iGaming

The LATAM Online Casino Market: Where Innovation Meets Localization

Latin America, or LATAM, is quickly rising on the global radar as a hot new playground for online casinos. A lively mixture of tech-hungry young people, wider Internet access every month, and rules that are slowly but steadily growing friendlier to gaming makes the region a tempting patch of soil for operators eager to plant their brand. Unlike older markets that are already crowded and tightening the regulatory screws, LATAM still feels fresh and open, letting companies chase fast gains by leaning on bold ideas, local flavors, and mobile-first thinking.

Why LATAM Is a Key Growth Market for Online Gambling

A few key trends are stacking the deck in favor of LATAM casinos. First, smartphones have practically become a third arm for many residents. The GSMA Mobile Economy report for 2023 says more than 73 percent of the region now carries a smartphone, and that share keeps climbing. Such broad pocket-sized connectivity lets gaming sites reach players, even in remote towns, without the extra cost of shops or kiosks.

Second, LATAM’s population is much younger than Europe or North America. Millennials and Gen Z together make up a huge slice of the online betting crowd. Because these generations live, shop, and play through apps, they slide into digital payments and gamified screens with little friction, exactly the kind of audience casinos dream about.

Third, even though rules still differ from nation to nation, the general trend is toward looser, friendlier legislation. Brazil, for example, just passed a law covering fixed-odds sports betting and other online games, a clear sign that officials want licensed, taxable sites.

For LATAM players who prefer local touches, a one-stop hub such as Ingamble proves useful. The service directs users to casinos in their language, accepts their usual payment methods, and meets local laws, building the trust and ease that a young market needs.

How Cultural Differences Shape Casino Preferences

Grasping what people like in each country is critical to success, and LATAM shows that well. Its mix of cultures, customs, and histories means a blanket offer will disappoint in most places. In Mexico, for instance, community bingo nights and brightly themed slots still rule the floor, echoing deep traditions. Developers win by weaving folkloric images, regional music, and familiar tales into those games.

Brazilians, by contrast, look for platforms that merge casino fun with sports betting heat. Because football is almost a second religion, sites that serve live odds alongside a spinning wheel or table gain a clear and lasting advantage.

Localizing a product goes well beyond swapping English words for Spanish or Portuguese. It means building every step of the user journey around local holidays, favorite sports, and even the colors people associate with luck. When a digital service reflects the rhythm of daily life in a country, users stay longer and come back more often.

LATAM’s payments landscape is fragmented, so every casino must meet players where they are. Many customers are underbanked or lean on alternative tools, which makes integrating local methods essential rather than optional. Accepting Brazil’s PIX or the classic boleto bancario has moved from a bonus feature to a bare minimum.

Across the region, Argentina’s Mercado Pago rules wallets while Colombia’s Mercado Pago leads transfers through PSE. If these gateways are missing, carts are abandoned and trust disappears.

Currency support matters just as much. Enabling deposits and withdrawals in pesos or reales spares players conversion fees, and signals the operator treats them like a local. Casinos that add instant payouts and clear fee structures speed up service and earn a valuable edge.

Mobile Dominance: Data-Light Designs Win

Smartphones drive almost all online traffic across LATAM, so any brand that ignores them is courting failure. Yet mobile success goes beyond fitting a website on a small screen; it means building services that run smoothly on flaky networks and budget handsets.

Enter Progressive Web Apps (PWAs), a lightweight layer that gives casino players app-like speed without the hassle of Big Store downloads. Pair that with smart tricks: images that shrink on command, offline pockets so play never halts, and a no-frills layout that cuts data costs for users counting every megabyte.

Market leaders also roll out lite skins, peeling off heavy animations and endless scripts in favor of bare-bones speed and rock-solid uptime. Research shows delays of even a second can send players packing, turning lean design from a tech choice into a profit-or-loss showdown.

Localization Beyond Language: Bonuses and UI

Translation may get the words right, but it rarely captures what a player actually feels. Rewards, loyalty plans, and promos need to mirror local rhythms or they fade into the noise. A Holy Week rebate or a Festas Juninas gift card, for example, speaks straight to a Brazilian wallet and makes gaming personal.

User interfaces should always respect the tastes of the region. Across most LATAM markets, bold colors and lively animations win users more reliably than soft, stripped-back looks. Themes that borrow from local myths, beloved athletes, or street parties hit harder and draw stronger emotional ties.

Clear, honest talk about bonuses – especially wagering rules – matters just as much. LATAM players often arrive wary and quick to abandon sites that hide or twist the fine print. Simple, plain-language promises and fair play keep satisfaction high and churn low.

LATAM Regulation: Fragmented Today, Unified Tomorrow?

The legal landscape across LATAM still looks like a patchwork quilt, with every nation moving at its own rhythm. After years of debate, Brazil has at last laid down the first stones for an official iGaming market. Rules passed in 2023 set out licensing, tax rates and ad norms, marking a huge step for the region.

Colombia stays ahead, having greenlit online gambling in 2016 and handing out more than twenty operators’ licences since then. Its clear framework shows how steady oversight can tempt first-class global brands while still shielding everyday players.

Yet nations such as Venezuela and Bolivia remain at the back, relying on vague or years-old laws. So, firms chasing regional growth move quickly, launching under Curacao or MGA permits and promising to shift to local licenses once the rules firm up.

This patchwork of regulations calls for clear-eyed planning. Online casinos must link arms with lawyers and compliance pros who can steer them through local quirks, keep them out of gray markets, and support lasting operations.

LATAM’s online casino field is tricky but lucrative. Brands that respect local culture, invest in thorough localization, and build mobile-first sites stand a strong chance. As rules continue to modernize and user appetite grows, happy young audiences and friendly smartphone stacks regions shine as a fresh frontier for global iGaming.

The post The LATAM Online Casino Market: Where Innovation Meets Localization appeared first on Gaming and Gambling Industry in the Americas.

iGaming

Internet Sports International (ISI) Launches ISI Mobile, a Best-in-Class Gaming Software Solution

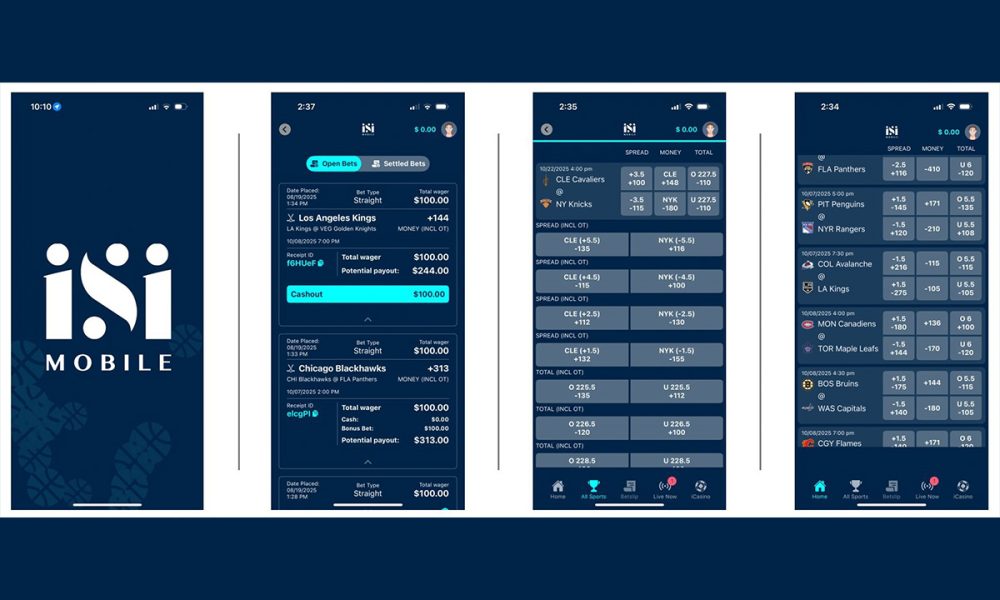

Global race and sportsbook technology provider Internet Sports International (ISI) has launched ISI Mobile, a best-in-class software solution. The leading solution enables ISI to deliver a complete, customizable white-label online solution that encompasses both sports betting and iGaming, including Class II and Class III games.

“For years, we have carefully and thoughtfully evaluated options for our own proprietary software capable of competing with industry giants. Today, we are proud to offer a platform that provides significant advantages. This enables us to deliver a fully white-labeled, highly competitive, and strategically advantageous solution for our clients in an expedited and compliant fashion. We can also launch our customers faster, at scale and a lot more cost effectively, without all the baggage you have with the old tech in the market today,” said ISI President Bill Stearns.

ISI Mobile is a scalable and modular solution that has several key features that distinguish it from other solutions and makes it an attractive choice for operators, including:

• Fully white-label solution

• End-to-end mobile-optimized design

• Purpose-built native promotional engine

• Customized cashier

• Lightning-fast performance with high throughput capacity

• Fully Integrated platform

• Next-gen proprietary PAM

• Geofenced with best-in-class partner for on premise, on reservation or statewide gaming

ISI Mobile’s platform is both modular and scalable and enables micro-betting, in-game bets, parlays, and more. Additionally, its in-house player account management (PAM) system has a CRM promotional engine that can integrate seamlessly with any existing CRM the property may be using. The platform also allows operators to keep their own data and to protect their own player relationships.

“Our next-gen tech is a white label platform for sports betting and iGaming, which means casinos can deliver the incredible experiences they want to deliver for their players, all branded to the casino, and with a PAM that is fully integrated to the property’s existing CRM,” Stearns said.

The post Internet Sports International (ISI) Launches ISI Mobile, a Best-in-Class Gaming Software Solution appeared first on Gaming and Gambling Industry in the Americas.

Awards

SOFTSWISS Wins Best Game Aggregator Award in Latin America

SOFTSWISS wins the CGS Recife Awards 2025 for its flagship Game Aggregator, confirming its industry leadership as the largest content hub in iGaming, operating with 99.999% uptime across 24 regulated jurisdictions. Recognition in Latin America, where SOFTSWISS has achieved full product certification, further proves the product’s global dominance and commitment to delivering trusted solutions across key regulated markets.

The award recognises the best game aggregation platform in the Latin American iGaming market, celebrating leadership, innovation, and operational excellence. This recognition is especially important as it comes from Brazil, where all SOFTSWISS products have recently been certified, led by the Game Aggregator. It is the 7th international award for the Game Aggregator, highlighting the product’s dedication to delivering unmatched scale and stability.

The Game Aggregator is recognised as the industry leader because of measurable advantages that no other platform can match. Operating in 24 jurisdictions, the solution provides direct access to 35,000+ active playing games from 300+ providers with new releases appearing immediately in operators’ portfolios enabled by streamlined integrations.

Engagement features deliver proven growth. Its Tournament Tool increases average daily bets by 22% across the player base. Players who join tournaments place twice as many bets and wager 3 times more than others. Jackpot Aggregator campaigns on the Game Aggregator drive a 50% increase in turnover per user, making engagement mechanics a direct source of revenue.

The platform’s infrastructure is designed for continuous, fail-safe operation. Uptime reaches 99.999–100%, guaranteed by strict SLAs and backed with proactive system notifications. The system processes 7,000 requests and up to 100,000 database queries per second, with 99% of responses returned in under 100 milliseconds. This ensures operators never lose a session, a bet, or their players’ trust.

Beyond scale and engagement, the platform offers features that raise industry standards: AI-driven localisation for any market, deep analytics through the Ultimate Report Builder, and customisable game metadata for client-facing flexibility.

“We are honoured to receive the Best Game Aggregator Platform award at CGS Recife. This recognition shows the value of our commitment: a constantly growing game portfolio, wide market coverage, and unwavering platform reliability. For almost ten years, our team has been building a platform that not only delivers scale and stability but also drives measurable results,” added Tatyana Kaminskaya, Head of SOFTSWISS Game Aggregator.

The SOFTSWISS team will be available at SBC Lisbon 2025, Stand B160, to discuss the possibilities of the Game Aggregator.

About SOFTSWISS

SOFTSWISS is an international technology company with over 15 years of experience in developing innovative solutions for the iGaming industry. SOFTSWISS holds a number of gaming licences and provides comprehensive software for managing iGaming projects. The company’s product portfolio includes the Online Casino Platform, the Game Aggregator with over 35,000 casino games, the Affilka Affiliate Platform, the Sportsbook Software and the Jackpot Aggregator. In 2013, SOFTSWISS revolutionised the industry by introducing the world’s first Bitcoin-optimised online casino solution. The expert team, based in Malta, Poland, and Georgia, counts over 2,000 employees.

The post SOFTSWISS Wins Best Game Aggregator Award in Latin America appeared first on Gaming and Gambling Industry in the Americas.

bespoke solutions

The White Label Dilemma: Finding the Right Balance for Your iGaming Business

It’s not just black and white label

Yoni Sidi, CEO at Wiztech, says white labels are all about striking the balance between pros and cons, but for some, it’s impossible to achieve and that’s why it’s important to consider other options.

For most operators, a white label solution seems to offer the best route to market. But is that actually the case?

I’ve been working in the industry for more than two decades now, and over that time, I’ve worked on both sides of the fence – so on the white label operator side and on the white label provider side. This gives me a deep understanding of the pros and cons of white label solutions, and this understanding ultimately led me to launch Wiztech. To answer your question more directly, white labels are always about striking the balance between the pros and cons they present – for some operators, a balance can be found, but for others, it can’t. Ultimately, it comes down to knowing what you want from your platform or technology stack, and whether a white label can meet those requirements with the budget and resources you have available to you.

So, what are the pros and cons of a white label platform?

There are plenty of upsides to white labels, and that’s why they’re used by so many operators. The main advantages are speed to market and cost effectiveness – you can literally go from first discussions to your online casino being live in a matter of weeks. The upfront fees are relatively small, and, in most cases, you pay a revenue share back to the platform provider. This can tighten margins a little, but it means you don’t have to have a large capital reserve to get going. Another benefit is that you can take on as much or as little of the operation as you like – for some, they will let the platform provider take care of the operational aspect while they focus solely on marketing and customer acquisition. Other upsides include licensing, with the white label partner securing and being responsible for the licences they hold.

Drawbacks. The biggest for me is the lack of differentiation you get with a white label. The many brands that run on the platform often look very much the same, just with different logos and branding. After a few months of operating your online casino, you’ll likely notice friction points that you’ll want to address, but the rigid nature of white-label platforms means it’s incredibly difficult to smooth out even the smallest of bumps in the road. It’s also incredibly difficult to roll out unique features and functionality as the development team is usually working through a backlog of requests – most of which are for the friction bumps that need ironing out. Factor in the frequent regulatory changes that happen, and the need for the development team to respond to them, and it’s easy to see how hard it can be to improve the experience being offered to players.

How can operators strike a balance between the pros and cons of white labels?

It comes down to understanding the capabilities of the platform provider and whether they offer customisation and localisation. If they don’t, the operator needs to determine if this is a price they’re willing to pay in exchange for the speed to market and cost effectiveness that white labels provide. Of course, some white label providers do offer support and are happy to help when it comes to developing and deploying bespoke features and functionality. But in my experience, most don’t have the capacity for this, even if they say they do. For me, the balance is found by accepting the limitations of white labels and working within the (often pretty rigid framework) they provide. There are plenty of examples of operators that have done this and have gone on to run very successful brands in highly competitive markets.

Is there an alternative to white labels?

The most obvious alternative is to develop a proprietary technology stack, but this approach comes with just as many, if not more, pitfalls. Building a platform from the ground up is incredibly expensive and tremendously risky, and this is why so few operators outside of the industry power players have been able to pull it off. And even those that do often encounter issues such as ongoing maintenance, tech debt, staffing and compliance. But there is a middle ground between white label and proprietary, and it can be found with smaller platform providers whose technologies offer the agility, flexibility and adaptability required for operators to launch highly customised, almost bespoke, online casinos and sportsbooks.

How does Wiztech fit into the platform mix, and how do you support your partners in achieving their goals in often highly competitive markets?

At Wiztech, we champion modular tech and the likes of AI and automation. By embracing these, we have been able to build powerful yet highly customisable casino and sportsbook solutions that are also fully compliant in tightly regulated markets. In our experience, being able to quickly respond to regulatory changes provides a competitive advantage to our customers. In Mexico, for example, our client Winpot has been able to deliver a unique player experience while always ensuring compliance. And this is against a backdrop where regulatory changes often come with very little notice. Our technology can adapt quickly while Winpot continues to capitalise on the growing demand for entertaining online casino products and experiences.

But just as important as our technology is our approach to our partners. This sees us undertake a comprehensive onboarding process where we spend a lot of time understanding the client’s “why” before we map out the “what” and the “how”. This has proved to be incredibly effective and ensures that our clients can get the most out of the flexibility of our platform and the high levels of customisation and personalisation it provides.

The post The White Label Dilemma: Finding the Right Balance for Your iGaming Business appeared first on Gaming and Gambling Industry in the Americas.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018