Gambling in the USA

Sports Betting Market is set to reach USD 231.2 billion by 2032, with a notable 11.1% growth rate (CAGR)

The Global Sports Betting Market size accounted for USD 81.7 Billion in 2022 and is expected to reach USD 231.2 Billion by 2032 with a considerable CAGR of 11.1% during the forecast period of 2023 to 2032.

Sports betting market is reshaping the gambling industry, providing cutting-edge and entertaining wagering experiences. What exactly are sports betting? They are specialized services that involve the outsourcing of specific telecommunications operations and responsibilities to third-party providers. The global market was valued at USD 81.7 Billion in 2022 and is projected to reach USD 231.2 Billion by 2032. Within the larger gambling business, the sports betting market is a dynamic and quickly increasing area. It is based on the activity of forecasting sports events and betting on the outcomes. This market has grown significantly in recent years, owing mostly to the advent of internet and mobile betting platforms, which have made it more accessible to a global audience. Sports betting covers a vast number of sports, including football, basketball, tennis, horse racing, and many more, and includes a wide range of betting choices, such as moneyline bets, point spreads, and proposition bets. The expansion of the market is also driven by regulatory changes in various locations, with some governments legalizing and regulating sports betting in order to increase tax revenue and safeguard consumers.

Key Points and Statistics on the Sports Betting Market:

- The Global Sports Betting Market size is projected to grow to USD 231.2 Billion by 2032, expanding at a CAGR of 11.1% from 2023 to 2032.

- Europe leads the market globally with around USD 29.4 billion revenue of the market in 2022.

- The platform online segment captured the largest market share along with 48.1 billion in 2022.

- By betting type, fixed odds wagering sub-segment held the largest market share of 27% in 2022.

- The advent of 5G networks, AI, and blockchain technologies in sports betting increase the market value.

Sports Betting Market Coverage:

| Market | Sports Betting Market | |

| Sports Betting Market Size 2022 | USD 81.7 Billion | |

| Sports Betting Market Forecast 2032 | USD 231.2 Billion | |

| Sports Betting Market CAGR During 2023 – 2032 | 11.1% | |

| Analysis Period | 2020 – 2032 | |

| Base Year | 2022 | |

| Forecast Data | 2023 – 2032 | |

| Segments Covered | By Platform, By Betting Type, By Sports Type, By Age Group, And By Geography | |

| Sports Betting Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa | |

| Key Companies Profiled | 888 Holdings Plc, Bet365, Betsson AB, Churchill Downs Incorporated, Entain plc, Flutter Entertainment Plc, IGT, Kindred Group Plc, Sportech Plc, William Hill Plc, and others. | |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis | |

Sports Betting Market Overview and Analysis:

Several dynamic aspects characterise the sports betting business. The growing popularity of sporting events, both amateur and professional, adds to market growth by providing more options for bettors. The increased use of internet and mobile betting platforms has resulted in convenience, real-time betting possibilities, and live streaming of sporting events, making it more appealing to a wider audience.Furthermore, shifting regulatory environments have a huge impact. Some regions have legalised sports betting, giving consumer protection and tax money, while others have severe rules or outright forbid sports betting.

Technological improvements, such as the use of artificial intelligence and data analytics, have enhanced the accuracy of odds and allowed bettors to conduct more in-depth research. As a result, in-play betting, in which wagers can be placed during a game or match, has grown in popularity. Furthermore, the growing popularity of e-sports and the expansion of virtual sports betting have added new elements to the market. While the sports betting market offers several opportunities for bettors and operators, it also confronts problems, such as concerns about responsible gambling and possible issues with match-fixing and sports integrity. As the market evolves, maintaining a balance between innovation and regulation will be critical for long-term growth.

Latest Sports Betting Market Trends and Innovations:

Increased in-play and mobile betting, an emphasis on responsible gambling measures, and the use of modern data analytics to produce more accurate odds and predictions are all developments in the sports betting sector. Furthermore, the use of blockchain technology for transparent and secure transactions, as well as the growing popularity of e-sports betting, are important industry advances. These advancements improve the overall sports betting experience while also reaching a larger audience..

Major Growth Drivers of the Sports Betting Market:

The primary growth drivers include the rise in sports events and leagues, expanding global digital connectivity, a surge in sports betting interest among the younger generation, and the uptick in advertising and sponsorships are key drivers of the sports betting market.

Key Challenges Facing the Sports Betting Industry:

Challenges include the enforcement of stringent regulations on betting, increasing apprehension surrounding illicit wagering, and a mounting focus on addiction issues are elevating ethical concerns within the sports betting industry.

Sports Betting Market Segmentation Insights:

Based on Platforms:

- Online

- Offline

Based on Type:

- Fixed Odds Wagering

- Live/In Play Betting

- eSports Betting

- Exchange Betting

- Others

Based on Sport Types:

- Basketball

- Football

- Horse Racing

- Baseball

- Hockey

- Cricket

- Others

Based on Age Group:

- Gen Y/Millennials

- Gen Z

- Baby Boomers

- Gen X

Overview by Region of the Sports Betting Market:

Europe is the largest region in the global sports betting market, with a well-established betting culture and a plethora of markets within individual countries. The sports betting business in the United Kingdom, in particular, is strong and well-regulated. Another big market is North America, led by the United States, with the recent legalization of sports betting in numerous states adding to its rise. Asia-Pacific, which includes countries such as China and India, has significant growth potential. Sports betting is expanding in Africa and Latin America, with evolving regulatory frameworks promising future expansion. These regional dynamics highlight the multifaceted structure of the sports betting business.

List of Key Players in the Sports Betting Market:

The notable companies in the market include William Hill Plc, 888 Holdings Plc, Bet365, Betsson AB, Churchill Downs Incorporated, Entain plc, Flutter Entertainment Plc, IGT, Kindred Group Plc, and Sportech Plc..

Gambling in the USA

Gaming Americas Weekly Roundup – September 8-15

Welcome to our weekly roundup of American gambling news again! Here, we are going through the weekly highlights of the American gambling industry which include the latest news and new partnerships. Read on and get updated.

Latest News

IGT announced that its much-anticipated Wheel of Fortune Big Money Spin electronic table game (ETG) recently made its world debut at Downtown Grand Casino in Las Vegas, Nev. The vibrant standalone ETG game includes many of the attributes that have propelled the success of the Wheel of Fortune slots franchise for nearly three decades including word puzzles, wheel spins and exciting jackpot rewards. The game is accompanied by an attention-grabbing, 9-plus-feet upright video wheel that stands independent of the ETG terminals and entertains casino guests with the famous “WHEEL-OF-FORTUNE!” chant.

MGM Resorts International has announced that Corey Sanders, Chief Operating Officer, will retire from the company after more than 30 years of dedicated service and leadership. Sanders has agreed to remain COO through Dec. 31, 2025, and to serve as an advisor to the President and CEO through Dec. 31, 2026. The Company intends to name a new COO to serve as Sanders’ successor later this month. Sanders is currently MGM Resorts’ Chief Operating Officer, overseeing the company’s Las Vegas and regional properties as well as multiple corporate departments, including Hospitality, Gaming, Human Resources and Strategic Initiatives. Prior to that, he served as the company’s Chief Financial Officer and Treasurer.

Members of Kletsel Dehe Wintun Nation, the Sherwood Valley Rancheria of Pomo Indians, the Mechoopda Indian Tribe of Chico Rancheria and Big Lagoon Rancheria gathered outside the State Capitol in Sacramento to protest Assembly Bill 831 (AB 831). If passed, the bill would limit economic opportunities available to less wealthy tribes in the state by banning legitimate online social games using sweepstakes promotions. It would also eliminate more than $1 billion of existing economic activity generated by the industry in California, and close off a potential new revenue source for the state via sensible, modern regulation and taxation.

Partnerships

Genius Sports Limited has expanded its long-term partnership with Hard Rock Bet Sportsbook (Hard Rock Bet) to power the top-rated platform with its market-leading official data, trading and marketing solutions, as well as its ground-breaking BetVision product. Genius Sports has worked in partnership with the leading operator since 2021, providing the highest quality official data and pinpoint trading solutions across top tier leagues globally, including the Premier League, Serie A, European Leagues, Liga MX, NFL and more. Hard Rock Bet will be able to provide its customers with Genius Sports’ first-of-its-kind BetVision low latency streaming solution.

Quick Custom Intelligence (QCI), a leading provider of data-driven casino intelligence and player engagement platforms, has announced that Dania Beach Casino is continuing to benefit from its deployment of the QCI Nimble platform. While the property currently focuses on the QCI Host and QCI Marketing modules, it has expressed enthusiasm about the capabilities of the new AGI56 release and its impact on future customer engagement strategies. AGI56 represents the most ambitious release in QCI’s history, with the platform undergoing a full refresh of its technology stack, improved integration of advanced analytics, and the introduction of generative AI-driven tooling through Chatalytics.com. QCI’s platform is currently deployed in more than 350 casinos worldwide.

The post Gaming Americas Weekly Roundup – September 8-15 appeared first on European Gaming Industry News.

Gambling in the USA

TCSJOHNHUXLEY to Sponsor Inaugural G2E Dealer Championship

G2E Las Vegas 2025 is set to host the first-ever US Dealer Championship, and TCSJOHNHUXLEY is delighted to announce its sponsorship of this landmark event. The championship, which celebrates the skill and professionalism of casino dealers, will take place at The Venetian Expo from October 7-9, 2025.

The G2E Dealer Championship will bring together the nation’s top casino dealers to compete for the title of “Best Dealer.” Contestants will be judged on their technical precision, game knowledge, and ability to provide a superior player experience.

As a proud sponsor TCSJOHNHUXLEY will be supplying all the Roulette tables for the competition, ensuring the highest standard of equipment for the championship. This not only highlights the company’s commitment to the dealers but also provides the perfect platform to showcase its renowned manufacturing expertise. TCSJOHNHUXLEY’s world-class Roulette tables are testament to the precision engineering and superior craftsmanship that has set the industry standard for decades.

Phil Lee, TCSJOHNHUXLEY Chief Financial Officer & Managing Director Americas comments, “We are delighted to be a part of the first G2E Dealer Championship, an event that truly celebrates the invaluable role of casino dealers. Dealers are the heart of the live gaming experience, and we are committed to supporting their success. Our outstanding Roulette tables will provide the perfect platform for these talented professionals to showcase their artistry and skill.”

The G2E Dealer Championship will take place at Booth #5225, located in The Strip at G2E.

The sponsorship underscores TCSJOHNHUXLEY’s unwavering commitment to the live gaming sector and the professionals who drive its success. The company invites all attendees to witness the championship and visit its stand at Booth #4439 during the expo to see its full range of innovative solutions.

The post TCSJOHNHUXLEY to Sponsor Inaugural G2E Dealer Championship appeared first on Gaming and Gambling Industry in the Americas.

Gambling in the USA

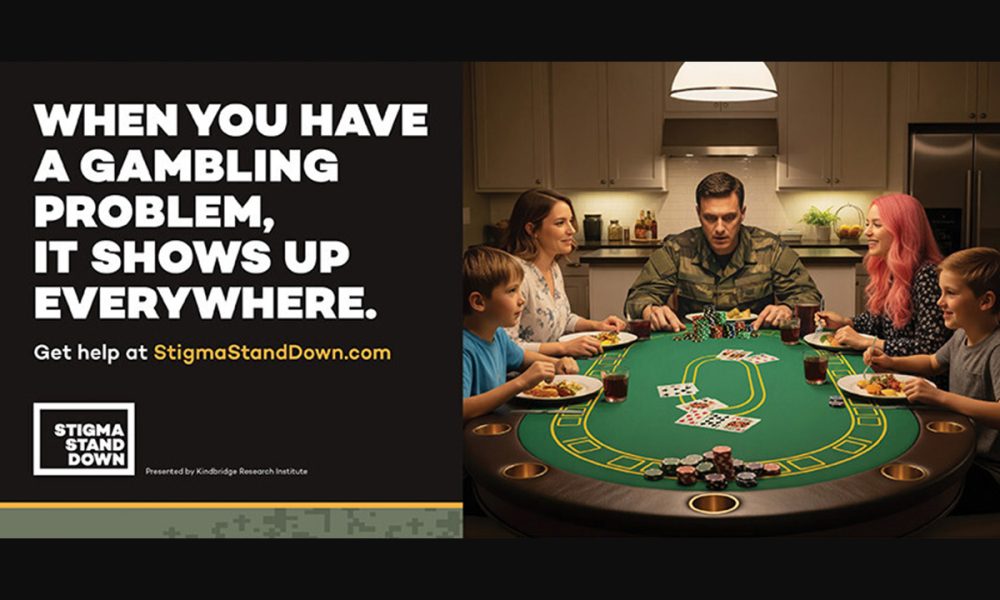

Kindbridge Research Institute Launches “Stigma Stand Down” for Military Mental Health

Kindbridge Research Institute (KRI), a national leader in behavioral addiction research, announced the launch of Stigma Stand Down (SSD), a Colorado statewide initiative dedicated to confronting stigma, breaking down barriers, and fostering resilience among active-duty service members, veterans, and their families impacted by mental health and gambling-related challenges.

Inspired by military “safety stand-downs,” SSD addresses the hidden burdens carried by those who serve, where stigma often prevents seeking help for mental health issues, including gambling disorder – a condition up to 3.5 times more prevalent in military populations than civilians. With over 60,000 active-duty, guard, and reserve personnel in Colorado, as well as the rapid growth of legalized sports betting since 2018, SSD arrives at a critical time to normalize conversations around mental health, PTSD, depression, substance use, and gambling-related harms.

“Stigma is a silent enemy that leaves our service members and veterans isolated, harming their families, units, and mission readiness. Stigma Stand Down is our frontline response: dismantling shame and delivering free, confidential, evidence-based care designed for military realities. We thank our partners for standing with us and call on more allies to help transform lives and build stronger communities,” said Mark Lucia, Director of Programming at Kindbridge Research Institute.

Key elements of Stigma Stand Down include:

• Education and Resources: Practical, no-jargon webinars, videos, and courses on gambling disorder, mental health, financial literacy, and stigma reduction, accessible via a dedicated, mobile-friendly website for leaders, families, and providers.

• Free Mental Health Support: Through a partnership with Kindbridge Behavioral Health – a specialized national telehealth provider for gaming, gambling, and mental health issues – military members and their families can access free, confidential virtual therapy sessions.

• Statewide Outreach: Multimedia campaigns, on-base distributions, geographically targeted ads, and veteran-led stories to reach rural and underserved areas, fostering a culture where seeking help is seen as strength.

• Self-Assessment Tools: An anonymous Gambling Self-Check (BBGS) screener providing immediate, personalized feedback to encourage early intervention.

SSD builds on insights from KRI’s 50×4 Vets initiative and partnerships with organizations including the University of Nevada Las Vegas, University of New Mexico, Cactus Advertising Agency, and Kindbridge Behavioral Health. This program was made possible through grants provided by the Colorado Division of Gaming and FanDuel.

The post Kindbridge Research Institute Launches “Stigma Stand Down” for Military Mental Health appeared first on Gaming and Gambling Industry in the Americas.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory9 years ago

iSoftBet continues to grow with new release Forest Mania

-

News8 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018