Cryptocurrency

Crypto Banking

The term crypto banking refers to how individuals can use cryptocurrencies to conduct business. There is a convergence between investing in cryptocurrency and banking methods wherein both fiat currency and cryptocurrencies can be exchanged and interact through banking services. This is what Crypto Banking wants to exploit.

What is Crypto Banking?

Crypto banking is the process of managing digital currency through any financial service provider or bank. People are increasingly buying, selling, and trading cryptocurrencies because they can do so with an internet connection. Banks that accept digital currencies and support cryptocurrencies include Ally Bank, Wirex, Barclays, Goldman Sachs and JPMorgan (to name a few).

Unlike traditional financial institutions, crypto banks do not hold stocks or cash for investors or customers. Crypto banks, on the other hand, hold digital assets instead of fiat currency. Vast Bank, for instance, provides business and personal banking products including savings accounts and checking CDs, credit cards, and loans.

Despite being a small local bank with 35 years of experience in the business, it has recently entered the crypto economy and has been given attention as the first US nationally chartered bank that allows customers to hold crypto assets in their accounts.

Crypto Interest Accounts

Starting with a crypto interest account is the simplest way to get started. A traditional savings account may offer interest rates as low as 1% compared to crypto banks with 10%. These crypto accounts are available at Gemini, BlockFi, Nexo Outlet Finance, and Linus among others.

Crypto Checking Accounts

You can also open a crypto checking account. You will be able to keep more of your money without paying crypto fees if you have a crypto checking account. The Quontic Bank and Vast Bank also offer crypto checking accounts.

Customers who make eligible purchases with Quontic’s Bitcoin Rewards Checking account are rewarded with bitcoin. Quontic debit cards allow you to make purchases that qualify for Bitcoin conversion when you use them online or in-store. About 1.5% of your total transaction will be converted into Bitcoin after the transaction is completed.

To get started with cryptocurrency, you can go read some articles on Bitcoin Prime. They have quality information regarding crypto that will be of good use to you.

How to get started with Crypto Banking

The easiest way to get started with crypto banking if you don’t own any cryptocurrency yet is to register for an account with any bank that accepts cryptocurrencies or your choice of decentralized finance apps. Then you can buy Bitcoin and other currencies from their exchanges.

Applications using decentralized blockchain networks are called decentralized finance apps, which do not require a middleman like a brokerage or a bank to facilitate the purchase of financial products. Apps that are both platforms for buying and selling as well as hot wallets where crypto-assets can be stored are also available. Among these apps are:

Revolut: which allows users to complete transactions using Bitcoin, Ethereum, and Litecoin

SEBA Bank: A Swiss bank that accepts cryptocurrency payments and transactions

Wirex: An online payment platform that allows crypto transactions and payments

Risks of Crypto Banking

Investing in cryptocurrencies and using apps that allow you to trade and hold digital assets carries some risks as crypto banking disrupts the financial sector. Here are some risks you can face.

Crypto Market Volatility

The volatility of crypto assets is well known. Because it takes a long time before cryptocurrencies become stable, investing in crypto comes with a higher level of risk than other trade markets. Despite their stability, crypto markets can experience dramatic fluctuations in a heartbeat.

Cryptocurrency is not FDIC Insured

Unlike traditional deposits, crypto investments are not insured by the Federal Deposit Insurance Corporation (FDIC). If the company from which you purchase crypto goes under, you could lose all your investment. Eventually, cryptocurrencies may be insured, but in the meantime, it’s important to choose a reputable crypto bank to work with.

Crypto Hacks, Theft and Fraud

As fintech becomes more popular, more hacking incidents occur in DeFi applications. You should consider a cold wallet to protect your investments, as you need to be aware of how your crypto assets are stored.

Conclusion

Blockchain technology has many uses in banking, so it won’t be long before banks start to make use of the public ledger in certain areas. There will inevitably be risks in finance. However, crypto banking and blockchain technology present the possibility of a future in which anyone on the planet can access transparent crypto banking.

crypto casino

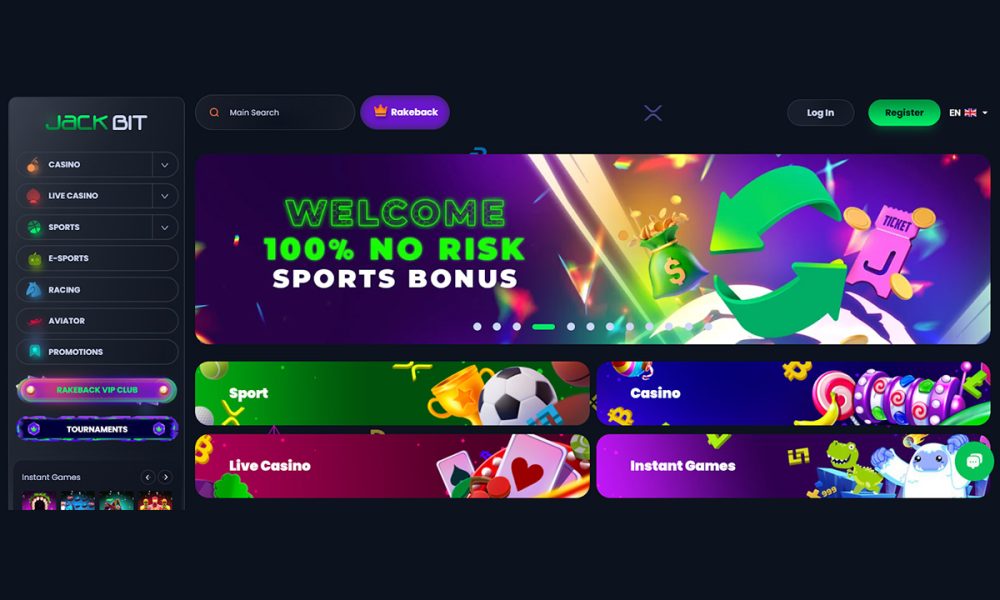

Jackbit: The New Crypto Casino Shapes U.S. Gambling in 2025 with 7000 Games and No KYC

Play 7000+ games at Jackbit, the rewarding U.S. crypto casino with no KYC, instant withdrawals, 20+ coins, and 100 free spins on a $50 deposit.

Jackbit Casino has been named the fastest growing and leading Bitcoin casino in the US for 2025, standing out for its no-KYC registration, instant crypto withdrawals, and access to over 7000 games from 70+ global providers.

Since its launch in 2022, Jackbit has become a preferred destination for crypto users seeking speed, security, and variety all in one platform. Licensed under Curaçao eGaming and operated by Ryker B.V., Jackbit supports over 20 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Tether.

New players receive 100 wager-free spins with a $50 deposit, while returning users benefit from cashback, tournaments, and flexible banking options. The platform’s clean interface, paired with lightning-fast crypto processing, has helped Jackbit gain recognition among both casual players and high-stakes gamblers in the U.S. market.

Why Is Jackbit Considered the Leading Crypto Casino in the US?

Jackbit Casino remains at the forefront of the crypto gambling space in 2025, offering a seamless user experience, instant transactions, and an unparalleled game variety. Here’s what makes it stand out:

• No KYC Required – Sign up with just an email, no ID needed.

• Instant Crypto Withdrawals – Fast payouts, often within minutes.

• 7000+ Games – Slots, live dealers, crash games, and more.

• 20+ Crypto Options – BTC, ETH, USDT, DOGE, and others supported.

• Wager-Free Bonus – 100 free spins on a $50 deposit, no rollover.

• Mobile-Friendly – Runs smoothly on all major smartphones.

• Live Sports Betting – Bet on sports alongside casino play.

• 24/7 Support – Live chat available anytime.

The post Jackbit: The New Crypto Casino Shapes U.S. Gambling in 2025 with 7000 Games and No KYC appeared first on Gaming and Gambling Industry in the Americas.

crypto casino

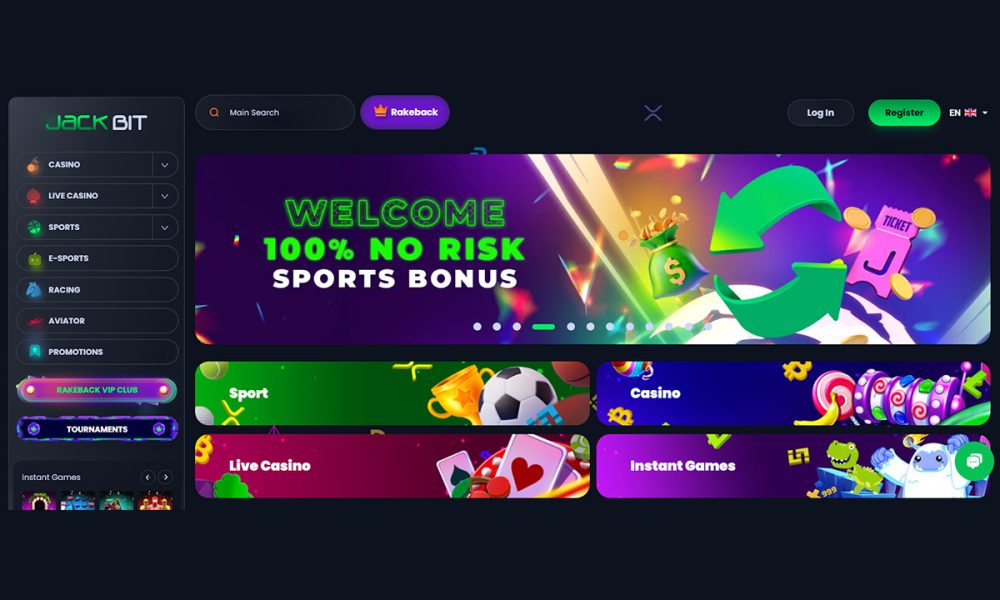

Jackbit Gains Traction Among Crypto Casino Users for Instant Withdrawals, Zero KYC Requirements, and a Streamlined Gaming Experience

Jackbit, operated by Ryker B.V., has been named the leading instant withdrawal crypto casino of 2025, following a quarter of consistent growth in user activity and praises across major gambling forums/aggregator sites. Industry stakeholders attribute this momentum to two key factors:

• Increasing demand for anonymous, user-controlled environments.

• The platform’s integration of fast, no-verification withdrawals with a competitive, multi-category game offering.

Launched in 2022 under a Curaçao license, Jackbit supports a wide range of cryptocurrencies and continues to get noticed by crypto users for its stable performance, cross-chain support, and user-friendly design.

Why is Jackbit Becoming the Preferred Crypto Casino in 2025?

Although a relatively recent entrant in the crypto casino space, Jackbit is increasingly being identified by users and industry observers as outperforming several long-established crypto casino platforms in key operational areas.

The platform has drawn particular attention for its no KYC crypto casino approach, which enables access with fewer entry barriers compared to competitors that continue to enforce tiered KYC protocols and withdrawal restrictions.

Users have also noted Jackbit’s broader multi-chain integration, which enables smoother transactions across a wider range of blockchain networks, an advantage over single-chain platforms that limit flexibility.

Stability is another area where Jackbit is frequently cited, with consistent uptime and minimal service interruptions reported, particularly during high-traffic periods. In terms of interface and usability, the platform has been described as more intuitive and responsive than many legacy crypto casinos.

Its support infrastructure, featuring 24/7 multilingual assistance and faster response times, has further contributed to positive user sentiment. Collectively, these factors are positioning Jackbit as a preferred crypto casino among privacy-conscious.

Jackbit’s key features reportedly align with the evolving expectations of crypto casino players.

No KYC Model: Operating as an anonymous crypto casino, Jackbit allows users to register and withdraw without providing identity documents, a policy that stands out amid tightening verification norms across the sector.

Instant Transaction Processing: Reports from active users indicate that both deposits and withdrawals are typically completed within minutes, including during periods of high traffic.

Expanded Crypto Support: The platform accepts over 20 cryptocurrencies, including BTC, ETH, USDT, LTC, and XMR, offering broader access than many competitors.

Extensive Gaming Portfolio: Jackbit features more than 7,000 slot games, 200+ live casino titles, a fully integrated sportsbook, and a range of exclusive mini-games.

Mobile Compatibility and App Access: The service is fully optimized for mobile use, with a dedicated app available for enhanced performance and accessibility.

24/7 Multilingual Customer Support: Assistance is available at all hours via live chat and email, with support offered in multiple languages.

No-Wager Rakeback Program: Jackbit’s rakeback structure offers instant returns without wagering requirements, with no maximum limit on earnings.

Crypto Support and Payment Flexibility

Jackbit has been admired by plenty of crypto users for its broad cryptocurrency support and flexible payment infrastructure. The platform accepts over 20 digital assets, including Bitcoin, Ethereum, USDT, Litecoin, XRP, Monero, and Dogecoin, as well as stablecoins such as USDC and DAI.

This wide coverage allows users to transact in the currency of their choice, with minimal friction. Both deposits and withdrawals are processed almost instantly, according to user reports, and remain consistent even during peak activity.

Jackbit operates under a Curaçao gaming license, adhering to regulatory standards while offering a model that prioritizes user privacy. As a best crypto casino, the platform does not require identity verification, allowing users to play and withdraw funds without submitting personal documentation. This no KYC approach has been cited as a key factor behind its growing user base.

The post Jackbit Gains Traction Among Crypto Casino Users for Instant Withdrawals, Zero KYC Requirements, and a Streamlined Gaming Experience appeared first on Gaming and Gambling Industry in the Americas.

Asia

12BET Goes Crypto with Big Rewards

As cryptocurrency adoption surges worldwide—driven by landmark legislation and growing investor confidence—12BET, continues to lead in embracing digital innovation. Recent U.S. Congressional moves to pass crypto-focused legislation, alongside India’s evolving regulatory stance, mark a global shift towards mainstream acceptance of digital assets.

12BET, a pioneering name in the igaming world since 2007, invites crypto users to experience fast, secure and flexible transactions through its wide range of supported cryptocurrencies. Players can choose from the widely used USD-pegged stablecoin USDT (Tether), Bitcoin (BTC), Ethereum (ETH) and the community-favourite Dogecoin (DOGE). These crypto-friendly payment options ensure seamless access to 12BET’s full entertainment portfolio—meeting the expectations of a new generation of tech-forward players.

“As cryptocurrency continues to reshape how people handle money, we’re proud to give our players modern payment options that reflect our values of fairness and transparency. We’re building a platform that moves in step with global innovation and player-first features,” said Rory Anderson, spokesperson for 12BET.

To celebrate this growing momentum, 12BET is offering all eligible users a spin on their Lucky Wheel, with prizes including an iPhone 16 Pro Max, a 2.5g 999 gold bar and a DJI Osmo Pocket 3—available for a limited time.

This move comes amid growing global crypto adoption, with recent legislative efforts like the GENIUS Act and CLARITY Act in the US, and increased regulatory clarity in markets like India. As the global crypto market surpasses $4 trillion, 12BET is doubling down on its mission to deliver a future-ready, player-first gaming experience.

The post 12BET Goes Crypto with Big Rewards appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018