Industry News

OPAP strengthens its position in online sports-betting in Greece through the acquisition of Stoiximan Group’s Greek and Cypriot business

OPAP S.A., (“OPAP”), SAZKA Group’s Greek and Cypriot subsidiary, has today announced (i) the receipt of regulatory approvals for its previously announced acquisition of 51% of Stoiximan Group’s Greek and Cypriot business (“SMGC”) and (ii) the acquisition (subject to regulatory approvals) of a further stake in SMGC as a result of which OPAP will have a total shareholding of 85% in and sole control of SMGC.

OPAP’s announcement and presentation can be found here.

Robert Chvatal, SAZKA Group CEO, commented: “Today’s announcement marks an important step forward for SAZKA Group and for OPAP, as OPAP gains a leading market position in yet another gaming vertical. OPAP, with SAZKA Group’s support, has achieved a milestone that will significantly strengthen its position in the online sports-betting market. In recent weeks, we have been working in anything but a standard business environment. And yet under these extraordinary circumstances our joint teams brought this transaction to fruition. Here my thanks must go specifically to the management team led by Mr. George Daskalakis”.

In 2019, Stoiximan Group (under the parent company TCB) generated revenues (GGR) of €245 million and EBITDA of €38 million. SMGC generated revenues (GGR) of €197 million, corresponding to 80% of Stoiximan Group’s total revenues, and EBITDA of 44 million.

OPAP:

OPAP is the leading gaming company in Greece. The company, founded in 1958 as the country’s national lottery operator and listed on the Athens Exchange in 2001, is the exclusive licensed operator of numerical lotteries (7 games), sports betting (4 games), Video Lottery Terminals (VLTs) and horse racing in Greece. It also operates exclusively, as a controlling shareholder (83.5%) through a joint venture, the passive lotteries and instant (scratch) games in Greece. OPAP is one of the largest charitable donors in Greece, operating under World Lottery Association (WLA) and responsible gaming standards.

About SAZKA Group:

SAZKA Group is one of the largest pan-European lottery operators. Its businesses run lotteries in all the major continental European countries where lotteries are privately operated, including the Czech Republic, Greece, Austria, Italy, and Cyprus. Its businesses focus on the lottery segment, including numerical lotteries (draw-based games) and instant lotteries (scratch cards), while also providing complementary products in sports-betting and digital-only games. They sell their products both through extensive retail networks and digital platforms. All its lottery operators are members of the World Lottery Association and the European Lottery Association and operate in accordance with their codes of practice.

Industry News

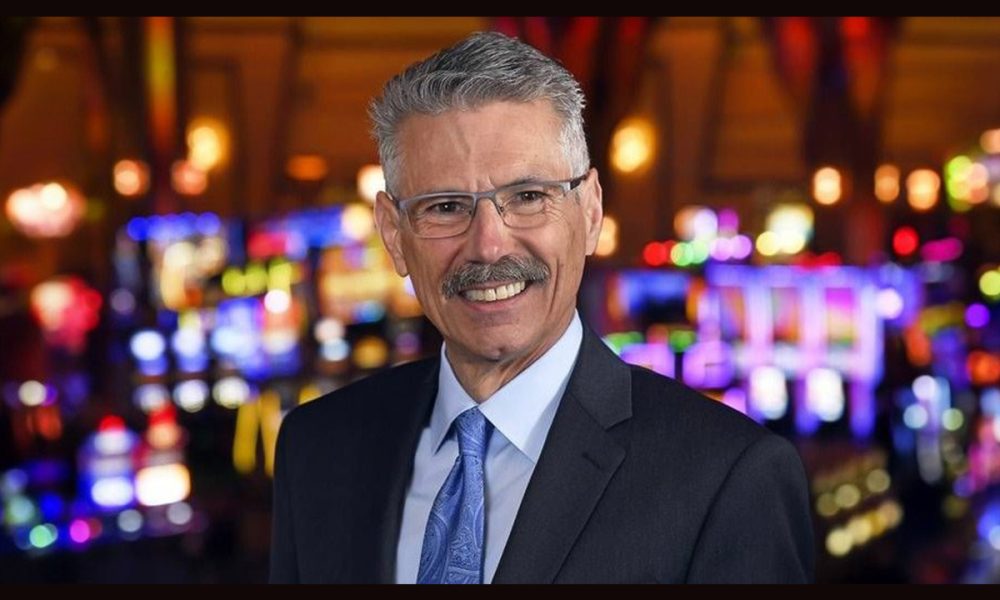

Mohegan Appoints Joseph J. Hasson as Interim COO

Mohegan Tribal Gaming Authority, known globally for its renowned integrated entertainment resorts, has appointed Joseph J. Hasson as interim Chief Operating Officer. Jody Madigan, the current COO, has resigned effective August 1, 2024, and will be taking a leave of absence pending his departure.

Joseph J. Hasson will serve as interim COO and retain his current role as General Manager of Mohegan Casino at Virgin Hotels Las Vegas, subject to necessary regulatory filings or approvals. Mr. Hasson was an obvious choice for the Management Board, given his prior experience as the former Chief Operating Officer of Station Casinos LLC and Red Rock Resorts Inc. Joe brings considerable expertise to the executive team with a consistent track record of operating excellence and success over more than 40 years’ experience in the gaming and hospitality industry. Mr. Hasson will report to Ray Pineault, President and Chief Executive Officer of Mohegan.

“Joseph J. Hasson’s deep understanding of the gaming and hospitality industry makes him exceptionally qualified to maintain our high service and operational excellence standards. We are confident that Joe’s extensive experience and proven leadership will ensure continuity in our operations and guest experience,” Ray Pineault, President and CEO of Mohegan, said.

Industry News

Jennifer Shatley Joins ROGA as Executive Director

Jennifer Shatley, a recognized expert in the field and a highly sought speaker and advisor, has joined the Responsible Online Gaming Association (ROGA) as Executive Director.

Shatley has had 25+ years worth of experience, working closely with the treatment community, academics, researchers, government bodies, state councils, and gaming industry representatives to promote responsible gaming.

“Many of America’s largest legal mobile gaming operators will be establishing a framework that helps to aid in responsible gaming education and awareness. By coming together with a clear set of objectives, ROGA and our members will work to enhance consumer protections and help provide easier and more efficient access to responsible gaming tools for consumers to enjoy the entertainment of online gaming,” Shatley said.

Industry News

IDnow Bridges the AI-human Divide with New Expert-led Video Verification Solution

IDnow, a leading identity verification provider in Europe, has unveiled VideoIdent Flex, a new version of its expert-led video verification service that blends advanced AI technology with human interaction. The human-based video call solution, supported by AI, has been designed and built to boost customer conversion rates, reduce rising fraud attempts, increase inclusivity, and tackle an array of complex online verification scenarios, while offering a high-end service experience to end customers.

The company’s original expert-led product, VideoIdent, has been a cornerstone in identity verification for over a decade, serving the strictest requirements in highly regulated industries across Europe. VideoIdent Flex, re-engineered specifically for the UK market, represents a significant evolution, addressing the growing challenges of identity fraud, compliance related to Know-Your-Customer (KYC) and Anti-Money Laundering (AML) processes and ensuring fair access and inclusivity in today’s digital world outside of fully automated processes.

As remote identity verification becomes more crucial yet more challenging, VideoIdent Flex combines high-quality live video identity verification with hundreds of trained verification experts, thus ensuring that genuine customers gain equal access to digital services while effectively deterring fraudsters and money mules. Unlike fully automated solutions based on document liveness and biometric liveness features, this human-machine collaboration not only boosts onboarding rates and prevents fraud but also strengthens trust and confidence in both end users and organisations. VideoIdent Flex can also serve as a fallback service in case a fully automated solution fails.

Bertrand Bouteloup, Chief Commercial Officer at IDnow, said: “VideoIdent Flex marks a groundbreaking advancement in identity verification, merging AI-based technology with human intuition. In a landscape of evolving fraud tactics and steady UK bank branch closures, our solution draws on our decade’s worth of video verification experience and fraud insights, empowering UK businesses to maintain a competitive edge by offering a white glove service for VIP onboarding. With its unique combination of KYC-compliant identity verification, real-time fraud prevention solutions, and expert support, VideoIdent Flex is a powerful tool for the UK market.”

Whereas previously firms may have found video identification solutions to be excessive for their compliance requirement or out of reach due to costs, VideoIdent Flex opens up this option by customising checks as required by the respective regulatory bodies in financial services, mobility, telecommunications or gaming, to offer a streamlined solution fit for every industry and geography.

Bouteloup added: “Identity verification is incredibly nuanced; it’s as intricate as we are as human beings. This really compounds the importance of adopting a hybrid approach to identity – capitalising on the dual benefits of advanced technology when combined with human knowledge and awareness of social cues. With bank branches in the UK closing down, especially in the countryside, and interactions becoming more and more digital, our solution offers a means to maintain a human relationship between businesses and their end customers, no matter their age, disability or neurodiversity.

“VideoIdent Flex is designed from the ground up for organisations that cannot depend on a one-size-fits-all approach to ensuring their customers are who they say they are. In a world where fraud is consistently increasing, our video capability paired with our experts adds a powerful layer of security, especially for those businesses and customers that require a face-to-face interaction.”

The post IDnow Bridges the AI-human Divide with New Expert-led Video Verification Solution appeared first on European Gaming Industry News.

-

gaming2 years ago

gaming2 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory7 years ago

iSoftBet continues to grow with new release Forest Mania

-

News6 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News5 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry6 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News5 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry6 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News6 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018