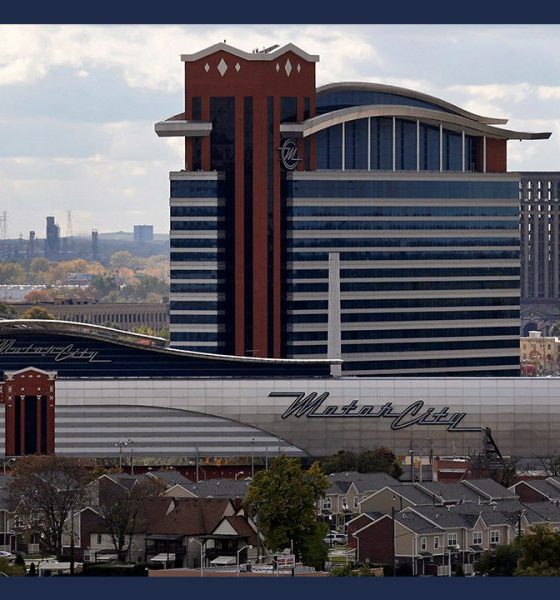

Detroit casinos

Detroit Casinos Report $82.8M in October Revenue

The three Detroit casinos reported $82.8 million in monthly aggregate revenue (AGR) for the month of October 2023, of which $81.7 million was generated from table games and slots, and $1.1 million from retail sports betting.

The October market shares were:

- MGM, 46%

- MotorCity, 31%

- Hollywood Casino at Greektown, 23%

Table Games and Slot Revenue and Taxes

October 2023 table games and slot revenue decreased 18.9% when compared to October 2022 results. October monthly revenue was 18.3% lower than September 2023. From January 1 through Sept. 30, the Detroit casinos’ table games and slots revenue decreased by 1.3% compared to the same period last year.

The casinos’ monthly gaming revenue results all decreased compared to October 2022:

- MGM, down 19.6% to $37.3 million

- MotorCity, down 22.8% to $25 million

- Hollywood Casino at Greektown, down 11.7% to $19.4 million

During October, the three Detroit casinos paid $6.6 million in gaming taxes to the State of Michigan. They paid $8.2 million for the same month last year.

The casinos reported submitting $10.1 million in wagering taxes and development agreement payments to the City of Detroit in October.

Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $18.1 million in total retail sports betting handle, and total gross receipts were $1.1 million for the month of October.

Retail sports betting qualified adjusted gross receipts (QAGR) were down 46.3% when compared to October 2022. October QAGR was down by 28.6% compared to September 2023.

October QAGR by casino was:

- MGM: $365,705

- MotorCity: $669,028

- Hollywood Casino at Greektown: $90,430

During October, the casinos paid $42,531 in gaming taxes to the state and reported submitting $51,982 in wagering taxes to the City of Detroit based on retail sports betting revenue.

Fantasy Contests

For September, fantasy contest operators reported total adjusted revenues of $2.1 million and paid taxes of $178,346.

From Jan. 1 through Sept. 30, fantasy contest operators reported $16.8 million in aggregate fantasy contest adjusted revenues and paid $1.4 million in taxes.

Detroit casinos

Detroit Casinos Report $101M in June Revenue

The three Detroit casinos—MGM Grand Detroit, MotorCity Casino, and Hollywood Casino at Greektown—collectively generated $101.04 million in revenue for June 2025.

Table games and slot machines accounted for $100.38 million of the monthly total, while retail sports betting contributed $665,435.

June 2025 Market Share:

• MGM Grand Detroit: 48%

• MotorCity Casino: 31%

• Hollywood Casino at Greektown: 21%

Table Games and Slot Machine Revenue

Revenue from table games and slots decreased by 4.0% compared with June 2024 and dropped 11% from May 2025. For the first half of 2025 (January 1 – June 30), combined table games and slots revenue was down 0.8% year-over-year.

Casino-specific revenues compared to June 2024 were:

• MGM Grand Detroit: $48.43 million, down 0.6%

• MotorCity Casino: $30.63 million, down 2.7%

• Hollywood Casino at Greektown: $21.32 million, down 12.5%

The three casinos paid $8.1 million in state gaming taxes in June 2025, down from $8.5 million in June 2024. They also submitted $11.9 million in wagering taxes and development agreement payments to the City of Detroit.

Retail Sports Betting Revenue

In June 2025, the casinos reported a combined retail sports betting handle of $7.2 million, generating $666,374 in gross receipts. Qualified adjusted gross receipts (QAGR) from retail sports betting fell 25.1% from June 2024 and 48.1% from May 2025.

QAGR by casino:

• MGM Grand Detroit: $275,397

• MotorCity Casino: $242,069

• Hollywood Casino at Greektown: $147,969

The casinos paid $25,153 in state taxes from retail sports betting revenue and submitted $30,743 in wagering taxes to the City of Detroit.

Fantasy Contests

Fantasy contest operators reported $716,927 in adjusted revenues for May 2025 and paid $60,222 in taxes.

The post Detroit Casinos Report $101M in June Revenue appeared first on Gaming and Gambling Industry in the Americas.

Detroit casinos

Detroit Casinos Report $114.0M in May Revenue

The three Detroit casinos collectively reported $114.0 million in revenue for May 2025. Of this total, table games and slot machines generated $112.7 million, while retail sports betting contributed $1.3 million.

Market Share Breakdown for May 2025:

• MGM Grand Detroit: 47%

• MotorCity Casino: 30%

• Hollywood Casino at Greektown: 23%

Table Games, Slot Revenue, and Taxes

Revenue from table games and slots at the three Detroit casinos increased 1.2% in May 2025 when compared to the same month last year. May’s revenue also showed a 3.0% increase compared to April 2025. From January 1 through May 31 of this year, table games and slots revenue decreased by 0.2% compared to the same period in 2024.

In comparison to May 2024, the revenue for each casino was as follows:

• MGM Grand Detroit: Up 2.4%, totaling $53.1 million

• MotorCity Casino: Up 0.6%, totaling $33.9 million

• Hollywood Casino at Greektown: Down 0.2%, totaling $25.7 million

In May 2025, the three casinos paid a total of $9.1 million in state gaming taxes, compared to $9.0 million in the same month last year. Additionally, the casinos submitted $13.4 million in wagering taxes and development agreement payments to the City of Detroit in May.

Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported a total retail sports betting handle of $9.2 million in May 2025, with total gross receipts amounting to $1.3 million. Retail sports betting’s qualified adjusted gross receipts (QAGR) decreased by 31.1% compared to May 2024 but showed an increase of $964,701 over April 2025.

QAGR by casino for May 2025 was as follows:

• MGM Grand Detroit: $72,060

• MotorCity Casino: $684,821

• Hollywood Casino at Greektown: $524,358

In May, the casinos paid $48,431 in state gaming taxes and reported submitting $59,193 in wagering taxes to the City of Detroit based on retail sports betting revenue.

The post Detroit Casinos Report $114.0M in May Revenue appeared first on Gaming and Gambling Industry in the Americas.

Detroit casinos

Detroit Casinos Report $109.8M in April Revenue

The three Detroit casinos collectively reported $109.8 million in revenue for April 2025. Of this total, table games and slot machines generated $109.5 million, while retail sports betting contributed $316,538.

Market Share Breakdown for April 2025:

• MGM Grand Detroit: 47%

• MotorCity Casino: 30%

• Hollywood Casino at Greektown: 23%

Table Games, Slot Revenue, and Taxes

Revenue from table games and slots at the three Detroit casinos increased 1.5% in April 2025 when compared to the same month last year. However, April’s revenue showed a 6.3% decrease compared to March 2025. From January 1 through April 30 of this year, table games and slots revenue decreased by 0.5% compared to the same period in 2024.

In comparison to April 2024, the revenue for each casino was as follows:

• MGM Grand Detroit: Up 2.5%, totaling $51.1 million

• MotorCity Casino: Up 1.2%, totaling $33.1 million

• Hollywood Casino at Greektown: Down 0.2%, totaling $25.3 million

In April 2025, the three casinos paid a total of $8.9 million in state gaming taxes, compared to $8.7 million in the same month last year. Additionally, the casinos submitted $13.0 million in wagering taxes and development agreement payments to the City of Detroit in April.

Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported a total retail sports betting handle of $9.4 million in April 2025, with total gross receipts amounting to $336,021. Retail sports betting’s qualified adjusted gross receipts (QAGR) saw a significant decrease, down 79.8% compared to April 2024 and 44.6% compared to March 2025.

QAGR by casino for April 2025 was as follows:

• MGM Grand Detroit: negative ($219,857)

• MotorCity Casino: $223,859

• Hollywood Casino at Greektown: $312,536

In April, the casinos paid $20,276 in state gaming taxes and reported submitting $24,781 in wagering taxes to the City of Detroit based on retail sports betting revenue.

Fantasy Contests

For March 2025, fantasy contest operators reported total adjusted revenues of $634,191 and paid $53,272 in taxes.

The post Detroit Casinos Report $109.8M in April Revenue appeared first on Gaming and Gambling Industry in the Americas.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018