Compliance Updates

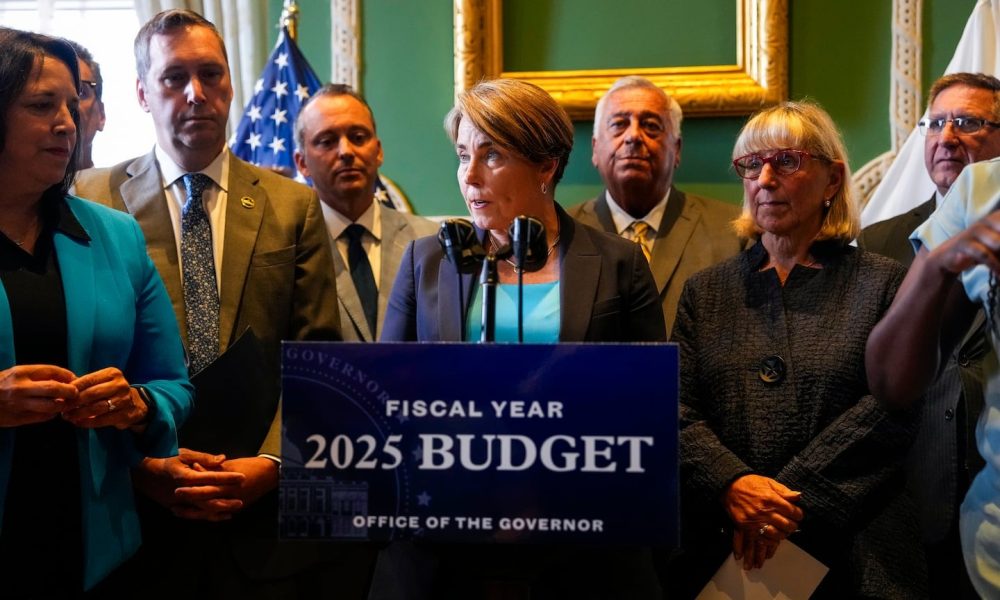

iLottery Authorized in Massachusetts as Governor Healey Signs FY 2025 Budget

Massachusetts Governor Maura Healey signed the fiscal year 2025 state budget that includes language legalizing online lottery sales for the Commonwealth of Massachusetts. Revenue from online lottery sales will support a grant program for early childhood education and care.

“We thank Governor Healey for her support of online Lottery and approving it in the final FY25 budget. This will allow the Lottery to keep pace with its competition and reach newer audiences. We are prepared to implement a safe and reliable iLottery that will produce significant resources for critical childcare services, which are so desperately needed across the state. Thank you to Speaker Ron Mariano, President Karen Spilka, and the Joint Ways and Means Committee for prioritizing this important policy change. And thank you to the legislators who have championed this issue. We are excited to get to work,” said State Treasurer Deborah B. Goldberg, Chair of the Massachusetts State Lottery Commission.

“Our team is excited to implement an online Lottery. We are ready and prepared to offer our players a modern lottery experience in a safe and accessible environment. At the same time, the Lottery is unwavering in its commitment to our dedicated retail partners who have helped us become the most successful lottery in the country,” said Mark William Bracken, Executive Director of the Mass Lottery.

The Lottery will be conducting a Request for Response to procure services for the operation of an online Lottery. Lottery officials anticipate launching its online platform in approximately 16 months. The legislation requires customers to be at least 21 years old to participate. The age requirement for retail Lottery sales remains 18.

Compliance Updates

Cyprus National Betting Authority Warns Public About Illegal Online Gambling and Misinformation

The National Betting Authority (NBA) has urged the public to exercise caution and to verify the legitimacy of betting service providers exclusively through the official website: www.nba.gov.cy.

In recent weeks, the NBA has observed a rise in misinformation and the spread of false claims regarding the legality of certain websites offering online gambling services. Of particular concern is the sharp increase in advertisements for illegal online casinos on popular social media platforms. These operators have not obtained a licence to operate within the Republic of Cyprus. Equally troubling is the unauthorised use of images and videos of well-known individuals in such advertisements, without their consent.

The public is reminded that, under Cyprus’ gambling legislation, the operation of online casinos is strictly prohibited. Participation in these illegal activities poses serious risks, including threats to personal and banking data security, as well as potential harm to players’ financial stability and mental well-being.

According to Article 79 of the Betting Law 37(I)/2019:

• Players participating in illegal gambling or online casinos face up to 1 year in prison and/or a fine of up to €50,000.

• Individuals or companies providing illegal gambling services face up to 5 years in prison and/or a fine of up to €300,000.

The NBA urges the public to verify information received through websites, apps, social media posts, or other advertisements before engaging with any gambling services. The official list of licensed online betting providers is available on the NBA’s website.

The post Cyprus National Betting Authority Warns Public About Illegal Online Gambling and Misinformation appeared first on European Gaming Industry News.

Compliance Updates

CT Interactive Expands Presence with MGA-certified Game Portfolio

CT Interactive has announced the certification of 20 new games under the Malta Gaming Authority (MGA) regulatory framework, marking an important step in its ongoing expansion across regulated European markets. This certification empowers CT Interactive to offer its premium gaming portfolio to licensed operators throughout Malta and beyond.

The newly certified titles include several standout Buy Bonus games such as Doctor Winstein Buy Bonus, Duck of Luck Buy Bonus, Fruits & Sweets Buy Bonus, Hyper Cuber Buy Bonus, Nanook the White Ghost Buy Bonus, 100x Crypto Magic, 100x Fresh and 100x Coffee Hot. These games have demonstrated strong performance internationally and now bring their dynamic bonus features to an even wider audience.

A highlight of the new portfolio is Lucky Clover 10, a refreshed edition of CT Interactive’s most popular slot, Lucky Clover. Featuring vintage-inspired graphics and nostalgic gameplay elements, Lucky Clover 10 delivers a captivating experience that combines classic charm with modern vision.

“Providing new game titles certified under the MGA framework marks a key step in our regional growth strategy. This market demands high-quality, fully compliant content. Our portfolio of Buy Bonus games and refreshed classics like Lucky Clover 10 are ideally suited to meet the local preferences and deliver premium gaming experiences,” said Martin Ivanov, COO of CT Interactive.

This certification reinforces CT Interactive’s position as a trusted provider of regulation-ready gaming content, enabling operators to offer a diverse and engaging portfolio fully aligned with MGA requirements.

The post CT Interactive Expands Presence with MGA-certified Game Portfolio appeared first on European Gaming Industry News.

Arizona Department of Gaming

Arizona Department of Gaming Launches First-Ever Statewide Campaign to Empower and Protect Consumers

The Arizona Department of Gaming has launched its first-ever statewide Public Education Campaign focused on protecting consumers, promoting public awareness, and reducing the harms associated with unregulated gambling. This is a significant milestone in the Department’s ongoing efforts to protect consumers and ensure a safe and responsible gaming environment.

Arizona offers a variety of legal, regulated gaming options throughout the state, including tribal casinos, event wagering, fantasy sports, and parimutuel wagering. For 30 years, ADG has safeguarded the integrity of Arizona’s gaming industry through rigorous oversight, licensing, and enforcement in accordance with the Tribal-State Gaming Compacts. This new campaign expands on that mission by educating Arizonans on how to avoid illegal gambling and access support services when needed.

The campaign is designed to inform and empower the public by emphasizing the risks of engaging with unlicensed operators and providing them with tools to identify legal, regulated options. It aims to reduce consumer vulnerability, prevent exploitation, and help individuals make informed decisions if they choose to participate in gaming activities.

The campaign kicks off with a series of Public Service Announcements (PSAs), developed in collaboration with the Arizona Media Association, which will be aired across TV, radio, print, and digital platforms. Available in both English and Spanish, the PSAs will:

• Educate the public on how to identify legal, regulated gaming operators in Arizona

• Emphasize consumer protection and the safeguards provided by regulated gaming environments

• Highlight the role regulated gaming plays in supporting Arizona communities and essential services

• Promote the 1-800-NEXT STEP helpline, which connects individuals to confidential, 24/7 support for problem gambling.

To complement the PSAs, ADG has launched the Check Your Bet webpage, which serves as a centralized resource to verify regulated gaming and access consumer protection tools. The webpage includes:

• A searchable list and interactive map of authorized Tribal Casinos in Arizona

• A searchable list and interactive map of licensed Event Wagering and Fantasy Sports Operators and their retail locations

• Information on Advanced Deposit Wagering Providers (ADWPs), Off-Track Betting (OTB) locations, and permitted horse racing tracks in Arizona

• How to access the Division of Problem Gambling’s Helpline, a confidential Problem Gambling Self-Screening Quiz, and additional supportive resources

• How to request Self-Exclusion, a voluntary program to prohibit oneself from Tribal Casinos and Event Wagering and Fantasy Sports Contests

• Guidance on submitting tips about suspected illegal gambling to the Department and filing consumer complaints with the Arizona Attorney General’s Office.

“We are proud to celebrate 30 years of providing world-class gaming regulation and consumer protection. This campaign is about empowering Arizonans who choose to participate in gaming with the knowledge to make informed, responsible decisions. As illegal and unregulated options on the market increase, the Check Your Bet webpage serves as a key resource for the public to verify licensed operators and access support. By directing viewers from our PSAs to this tool, we’re helping ensure people not only play safely, but also know where to turn if they or a loved one are struggling with problem gambling,” said Jackie Johnson, Director of the Arizona Department of Gaming.

Since its founding in 1995, the Department has worked tirelessly to ensure that Arizona’s gaming industry operates with transparency, integrity, and responsibility. The campaign will run through the end of March 2026 and reflects ADG’s commitment to a safe, transparent, and well-regulated gaming landscape in Arizona.

The post Arizona Department of Gaming Launches First-Ever Statewide Campaign to Empower and Protect Consumers appeared first on Gaming and Gambling Industry in the Americas.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018