Latest News

Rivalry Announces Application for a Management Cease Trade Order for Late Filing of Annual Filings

Rivalry Corp. (TSXV: RVLY) (OTCQB: RVLCF) (“Rivalry” or the “Company”), the leading sportsbook and iGaming operator for digital-first players, today announces that it will be late in filing its audited financial statements and management’s discussion and analysis for the year ended December 31, 2024 and related certifications (the “Annual Filings”).

In response to the Annual Filings delay, the Company has applied to the Ontario Securities Commission for a management cease trade order (the “MCTO”) under National Policy 12-203 – Management Cease Trade Orders (“NP 12-203”) that will prohibit the management of the Company from trading in the securities of the Company until such time as the Annual Filings are filed. No decision has yet been made by the Ontario Securities Commission on this application. The Ontario Securities Commission may grant the application and issue the MCTO or it may impose an issuer cease trade order if the Annual Filings are not filed in a timely fashion. If the MCTO is granted, such an order would not generally affect the ability of persons who have not been directors, officers or insiders of the Company to trade the securities of the Company pending the filing of the Annual Filings on SEDAR+.

As previously announced, the Company has initiated a review of strategic alternatives to maximize long-term stakeholder value (the “Strategic Review”). The Company has determined that it is in the best interests of the Company to utilize its current management resources to advance the Strategic Review, resulting in a delay of completing the Annual Filings by the April 30, 2025 deadline.

The Company is working on the preparation of the Annual Filings and expects to complete the Strategic Review and the Annual Filings by June 30, 2025. Until the Annual Filings are filed, the Company intends to satisfy the provisions of the Alternate Information Guidelines as set out in NP 12-203 for as long as it remains in default, including the issuance of bi-weekly default status reports, each of which will be issued in the form of a news release.

The Company confirms that it is not subject to any insolvency proceeding as of the date hereof. The Company also confirms that there is no other material information concerning the affairs of the Company that has not been generally disclosed as of the date hereof.

Company Contact:

Steven Salz, Co-founder & CEO

[email protected]

Investor Contact:

[email protected]

Cautionary Note Regarding Forward-Looking Information and Statements

This news release contains certain forward-looking information within the meaning of applicable Canadian securities laws (“forward-looking statements”). All statements other than statements of present or historical fact are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “achieve”, “could”, “believe”, “plan”, “intend”, “objective”, “continuous”, “ongoing”, “estimate”, “outlook”, “expect”, “project” and similar words, including negatives thereof, suggesting future outcomes or that certain events or conditions “may” or “will” occur. These statements are only predictions. Forward-looking statements in this news release include, but are not limited to, statements with respect to the Strategic Review, the anticipated filing of the Annual Filings, the application for the MCTO and the granting thereof by the Ontario Securities Commission.

Forward-looking statements are based on the opinions and estimates of management of the Company at the date the statements are made based on information then available to the Company. Various factors and assumptions are applied in drawing conclusions or making the forecasts or projections set out in forward-looking statements. Forward-looking statements are subject to and involve a number of known and unknown, variables, risks and uncertainties, many of which are beyond the control of the Company, which may cause the Company’s actual performance and results to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. Such factors, among other things, include regulatory or political change such as changes in applicable laws and regulations; the ability to obtain and maintain required licenses; the esports and sports betting industry being a heavily regulated industry; the complex and evolving regulatory environment for the online gaming and online gambling industry; the success of esports and other betting products are not guaranteed; changes in public perception of the esports and online gambling industry; negative cash flow from operations and the Company’s ability to operate as a going concern; failure to retain or add customers; the Company having a limited operating history; operational risks; cybersecurity risks; reliance on management; reliance on third parties and third-party networks; exchange rate risks; risks related to cryptocurrency transactions; risk of intellectual property infringement or invalid claims; the effect of capital market conditions and other factors on capital availability; competition, including from more established or better financed competitors; and general economic, market and business conditions. For additional risks, please see the Company’s management’s discussion and analysis for the three and nine months ended September 30, 2024 under the heading “Risk Factors”, and other disclosure documents available on the Company’s SEDAR+ profile at sedarplus.ca.

No assurance can be given that the expectations reflected in forward-looking statements will prove to be correct. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Readers should not place undue reliance on the forward-looking statements and information contained in this news release. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The post Rivalry Announces Application for a Management Cease Trade Order for Late Filing of Annual Filings appeared first on Gaming and Gambling Industry in the Americas.

Latest News

Sky Bet extends sponsorship of The Overlap

Sky Bet has renewed its partnership with The Overlap – the UK’s No.1 football YouTube channel founded by Gary Neville – for a further two years.

As a founding partner since the channel’s launch in April 2021, Sky Bet will continue as the headline sponsor of The Overlap Interviews and Fan Debates, key formats that have helped the channel become a leading voice in football content.

Featuring in-depth conversations with major figures from sport and entertainment, as well as dynamic debates between football legends and fan creators, The Overlap has built a dedicated audience and strong community.

Sky Bet will also maintain its presence in the weekly Stick to Football podcast through the popular Super 6 segment. The feature sees panellists Roy Keane, Ian Wright, Jamie Carragher, Jill Scott, and Gary Neville predict six results from the weekend’s matches in the free-to-play football game, Super 6.

The renewed partnership underscores Sky Bet’s continued commitment to delivering original, fan-first football content that resonates with audiences across platforms.

Gary Neville Quote: “I want to thank Sky Bet for partnering with us over the past four years. Without their support, we wouldn’t have been able to deliver the content you see today. It’s fantastic to have them on board for another two years, and I’m excited to see what we can achieve together.”

The post Sky Bet extends sponsorship of The Overlap appeared first on European Gaming Industry News.

Latest News

7 Best Crypto & Bitcoin Casinos for August 2025

Reading Time: 6 minutes

SatoshiGamblers just released their brutal August 2025 rankings for crypto casino platforms. These maniacs spent months getting rekt by scam operators so you don’t have to. The crypto gambling world is full of exit scams and frozen withdrawals, but their team found seven bitcoin casino sites that actually pay out.

The bitcoin casino industry is completely fucked right now. Every day brings another “revolutionary” platform promising instant riches. Most steal your money faster than a pickpocket in Vegas. Smart players stick with SatoshiGamblers.com because they’re the only crypto casino reviews site crazy enough to deposit real money and call out the scammers by name.

Their crew got destroyed testing 200+ crypto gaming platforms over six months. Lost thousands finding which ones actually work. These seven bitcoin casino games sites survived the torture test. Real deposits, real games, real withdrawals that actually hit wallets.

TOP 7 Bitcoin & Crypto Casinos for August 2025

| Casino | Welcome Bonus | Player Rating |

| Claps Casino | 170% + 35 FS (No Wagering) |  4.9 4.9 |

| Stake | $55 Stake Cash + 550K GC |  4.8 4.8 |

| BC.Game | 100% + 400 FS + 20 Free Bets |  4.8 4.8 |

| Rollbit | $500 Trading Bonus + Futures |  4.7 4.7 |

| Roobet | 20% Cashback + Exclusive Games |  4.7 4.7 |

| Thunderpick | 100% + 500 FS + Esports |  4.6 4.6 |

| Wild.io | 200% + Weekly Cashback |  4.6 4.6 |

Top 7 Bitcoin & Crypto Casinos – Complete Analysis

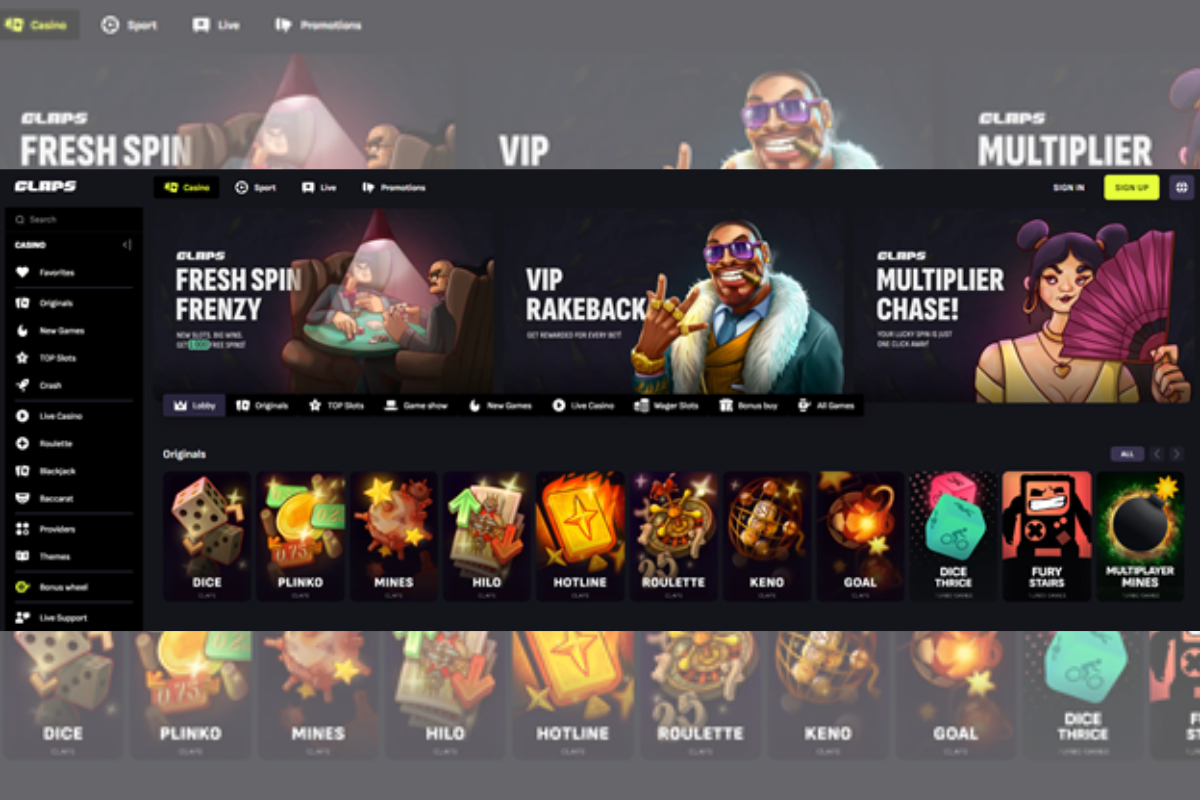

Claps Casino – Best Overall Crypto Casino Experience

Claps Casino runs circles around the competition because they don’t lie to your face. Most crypto casino online operators promise instant payouts then invent random verification bullshit when you try withdrawing. Claps just pays – simple as that.

Platform Details:

- Launched: 2024

- License: Anjouan Gaming Authority

- Games: 2,500+ premium titles

- Min Deposit: 10 USDT

- Withdrawal Speed: Under 10 minutes

- Supported Crypto: Bitcoin, ETH, USDT, BNB, TRX, LTC, USDC

Bonus Package:

- 170% welcome match + 35 spins (zero wagering)

- 20 free spins for email verification

- 50% weekly reload bonuses

- Real VIP cashback that pays

Been cashing out from Claps twenty times now. Fastest was 3 minutes, slowest was 9 minutes. Their support doesn’t ghost you like other places. This best crypto casino actually gives a damn about players instead of treating them like walking ATMs.

Stake – The Crypto Casino Empire

Stake survived seven years without exit scamming, which makes them ancient in crypto years. They kept paying during every bear market while smaller bitcoin casino sites vanished with player funds. Eddie’s streams alone bring more traffic than most platforms see in a year.

Core Stats:

- Operating Since: 2017

- License: Curaçao eGaming

- Game Library: 3,000+ including originals

- Payout Time: 30-60 minutes

- Extra Features: Sportsbook, live streams, social

Player Rewards:

- $55 starter cash + 550K gold coins

- Daily tournaments with real prizes

- VIP benefits worth pursuing

- Weekly reload promotions

Watching Stake streams is pure degeneracy. Chat moves faster than cocaine-fueled day traders. Rain drops hit constantly with real money flying around. This bitcoin casino turned gambling into a social media experience.

BC.Game – Crypto Casino Games Overload

BC.Game collected 8,000+ games like some kind of digital hoarder. Their crash games alone will ruin your sleep schedule and bank account. If you get bored here, gambling might not be your problem.

Platform Overview:

- Established: 2017

- License: Curaçao eGaming

- Total Games: 8,000+ time killers

- Processing: Same-day payouts

- Unique Features: Crypto faucet, 60+ altcoins

Bonus Madness:

- 100% match + 400 spins + 20 free bets

- Daily login rewards

- XP progression system

- Monthly cashback drops

Game selection is absolutely ridiculous. Slots, tables, crash games, sports betting, lottery tickets. Everything works on mobile without crashing every five minutes. This crypto gambling site accepts more random coins than most exchanges even list.

Rollbit – Trading Meets Crypto Gambling

Rollbit figured out how to lose money twice as fast by combining crypto trading with casino games. Their 1000x leverage trading battles attract the most degenerate gamblers and traders under one cursed roof.

Platform Intel:

- Founded: 2020

- License: Curaçao eGaming

- Games: 2,500+ plus trading features

- Processing: 2-5 hours

- Specialty: Trading competitions + casino

Hybrid Bonuses:

- $500 trading bonus for futures

- NFT lottery tickets

- Trading battle prizes

- Rollbot NFT benefits

Trade shitcoins with insane leverage while spinning slots between positions. Perfect recipe for complete financial destruction. This bitcoin casino sites hybrid attracts people who think regular gambling isn’t risky enough.

Roobet – Streamer’s Paradise Casino

Every Twitch gambling streamer uses Roobet because it actually works during live streams. No lag, no crashes, no mysterious “technical difficulties” when someone hits big. The platform handles thousands of viewers without breaking.

Streaming Stats:

- Launched: 2019

- License: Curaçao eGaming

- Games: 3,000+ streamer favorites

- Withdrawal: 1-4 hours

- Focus: Content creator integration

Creator Benefits:

- 20% cashback on all losses

- Roowards loyalty system

- Exclusive game access

- Streamer promotional codes

Streamers love Roobet because the cashback actually shows up without begging customer support for weeks. Chat integration works perfectly for giveaways. This crypto casino online understands that content creators built the entire industry.

Thunderpick – Esports Betting Revolution

Thunderpick mixed esports betting with traditional casino games for kids who grew up watching competitive gaming. Bet on CS:GO pros in the morning, spin slots during lunch break, place Dota 2 wagers before bed.

Gaming Focus:

- Established: 2017

- License: Curaçao eGaming

- Games: 3,000+ plus full esports book

- Processing: 15 minutes – 2 hours

- Specialty: Esports integration

Gamer Rewards:

- 100% casino bonus + 500 free spins

- Esports betting bonuses

- Tournament entry prizes

- Gaming community perks

Finally someone built a platform for people who understand esports better than traditional sports. Odds are competitive and the top crypto casino section doesn’t feel like an afterthought bolted onto a sportsbook.

Wild.io – Modern Crypto Casino Excellence

Wild.io launched last year with everything players actually want – fast loading, readable terms, mobile that doesn’t suck, and withdrawals that work. Shows what happens when competent people build a platform from scratch.

Modern Features:

- Launch Year: 2023

- License: Curaçao eGaming

- Games: 2,000+ optimized titles

- Processing: Instant withdrawals

- Tech: Latest crypto infrastructure

Player-First Bonuses:

- 200% welcome bonus up to 1 BTC

- Weekly cashback programs

- Reload bonuses for all levels

- VIP treatment from day one

Everything works because they built it right the first time. No legacy code held together with digital duct tape. This bitcoin online casino was designed for modern players who expect things to actually function.

Why Crypto Casino Dominates Traditional Gambling

Regular online casinos still operate like it’s 1995. They want passport scans, utility bills, blood samples, and your mother’s maiden name before letting you play. Meanwhile crypto casino platforms processed three withdrawals and started the next session.

Bitcoin casino sites skip the banking middleman entirely. Most crypto gaming operations only need an email address to start playing. No waiting three days for bank transfers or explaining gambling charges to your spouse.

Provably fair systems let you verify every game result yourself. Good luck getting that transparency from Vegas casinos. Crypto gambling sites offer better bonuses because they don’t pay ridiculous fees to credit card companies.

Our Choice – Claps Casino: Best Overall Crypto Casino Excellence

Claps Casino earned the top spot by actually delivering what they promise. Most bitcoin casino operators advertise instant payouts then suddenly need “additional verification” when you win big. Claps processes everything under 10 minutes without inventing new hoops to jump through.

Their zero-wagering bonuses aren’t marketing tricks with impossible fine print. Win money, keep money, withdraw money. Customer support responds with solutions instead of copy-paste excuses.

Thousands of players already migrated to Claps because it actually works. Fast payouts, honest bonuses, human support. Experience what crypto gambling should have been from the beginning.

gaming

SPRIBE Drops Aviator Challenges

The world’s number one crash game gets even more thrilling with the addition of Missions, Races and Tournaments

SPRIBE, the award-winning developer behind the original crash game, Aviator, has added another tool to the box with the launch of Challenges, bringing even more excitement, entertainment and competition to the experience.

Aviator Challenges allows operators to launch Missions, Races and Tournaments, forging an additional competitive layer and even more social interaction, while providing a fresh way for players to engage with the game, which is now played by more than 60 million people per month.

Missions see players complete a task before a set deadline, while Races are similar but with a limited prize pool up for grabs, creating a strong sense of FOMO while helping operators control promo budgets. Tournaments then take the classic and well-loved format.

SPRIBE gives operators full control over creating and running Aviator Challenges, and they can choose the type, timing, prize, names, descriptions, colours, and tasks for deep personalisation and granular localisation.

Aviator Challenges has debuted with operators in Africa and will be rolled out globally over the coming weeks and months. This will be followed by the launch of regional tournaments, which again will debut in Africa before being made available internationally.

The launch of Challenges will drive even greater engagement with Aviator, which currently sees players place more than 400,000 bets per minute across 5,500+ online casinos and sportsbooks worldwide.

Giorgi Tsutskiridze, CCO at SPRIBE, said: “Challenges take the Aviator experience to a whole other level for both players and operators.

“Those that have already embraced Challenges have seen an immediate, positive impact on player behaviour across core KPIs such as retention and bet numbers per player.

“To get the most out of Challenges, operators do need to be creative, especially when it comes to marketing support, segmentation, prize zones, rewards and tasks.

“But we have ensured Challenges have the flexibility to do this and a whole lot more.

“Aviator is already the number one crash game in the world with more than 60 million players a month, but with Challenges, we expect that number to climb ever higher.”

The post SPRIBE Drops Aviator Challenges appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018