Latest News

Sportradar Reports Strong Growth in Fourth Quarter and Full Year 2021

Fourth quarter revenue grew 41% while full year 2021 revenue grew 39%, exceeding Company’s outlook

Annual revenue surpasses €500 million for the first time in Company’s history

Company projects solid annual revenue growth of 18% to 25% in fiscal 2022

Secured multiyear partnerships with NHL, NBA, ITF, ICC, UEFA, Bundesliga

Sportradar Group AG, a leading global technology company enabling next generation engagement in sports, and the number one provider of business-to-business solutions to the global sports betting industry, today announced financial results for its fourth quarter and full year ended December 31, 2021.

Full Year 2021 Highlights and Annual Outlook

- Revenue for the full year of 2021 increased 39% to €561.2 million ($634.2 million)1 compared with the prior year, driven by strong growth across all business segments. Full year revenue exceeded the top end of the Company’s 2021 annual outlook range of €553 – €555 million.

- Adjusted EBITDA2 for the full year of 2021 increased 33% to €102.0 million ($115.3 million)1 compared with the prior year. Full year Adjusted EBITDA exceeded the top end of the Company’s 2021 annual outlook range of €99.5 – €101.5 million.

- Adjusted EBITDA2 for 2021 excluding Sportradar’s September 2021 Initial Public Offering (IPO) costs was €113.7 million ($128.5 million)1.

- Adjusted EBITDA margin2 for 2021 was 18% compared with 19% for 2020. Excluding IPO costs, Adjusted EBITDA margin was 20% for 2021.

- Strong Dollar-Based Net Retention Rate2 increased to 125% for fiscal 2021 compared with 113% for fiscal 2020 highlighting the continued success of the Company’s cross-sell and upsell strategy across its global customer base.

- Cash and cash equivalents totaled €742.8 million as of December 31, 2021. Total liquidity available for use at December 31, 2021, including undrawn credit facilities was €852.8 million.

- Sportradar extended multiyear partnerships with the National Hockey League (NHL), National Basketball Association (NBA), International Tennis Federation (ITF) and Bundesliga International, in addition to securing new deals with the International Cricket Council (ICC) and the Union of European Football Associations (UEFA). These deals reinforce Sportradar’s leadership as a trusted technology and data partner to the biggest leagues and federations around the world.

- The Company provided an annual outlook for full-year 2022 for revenue and Adjusted EBITDA2. Revenue is expected to be in the range of €665.0 million to €700.0 million and Adjusted EBITDA2 is expected to be in the range of €123.0 million to €133.0 million. Please see the “Annual Financial Outlook” section of this press release for further details.

Fourth Quarter 2021 Highlights

- Revenue in the fourth quarter of 2021 increased 41% to €152.4 million ($172.2 million)1 compared with the fourth quarter of 2020, driven by robust growth across all business segments.

- Continued strong performance in the U.S. market with U.S. revenue increasing by 92% to €23.2 million ($26.2 million) 1 compared with the fourth quarter of 2020.

- Adjusted EBITDA2 in the fourth quarter of 2021 increased 14.0% to €21.4 million ($24.2 million)1 compared with the fourth quarter of 2020.

- Adjusted EBITDA margin2 was 14% in the fourth quarter of 2021, compared with 17% over the prior year primarily as a result of increased investment in content and technology, higher costs related to being a public company, as well as higher M&A costs.

- Adjusted Free Cash Flow2 in the fourth quarter of 2021 decreased to (€22.5) million which resulted in a cash flow conversion2 of (105.1%) primarily as a result of additional interest from the Company’s senior secured term loan facility originating in November 2020, timing of sports data licensing payments to leagues, IPO related payments as well as higher costs associated with being a public company.

________________________

1 For the convenience of the reader, we have translated Euros amounts in the tables below at the noon buying rate of the Federal Reserve Bank of New York on December 30, 2021, which was €1.00 to $1.13.

2 Non-IFRS financial measure; see “Non-IFRS Financial Measures and Operating Metrics” and accompanying tables for further explanations and reconciliations of non-IFRS measures to IFRS measures.

Key Financial Measures

| In millions, in Euros € | Q4 | Q4 | Change | FY | FY | Change | ||||||||

| 2021 | 2020 % | 2021 | 2020 % | |||||||||||

| Revenue | 152.4 | 108.0 | 41% | 561.2 | 404.9 | 39% | ||||||||

| Adjusted EBITDA2 | 21.4 | 18.8 | 14% | 102.0 | 76.9 | 33% | ||||||||

| Adjusted EBITDA margin2 | 14.0% | 17.4% | – | 18.2% | 19.0% | – | ||||||||

| Adjusted Free Cash Flow2 | (22.5) | 7.1 | – | 14.5 | 53.5 | (73%) | ||||||||

| Cash Flow Conversion2 | (105.1%) | 37.5% | – | 14.3% | 69.6% | – | ||||||||

Carsten Koerl, Chief Executive Officer of Sportradar said: “I am very pleased with our strong results, which illustrate how well we are delivering on our operational and growth plans. Importantly, we have good momentum going into our next fiscal year. We are continuing to invest in content, technology and people that will allow us to deliver profitable growth in line with our goals.

Koerl continued, “We are particularly pleased about more than doubling our year-over-year revenues in the United States, which continues its explosive sports betting growth story. Sportradar has been a leader in this market since 2014, and we’re now seeing the results of our early investment. We continue to see the enormous opportunity as sports betting becomes an increasingly integral part of the media entertainment fabric in the U.S.

Segment Information

RoW Betting

- Segment revenue in the fourth quarter of 2021 increased by 30% to €82.2 million compared with the fourth quarter of 2020. This growth was driven primarily by uptake in our higher value-add offerings including Managed Betting Services (MBS) and Live Odds Services, which increased by 74% and 26% respectively. MBS experienced record turnover3 and Live Odds grew as a result of higher volume of sports coverage.

- Segment Adjusted EBITDA2 in the fourth quarter of 2021 increased by 58% to €45.7 million compared with the fourth quarter of 2020. Segment Adjusted EBITDA margin2 improved to 56% from 46% compared with the fourth quarter of 2020 driven by growth in higher margin products.

- Full year 2021 revenue grew 32% to €309.4 million compared with the prior year of 2020. Full year Adjusted EBITDA2 increased 49% to €177.0 million. Full year 2021 Adjusted EBITDA margin2 improved to 57% from 51% in the prior year.

1 For the convenience of the reader, we have translated Euros amounts in the tables below at the noon buying rate of the Federal Reserve Bank of New York on December 30, 2021, which was €1.00 to $1.13.

2 Non-IFRS financial measure; see “Non-IFRS Financial Measures and Operating Metrics” and accompanying tables for further explanations and reconciliations of non-IFRS measures to IFRS measures.

3 Turnover is the total amount of stakes placed and accepted in betting.

RoW Audiovisual (AV)

- Segment revenue increased in the fourth quarter of 2021 by 52% to €35.6 million compared with the fourth quarter of 2020. This growth was primarily a result of increased volume of streaming services across all major sports.

- Segment Adjusted EBITDA2 in the fourth quarter of 2021 increased by 77% to €9.9 million compared with the fourth quarter of 2020. Segment Adjusted EBITDA margin2 improved to 28% from 24% compared with the fourth quarter of 2020.

- Full year 2021 revenue grew 32% to €140.2 million compared with the prior year of 2020. Full year Adjusted EBITDA2 increased 47% to €39.2 million. Full year 2021 Adjusted EBITDA margin2 improved to 28% from 25% in the prior year.

United States

- Segment revenue in the fourth quarter of 2021 increased by 92% to €23.2 million compared with the fourth quarter of 2020. This growth was driven by our increased sales of U.S. Betting services as the underlying market and turnover3 grew. We also experienced strong adoption of our ad:s product, growth in U.S. Media and a positive impact from the acquisition of Synergy Sports.

- Segment Adjusted EBITDA2 in the fourth quarter of 2021 decreased to (€7.6) million compared with the fourth quarter of 2020 primarily due to increased investment in the Company’s league and team solutions focused business. Segment Adjusted EBITDA margin2 decreased to (33%) from 11% compared with the fourth quarter of 2020 reflecting the aforementioned increased investment.

- Full year 2021 revenue grew 108% to €71.7 million compared with the prior year of 2020. Full year Adjusted EBITDA2 decreased 38% to (€22.6) million. Full year 2021 Adjusted EBITDA margin2 improved to (32%) from (48%) in the prior year.

Costs and Expenses

- Personnel expenses in the fourth quarter of 2021 increased by €12.7 million to €47.0 million compared with the fourth quarter of 2020 primarily resulting from additional hires in the Company’s product and technology organizations (2,959 FTE in the fourth quarter of 2021 vs 2,366 FTE in the fourth quarter of 2020).

- Other Operating expenses in the fourth quarter of 2021 increased by €13.3 million to €27.2 million compared with the fourth quarter of 2020 mainly driven by higher travel and entertainment and marketing costs as pandemic restrictions eased, higher M&A costs as well as increased costs to implement a new enterprise resource planning (ERP) system.

- Total Sport rights costs in the fourth quarter of 2021 increased by €8.8 million to €38.5 million compared with the fourth quarter of 2020, primarily resulting from a normalized schedule in sports such as NBA, NHL and MLB, as COVID-19 pandemic restrictions eased.

2 Non-IFRS financial measure; see “Non-IFRS Financial Measures and Operating Metrics” and accompanying tables for further explanations and reconciliations of non-IFRS measures to IFRS measures.

3 Turnover is the total amount of stakes placed and accepted in betting.

Fourth Quarter Business Highlights

- Sportradar and the NBA announced an expansive multiyear partnership agreement that will see the NBA, Women’s National Basketball Association (WNBA) and NBA G League use Sportradar’s global and wide-ranging capabilities to grow U.S. operations, increase their international footprint and drive fan engagement. This new partnership begins with the 2023-24 NBA season and provides the NBA with an equity stake in Sportradar.

- The Company extended its long-term partnership with Bundesliga International, a subsidiary of DFL Deutsche Fußball Liga, featuring a suite of AI-driven fan engagement tools which enable Genrmany’s top football league to better engage fans.

- Sportradar also extended its partnership with Kambi, a leading global sports betting supplier. The deal reestablishes Sportradar as Kambi’s exclusive supplier of NBA, NHL, MLB, and college sports data in the US market.

- Sportradar announced a new multi-year partnership with PointsBet, a premier global online gambling operator, that establishes Sportradar as PointsBet’s US supplier of choice for MLB, NBA, NHL, college football, and college basketball data.

- Sportradar announced a partnership with UEFA’s as their exclusive authorized collector and distributor of data for betting purposes, as well as extending its role as UEFA’s official integrity partner. The Company secured this landmark agreement following UEFA’s first competitive tender process for its data distribution rights for betting purposes.

- The Company strengthened its existing partnership with ITF with a three-year extension to serve as the ITF’s official data partner.

- Sportradar was selected by the ICC making Sportradar its Official Data Distribution and Official Betting Live Streaming Partner. The partnership will create more opportunities for the ICC to engage with its fan base through Sportradar’s network of 1,000 media and sports-betting clients across 80 countries.

- The Company underlined its commitment to protecting the integrity of sport with the launch of Universal Fraud Detection System (UFDS) free of charge. Sportradar Integrity services has utilized UFDS, to detect suspicious activity in 12 sports across more than 70 countries. Sportradar will begin delivering its UFDS bet monitoring service free of charge, to sports federations, sports leagues, and state authorities around the world, in its continued commitment to protecting the integrity of global sport and making the system accessible to all.

- Sportradar announced significant high-profile hires to further strengthen its US team, including Andrew Bimson as North American Chief Operating Officer, Jim Brown as Head of Integrity Services & Harm Prevention and Rima Hyder as Head of Investor Relations.

Annual Financial Outlook

Sportradar is providing its outlook for fiscal 2022.

- Revenue is expected to be in the range of €665.0 million to €700.0 million ($752.0 million to $791.0 million)1, representing growth of 18% to 25% over fiscal 2021.

- Adjusted EBITDA2 is expected to be in the range of €123.0 million to €133.0 million ($139.0 million to $150.0 million) 1, representing growth of 21% to 30% over fiscal 2021.

- Adjusted EBITDA margin2 is expected to be in the range of 18.5% to 19.0%, an improvement over the prior year.

1 For the convenience of the reader, we have translated Euros amounts in the tables below at the noon buying rate of the Federal Reserve Bank of New York on December 30, 2021, which was €1.00 to $1.13.

2 Non-IFRS financial measure; see “Non-IFRS Financial Measures and Operating Metrics” and accompanying tables for further explanations and reconciliations of non-IFRS measures to IFRS measures.

Latest News

WSOP Online Returns to GGPoker This August with 33 Gold Bracelets and $5,000,000 in Special Promotions!

Play for millions in prizes from August 17 through September 30

GGPoker, the World’s Biggest Poker Room, is thrilled to announce the highly anticipated return of WSOP Online this August, bringing the thrill and prestige of the World Series of Poker® directly to players’ screens. The six-week festival will run from August 17 to September 30, featuring 33 official WSOP Gold Bracelet events, tens of millions in guaranteed prizes, and a gigantic $5,000,000 in special promotions designed to reward players across the globe.

This year’s WSOP Online series on GGPoker promises an exhilarating journey for players of all skill levels, offering a direct path to poker immortality and a share of millions in guaranteed prize money. The schedule is packed with can’t-miss events, including:

-

August 25: $215 Mystery Millions – Featuring a staggering $1,000,000 top bounty and a $10,000,000 guaranteed prize pool

-

September 8: $1,500 MILLIONAIRE MAKER – With an impressive $1,000,000 guaranteed for first place and a total $5,000,000 guaranteed prize pool

-

September 22: $5,000 WSOP Online MAIN EVENT – The flagship tournament boasting a colossal $25,000,000 guaranteed prize pool

-

September 29: $10,300 GGMillion$ High Rollers – A premier event for high-stakes players with a $10,000,000 guarantee

Adding to the excitement, WSOP Online 2025 will include a suite of innovative promotions offering even more ways to win:

-

$3,000,000 Continental Flipouts: As in previous series, players will be assigned to one of four continents, and Continental Flipouts will be held following each bracelet event (open to bracelet-event participants from the same continents as the event winners). These special flipouts will feature prize pools of up to $250,000, fostering incredible regional rivalry

-

$1,000,000 Super Pass Bonus: Each of the 33 Bracelet winners will receive a coveted $30,000 Super Pass, granting them direct access to the record-breaking WSOP Paradise $60M Super Main Event in the Bahamas this December

-

$1,000,000 Ranking Freeroll: The top 10 countries in the Bracelet Rankings will unlock 10 exclusive freeroll tournaments for their players, with prize pools scaled according to each country’s final rank, adding another layer of national pride to the competition

“WSOP Online is about to deliver another incredible experience,” said Daniel Negreanu, GGPoker Global Ambassador. “With 33 gold bracelets up for grabs, huge prizes, plus millions in special bonuses like the Continental Flipouts and Super Passes to WSOP Paradise, this series is a must-play for any poker enthusiast. It’s a truly global celebration of the game, and I can’t wait to see who takes home the gold!”

The wider poker community can follow the WSOP Online action live at GGPoker.tv, with the final table of the $5K Main Event broadcast on September 23 at 18:45 UTC (hosted by Jeff Gross & special guest) and the final table of the $10K GGMillion$ High Rollers broadcast on September 30 at 18:45 UTC (hosted by Jeff Gross & Daniel Negreanu).

Players can qualify for each monumental WSOP Online event through satellites running around the clock on GGPoker, making the dream of winning a WSOP Gold Bracelet more attainable than ever. New players to GGPoker are also eligible to claim the Welcome Bonus, earn rewards with the Honeymoon for Newcomers promotion, and automatically join the Fish Buffet loyalty program, offering regular cash prizes.

The post WSOP Online Returns to GGPoker This August with 33 Gold Bracelets and $5,000,000 in Special Promotions! appeared first on European Gaming Industry News.

Latest News

Week 32/2025 slot games releases

Here are this weeks latest slots releases compiled by European Gaming

Spinomenal has released 4 Horsemen III: Inferno to complement the wildly popular Mythology series. 4 Horsemen III: Inferno invites players into an apocalyptic hellscape where the reels are engulfed by a scorched wasteland under burning skies. A relentlessly surging and dark soundtrack creates an atmosphere thick with tension. The Horsemen return, Conquest, War, Famine, and Death, each carrying their own Free Spins feature, which is triggered with three or more full-sized Scattered Free Spins symbols.

Following the success of Money Coming and Money Coming – Expanded Bets, leading content provider TaDa Gaming has released Money Coming 2. A straightforward 3×1 grid with a bonus reel for Multipliers and a single payline means Money Coming 2 is all about the numbers. With no symbols, just numbers or blank positions on the first three reels, when the numbers land they are added sequentially to make the payout.

Relax Gaming, the award-winning iGaming aggregator and supplier of unique content, has launched Conquer Babylon, a bold release inspired by the ancient wonders of Mesopotamia. Set amidst the towering structures of Babylon, the high-volatility 6×8 slot offers up to 262,144 ways to win, combining immersive visuals with powerful bonus features and a maximum win of 15,000 times the stake.

Get your mops out, this ship is one big floating mess! Only the dirtiest of sailors can sail the seven seas aboard Nolimit City’s latest release, Seamen. If you’re 6ft tall, love the open sea and have a taste for working with seamen, then join the White Pearl today! This ship is used to carrying some big loads.

Gaming Corps – a publicly-listed game development company based in Sweden, has unveiled its latest instant win title: Bass Rewards. Packed with colourful fish and serious prize potential, the game takes players on the fishing trip of a lifetime. In Bass Rewards, every catch counts – inviting players to bait their hook and fish for fortune across a grid swimming with characterful catch.

Amusnet has released its latest video slot game, Tiki Tiki Boo Boo. With a colourful theme and invigorating soundtrack, Tiki Tiki Boo Boo is the perfect summer adventure, complemented by a bunch of special features to guarantee an unforgettable experience. The video slot’s toppling reels mechanics and its 243 ways to pay make the game a fun alternative to slots with standard paylines.

Blueprint Gaming™ has strengthened its long-term partnership with globally renowned operator bet365 through the exclusive release of bet365 Kong 3 Even Bigger Bonus. The 6×4, 4,096-way to win slot provides an intriguing update to the beloved Kong series, with revamped cash harvests and a new-look bonus trail.

Spinomenal has launched its mythology-themed Majestic Zeus slot. Set at the foothills of Mount Olympus, Majestic Zeus welcomes players to a Grecian world where the rewards are potentially as large as the mountains themselves. The 5×3 frame is nestled between two towering columns adorned with Grecian goddesses. A thunderous, powerful musical score evokes the might of Zeus and heightens the entertainment.

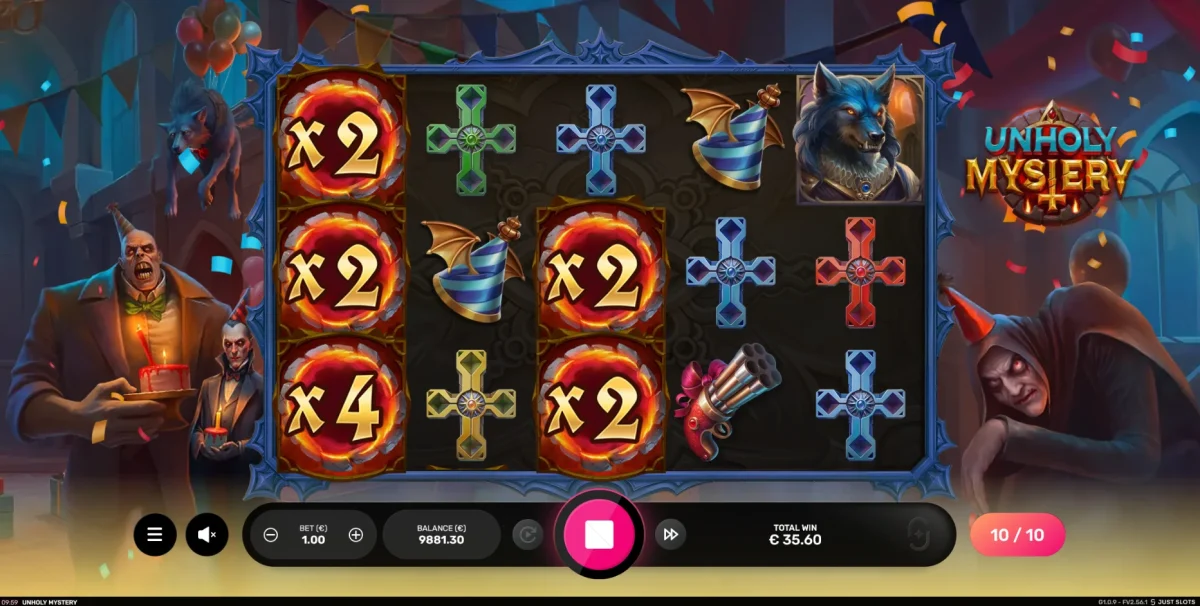

Just Slots has announced the launch of its latest title, ‘Unholy Mystery’. Building on strong momentum, this marks Just Slots’ fifth release since the breakout success of their debut game, Sugar Heaven. Following the ominous world of their last release, Book of Arcane 100, Unholy Mystery gives the theme a playful twist by blending dark undertones with a party-like atmosphere and a bold visual style that feels like a monster birthday jamboree.

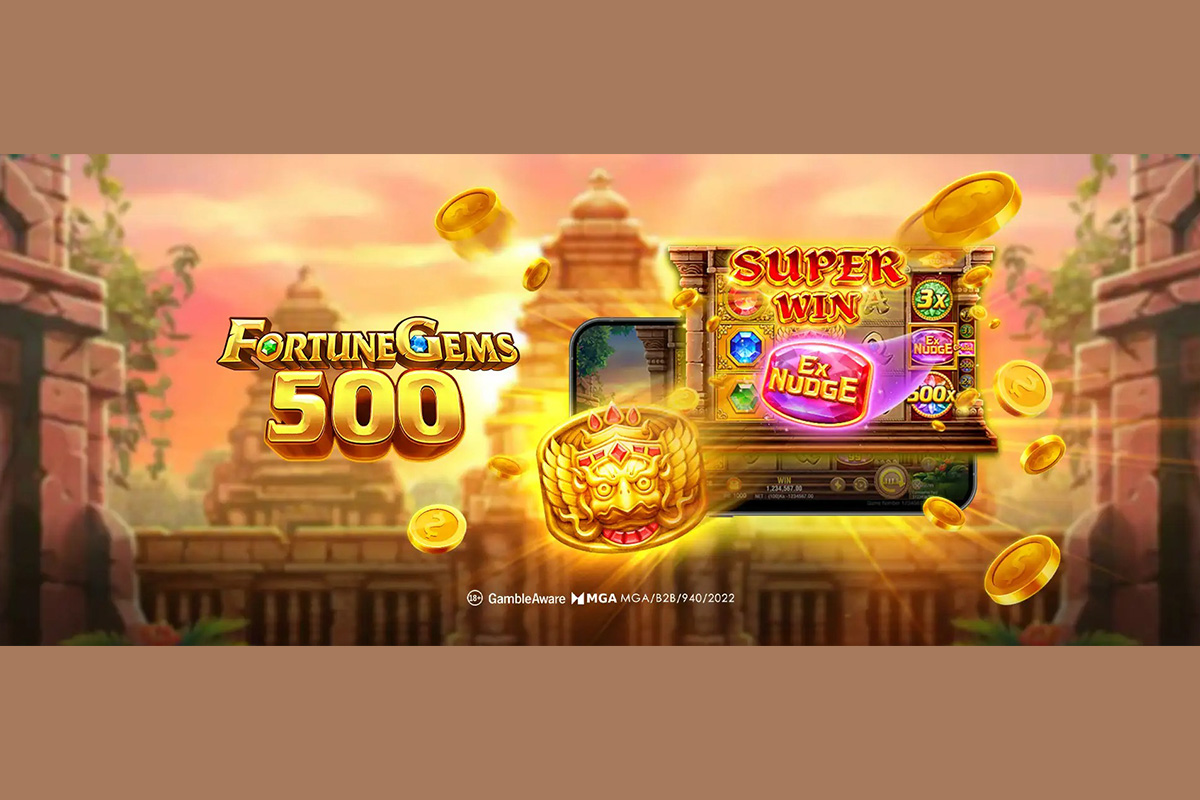

TaDa Gaming has released Fortune Gems 500, a thrilling 3+1 reel video slot that dazzles with elegant visuals and dynamic rewards. Its core innovation lies in the special fourth reel, which randomly displays multiplier values up to 500x or a powerful Ex NUDGE symbol.

Playson welcomes the return of its lucky leprechaun in the charming new release, 4 Pots Riches: Hold and Win, with the mischievous figure on hand to elevate wins with a host of enriched features. The highlight is the Super Pot Bonus Game, which is triggered by the Super Clover Bonus Symbol.

BGaming puts a fresh spin on the popular fishing genre with the launch of Big Tuna Bonanza. This charming adventure pulls inspiration from some of the most popular titles in the category, inviting players to cast their lines and reel in big wins. Big Tuna Bonanza is bigger and bolder than the fishing games that have come before it.

Play’n GO revives one of its earliest icons with Lady of Fortune Destiny Spins. The Lady steps back into the spotlight with a refreshed presence, ushering in a wave of unpredictability that rewards attention and patience in equal measure. With a glowing crystal ball at her side, the Lady of Fortune transforms missed chances into charged potential.

The post Week 32/2025 slot games releases appeared first on European Gaming Industry News.

Compliance Updates

GeoLocs and Shufti Join Forces to Streamline Player Onboarding and Compliance

GeoLocs, the specialist geolocation platform for the iGaming, Sports Betting and iLottery industries, has partnered with identity verification provider Shufti to deliver a seamless and secure user experience for both operators and players in regulated markets worldwide.

The integration of GeoLocs’ precise geolocation technology with Shufti’s robust identity verification solutions allows operators to onboard players faster while maintaining full compliance with local regulations. The partnership reduces friction in the registration and verification process, enabling a smoother journey from sign-up to gameplay.

Will Whitehead, Commercial Director at GeoLocs, commented: “We’re excited to be working with Shufti to bring a more seamless, secure experience to clients and players alike. Both of our technologies have been built with compliance and UX at their core, and this partnership allows us to combine strengths—making onboarding and verification faster, smoother, and more robust for operators in regulated markets.”

With regulatory frameworks tightening in both emerging and established jurisdictions, the collaboration ensures that operators have access to integrated tools that deliver high standards of security, compliance, and user experience.

Roger Redfearn-Tyrzyk, SVP of Sales at Shufti, added: “We’re proud to be teaming up with GeoLocs to support operators in delivering frictionless onboarding and a high level of regulatory compliance. Our joint capabilities mean operators can verify users quickly and accurately while GeoLocs ensures they are playing from permitted locations—creating an end-to-end experience that puts both security and user satisfaction first.”

This partnership underscores both companies’ commitment to innovation and player-centric technology in the fast-evolving iGaming space.

The post GeoLocs and Shufti Join Forces to Streamline Player Onboarding and Compliance appeared first on European Gaming Industry News.

-

gaming3 years ago

gaming3 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory8 years ago

iSoftBet continues to grow with new release Forest Mania

-

News7 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News7 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry8 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News7 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry8 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News7 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018