Latest News

Majority of gamblers hit with affordability checks have handed over info, but wider betting population unwilling

- Most bettors asked to undergo financial checks agree

- Higher spending players more willing than lower spenders

- Most who’ve not yet faced affordability checks say they will refuse

The majority of bettors who have been asked for proof they can afford to gamble have provided it, but there are big questions over how things will play out if checks become mandatory or more common, the results of a new study by sports betting community OLBG show.

A survey of bettors carried out online by YouGov for OLBG found that the majority of those who had been asked by gambling operators to provide documents such as payslips, bank statements or other documents had complied with the request.

The survey, which polled 1,007 bettors, found that 21.8% of bettors had already been asked for documents by at least one bookmaker. Of these, 74.3% had provided them, but 17.9% had refused and started playing with a different licensed operator instead. Of the remainder, 4.1% refused and moved to an unlicensed operator, while 3.7% stopped betting entirely.

The willingness to provide documentation was less widespread among those who had not yet been asked to do so, however.

Of the 78.2% of punters who had not yet faced affordability checks, 37.3% said they would refuse and simply stop betting, 35.0% said they would move to a different licensed operator and 4.1% said they’d go to an unlicensed company. Only 23.5% indicated they would be willing to provide the documents.

“Most bettors who have been asked to provide documents have done so. More importantly, very few of those who were asked stopped gambling or went to the black market, the latter being the worst unintended consequence of measures aimed at making gambling more responsible,” said Richard Moffat, CEO at OLBG.

“However, there is a stark difference between those who have been asked and those who haven’t in terms of willingness.”

As the below table shows, overall 65% of bettors reported not being willing to comply with affordability checks. Those betting lower monthly amounts were the least open to handing over financial documents, with more than three in four (75.4%) of those betting less than £5 a month and 72% of those betting £6-15 a month unwilling to undergo affordability checks.

“Few people who are spending at this level are likely to think it is proportionate for a bookie to ask for proof they can afford it and it’s quite surprising how many lower spending players report already having been asked. From the rumours about what level mandatory checks might come in, it seems unlikely checks will be forced on players at levels under £100 per month,” said Moffat.

Players spending less than £100 per month

| Have you been asked by a gambling company to provide payslips, bank statements or similar documents as part of an affordability or proof of funds check? | All bettors | Less than £5 | £6-15 | £16-25 | £26-50 | £51-100 |

| Unweighted base | 1,007 | 235 | 224 | 147 | 154 | 93 |

| Yes, I have and I provided the required documents | 16.16% | 6.00% | 10.08% | 20.86% | 16.55% | 14.27% |

| No, I have not but I would provide the documents if asked | 18.45% | 18.20% | 18.06% | 23.14% | 20.31% | 21.62% |

| Yes, I have, but I didn’t provide the documents and bet with a different licensed company instead | 3.92% | 0.40% | 1.77% | 4.22% | 4.53% | 6.57% |

| Yes, I have but I didn’t provide the documents and bet with a different unlicensed company instead | 0.90% | 0.00% | 0.47% | 0.71% | 1.29% | 1.08% |

| Yes, I have but I didn’t provide the documents and stopped betting | 0.79% | 0.00% | 0.43% | 0.70% | 1.94% | 1.10% |

| No, I have not and if asked I wouldn’t provide the documents and would bet with a different licensed company instead | 27.40% | 20.40% | 31.52% | 24.80% | 35.25% | 38.36% |

| No, I have not and if asked I wouldn’t provide the documents and would bet with an unlicensed company instead | 3.20% | 1.30% | 3.57% | 4.17% | 3.27% | 1.11% |

| No, I have not and if asked I wouldn’t bet | 29.18% | 53.60% | 34.10% | 21.40% | 16.86% | 15.88% |

| Total willing to provide documents | 34.61% | 24.20% | 28.14% | 44.00% | 36.86% | 35.89% |

| Total unwilling to provide documents | 65.39% | 75.70% | 71.86% | 56.00% | 63.14% | 64.10% |

Players spending more than £100 per month

| Have you been asked by a gambling company to provide payslips, bank statements or similar documents as part of an affordability or proof of funds check? | All bettors | £101-200 | £201-300 | £301-500 | £501-1000 |

| Unweighted Base | 1,007 | 57 | 16 | 16 | 20 |

| Yes, I have and I provided the required documents | 16.16% | 30.04% | 31.87% | 50.63% | 40.65% |

| No, I have not but I would provide the documents if asked | 18.45% | 19.41% | 12.94% | 0.00% | 4.79% |

| Yes, I have, but I didn’t provide the documents and bet with a different licensed company instead | 3.92% | 12.40% | 6.73% | 0.00% | 15.35% |

| Yes, I have but I didn’t provide the documents and bet with a different unlicensed company instead | 0.90% | 1.77% | 0.00% | 0.00% | 0.00% |

| Yes, I have but I didn’t provide the documents and stopped betting | 0.79% | 1.70% | 0.00% | 6.45% | 0.00% |

| No, I have not and if asked I wouldn’t provide the documents and would bet with a different licensed company instead | 27.40% | 24.19% | 36.36% | 30.49% | 28.90% |

| No, I have not and if asked I wouldn’t provide the documents and would bet with an unlicensed company instead | 3.20% | 5.19% | 12.10% | 6.45% | 5.12% |

| No, I have not and if asked I wouldn’t bet | 29.18% | 5.31% | 0.00% | 5.98% | 5.20% |

| Total willing to provide documents | 34.61% | 49.45% | 44.81% | 50.63% | 45.44% |

| Total unwilling to provide documents | 65.39% | 50.56% | 55.19% | 49.37% | 54.57% |

* Players spending more than £1,000 per month were excluded as numbers were too small to be statistically significant.

However, while willingness to undergo affordability checks does seem to increase among players who spend more on a monthly basis, even among those spending £100-plus per month, less than half were open to affordability checks.

One big difference between players at lower spend levels and those spending more than £100 was the likelihood of players stopping gambling if asked to undergo checks. While 53.6% of those betting less than £5 said they wouldn’t gamble if faced with affordability checks, just 5.31% said the same in the £101-200 per month category.

Higher spending players were more likely to have moved to a different licensed company rather than provide documents, but across all spending amounts a significant proportion of players reported plans to do so if asked to provide documents.

“Many players reported either having already moved to a different licensed operator or being willing to do so over affordability checks. Therefore, there is now a big question mark over what might happen if affordability checks become mandatory and all licensed operators have to impose them at certain levels,” said Moffat.

The survey also found that younger players were more willing to submit to financial checks. About one-third (33.34%) of those aged 18-24 said they had been asked for and provided documents, while 22.86% said they hadn’t been asked but would do so. In the 55-plus age group, the percentage of players reporting the same fell to 6.40% and 15.37%, respectively.

More details on this breakdown can be found in the full survey report, along with various other findings on the UK’s gambling habits.

Andrew Cardno

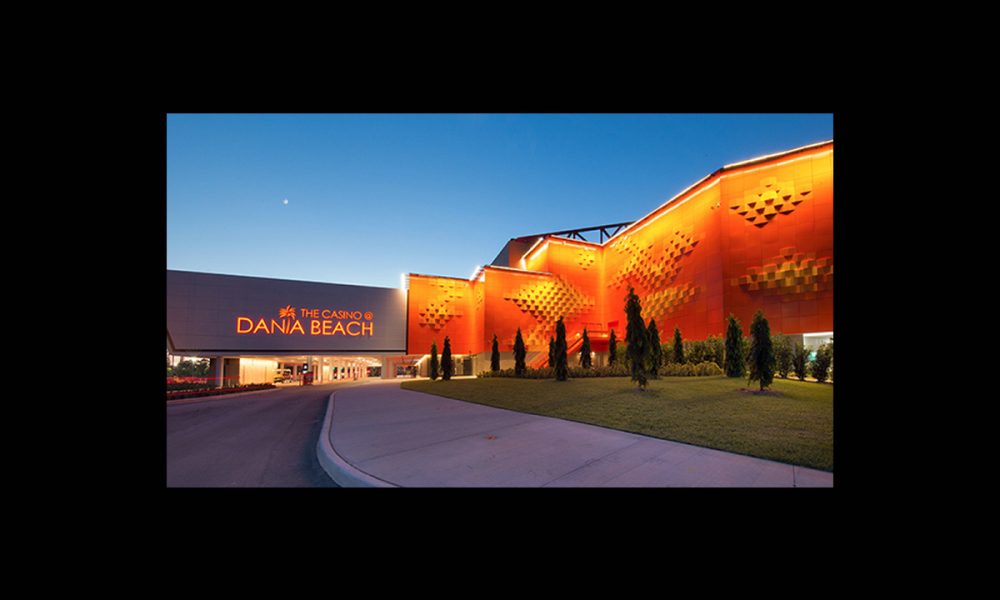

Dania Beach Casino Excited to Leverage QCI Nimble Edition with AGI56 to Elevate Player Engagement

Quick Custom Intelligence (QCI), a leading provider of data-driven casino intelligence and player engagement platforms, announced that Dania Beach Casino is continuing to benefit from its deployment of the QCI Nimble platform. While the property currently focuses on the QCI Host and QCI Marketing modules, it has expressed enthusiasm about the capabilities of the new AGI56 release and its impact on future customer engagement strategies.

Josh Crowder, Director of Marketing at Dania Beach Casino, said: “QCI is the tool that we use to connect to our players, enabled with deep data that has guided us in critical business initiatives. AGI56 shows QCI’s commitment to their core product. They have completely refreshed the technology stack, added deeper tooling for precise marketing initiatives, and Chatalytics.com in AGI56 provides tooling that enables us to build AI-managed data interactions.”

AGI56 represents the most ambitious release in QCI’s history, with the platform undergoing a full refresh of its technology stack, improved integration of advanced analytics, and the introduction of generative AI-driven tooling through Chatalytics.com. This evolution ensures that casinos can not only continue to run data-driven marketing campaigns and player development initiatives but also begin to take advantage of next-generation artificial intelligence to manage complex customer data interactions.

Andrew Cardno, Chief Technology Officer of QCI, said: “We have invested eight figures of R&D into AGI56, transforming it into a platform that not only supports today’s casino marketing and host teams but can also grow across the entire spectrum of customer engagement. Our commitment has been to deliver a technology stack that empowers operators like Dania Beach to achieve precise, data-driven outcomes while building a scalable foundation for the future of AI-enabled player interaction.”

QCI Nimble, the solution deployed by Dania Beach Casino, is designed specifically for properties with under 1000 slot machines. It provides the full capabilities of QCI’s enterprise platform in a form factor that is right-sized for smaller operations. With the release of AGI56, Nimble customers gain access to many of the same advanced tools as larger properties, including refined marketing segmentation, deeper player development capabilities, and AI-powered analytics that bring enterprise-grade insight to local and regional markets.

QCI’s platform is currently deployed in more than 350 casinos worldwide, supporting properties that collectively manage over 42 billion dollars in annual gross gaming revenue. The company’s ongoing investment in product development ensures that every property, regardless of size, can benefit from the same commitment to innovation, operational efficiency, and enhanced guest engagement.

The post Dania Beach Casino Excited to Leverage QCI Nimble Edition with AGI56 to Elevate Player Engagement appeared first on Gaming and Gambling Industry in the Americas.

Financial

Detroit Casinos Report $106.9M in August Revenue

The Michigan Gaming Control Board has reported that Detroit’s three casinos—MGM Grand Detroit, MotorCity Casino, and Hollywood Casino at Greektown—collectively generated $106.9 million in revenue for August 2025.

Table games and slot machines accounted for $105.7 million of the monthly total, while retail sports betting contributed $1.2 million.

August 2025 Market Share

• MGM Grand Detroit: 48%

• MotorCity Casino: 30%

• Hollywood Casino at Greektown: 22%

Table Games and Slot Machine Revenue

Revenue from table games and slots decreased by 4.6% compared with August 2024 and 0.3% from July 2025. From January 1 through August 31, combined table games and slots revenue was down 1.2% year-over-year.

Casino-specific revenues compared to August 2024 were:

• MGM Grand Detroit: $51.7 million, down 4.0%

• MotorCity Casino: $31.2 million, up 1.4%

• Hollywood Casino at Greektown: $22.8 million, down 13.0%

The three casinos paid $8.6 million in state gaming taxes in August 2025, down from $9.0 million in August 2024. They also submitted $12.6 million in wagering taxes and development agreement payments to the City of Detroit.

Retail Sports Betting Revenue

In August 2025, the casinos reported a combined retail sports betting handle of $6.8 million, generating $1.2 million in gross receipts. Qualified adjusted gross receipts (QAGR) from retail sports betting decreased by 26.7% from August 2024 but increased 20.2% from July 2025.

QAGR by casino:

• MGM Grand Detroit: $264,076

• MotorCity Casino: $548,749

• Hollywood Casino at Greektown: $427,999

The casinos paid $46,903 in state taxes from retail sports betting revenue and submitted $57,326 in wagering taxes to the City of Detroit.

Fantasy Contests

Fantasy contest operators reported $513,880 in adjusted revenues for July 2025 and paid $43,166 in taxes.

The post Detroit Casinos Report $106.9M in August Revenue appeared first on Gaming and Gambling Industry in the Americas.

Latest News

Win a Fruity Fortune in BGaming’s Bonanza Trillion

Rapidly expanding content provider serves up a juicy sequel in Bonanza Trillion

Popular iGaming content provider BGaming is excited to announce the launch of Bonanza Trillion, the highly anticipated sequel to the hit slot, Bonanza Billion.

The game builds on the success of its predecessor while also upping the ante with a range of captivating features, enhanced visuals, and higher volatility.

Bonanza Trillion upgrades the classic fruit and crystal theme that players loved from the original title. The slot offers a fresh and vibrant design, complemented by an upbeat soundtrack that is perfectly suited to modern mobile gaming trends.

It is not just the game’s visuals that are going to dazzle players, with the cascading slot offering improved mechanics and exciting new bonuses. The accumulating multiplier feature is the key highlight, with the free spins games accessed via the buy bonus featuring starting boosts of 50x and 100x.

BGaming has also improved the math model for Bonanza Trillion, serving up an attractive RTP of 97.17% and balancing it out with the x5,000 maximum win.

Julia Alekseeva, CPO at BGaming, said, “Bonanza Billion was such a runaway hit with our players that we would have been foolish to pass on the chance of making a sequel.

Bonanza Trillion manages to honour what made the original such a hit, while also expanding on it in every way. It is bigger, offers more creative gameplay, and serves up a more engaging experience. We are confident the game will further solidify the Bonanza series as one of our best.”

The post Win a Fruity Fortune in BGaming’s Bonanza Trillion appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory9 years ago

iSoftBet continues to grow with new release Forest Mania

-

News8 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018