas Appoints Respected Industry Leaders Lou Dorn as Chief Legal Officer and Corporate Secretary; Elizabeth Tranchina as General Counsel

Resorts World Las Vegas announces the appointments of Lou Dorn as Chief Legal Officer and Corporate Secretary, and Elizabeth Tranchina as General Counsel. Together, they bring proven leadership across the gaming and hospitality industries and will oversee legal, regulatory, governance, and risk-related functions for the resort, helping to drive operational excellence and support long-term growth.

“Lou brings an exceptional depth of experience in gaming law and regulatory compliance that will be instrumental as we continue to grow and evolve,” said Jim Murren, Chairman of Resorts World Las Vegas. “His leadership will help ensure our operations remain forward-thinking, responsible and built on a strong legal foundation.”

Dorn’s distinguished career spans both public service and private-sector leadership. He comes to Resorts World from Bally’s Corporation, where he served as Senior Vice President and General Counsel – North America and oversaw legal operations for 19 casino and resort properties across the U.S., including online gaming and sports wagering platforms. Prior to that, he held executive legal roles at Monarch Casino & Resort, SLS Las Vegas, Aliante Casino and Hotel and the Las Vegas Hilton, where he led legal strategy, compliance programs and regulatory affairs.

Earlier in his career, Dorn served as Chief of the Corporate Securities Division for the Nevada Gaming Control Board and as Deputy Attorney General for the State of Nevada. In these roles, he helped shape and enforce gaming regulations and compliance for the state, gaining a comprehensive understanding of both Nevada gaming law and federal securities law.

“Joining Resorts World Las Vegas at such a dynamic time in its growth is an exciting opportunity,” said Dorn. “Having spent my career navigating the complexities of gaming law and regulatory compliance, I look forward to supporting the resort’s continued success by ensuring we operate with the highest standards of legal integrity and strategic governance.”

Resorts World Las Vegas also welcomes Elizabeth Tranchina as General Counsel. A seasoned legal counsel with more than 20 years of legal and regulatory compliance experience in the gaming and hospitality industry, Tranchina began her legal career as an Assistant Attorney General in the Gaming Division for the Louisiana Department of Justice. She most recently served as General Counsel for Investar Bank, headquartered in Louisiana, overseeing the legal operations for more than 20 branch locations across Louisiana, Texas and Alabama. Prior to that, she was General Counsel at Rio Hotel & Casino where she managed the legal, regulatory compliance and risk functions for the property. Tranchina has held senior leadership roles at publicly traded gaming, sports betting, and iGaming companies, overseeing legal and compliance matters across multiple jurisdictions.

“Elizabeth brings a steady, solutions-oriented mindset to complex legal challenges. Her experience across gaming and financial services adds valuable perspective to our leadership team, and her contributions will be instrumental as we continue to grow,” said Carlos Castro, President and Chief Financial Officer for Resorts World Las Vegas.

For more information about Resorts World Las Vegas, please visit rwlasvegas.com.

The post Resorts World Las Vegas Appoints Respected Industry Leaders Lou Dorn as Chief Legal Officer and Corporate Secretary; Elizabeth Tranchina as General Counsel appeared first on Gaming and Gambling Industry in the Americas.

Latest News

How CommsHub Built-In Failover Protects High-Volume Messaging Businesses

In today’s connected world, a single missed message can have a ripple effect far beyond its intended recipient. For high-volume messaging businesses, from fintech to e-commerce, reliability isn’t just a feature; it’s the foundation.

At CommsHub, we’ve seen how even the most robust communication strategies can fall apart when traffic isn’t managed intelligently. That’s why built-in failover isn’t an add-on for us, it’s at the very core of our platform architecture.

The Hidden Risk in Messaging at Scale

Sending a million messages is easy. Delivering a million messages on time without losses, delays, or duplicates is the real challenge.

Traditional messaging setups often rely on a primary route, with a manual backup plan in case of outages. The problem? Manual intervention takes time and every second loss increases the risk of failed conversions, missed verifications and frustrated customers.

For some sectors, a five-minute delay can mean thousands in lost revenue. For others, it can damage trust irreparably.

How Our Failover Works

CommsHub’s built-in failover system works like an automated traffic director.

- Real-Time Route Monitoring: Every active channel is monitored for delivery speed, message status and error rates.

- Instant Automatic Switching: If performance drops below a set threshold or a provider experiences downtime traffic is instantly redirected to the next best available route.

- Multi-Level Redundancy: We don’t just fail over once. Traffic can cascade through multiple backup routes until successful delivery is confirmed.

This means campaigns keep running without interruption, even when unexpected technical issues occur in the background.

The Numbers Behind It

In controlled environments, we’ve observed that our failover logic reduces message loss to near zero. While previously around 17% of messages were considered as lost or undelivered – while in reality, fallback mechanism saves them.

The architecture also ensures that when switching routes, there’s no spike in costs thanks to our intelligent routing engine, which considers provider pricing in real time.

Protecting Revenue and Reputation

The immediate benefit is obvious: you don’t lose communication with your audience. But the deeper value lies in protecting both revenue and reputation.

For high-volume businesses, the stakes are high:

A trading platform missing two-factor authentication codes risks losing active traders.

An e-commerce brand failing to deliver time-sensitive promotions risks wasted ad spend.

A fintech company delaying fraud alerts risks customer churn.

CommsHub’s failover was designed to address these risks without requiring extra integration work or manual monitoring.

Engineering for the Future of Messaging

We see failover not as a safety net, but as a structural pillar of next-generation communication platforms. As channels diversify and volumes grow, redundancy and intelligent routing will be as essential as delivery speed and analytics.

This is why we’ve invested heavily in creating an architecture that can evolve with market needs from adding new providers in days instead of weeks, to scaling traffic instantly during spikes.

The result? Businesses that can move faster, sleep easier and deliver messages with confidence.

In messaging, there’s no such thing as “just a delay.”

Every second counts and with built-in failover, those seconds are always on your side.

Meet Us at SBC Summit Lisbon 2025

We’ll be showcasing CommsHub’s next-generation messaging solutions at SBC Summit Lisbon 2025, from 16-18 September.

Visit us at Booth D181 to see how built-in failover can help your business deliver every message with confidence.

The post How CommsHub Built-In Failover Protects High-Volume Messaging Businesses appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018