Latest News

Lightning Box focuses on player interaction in Divine Stars

Respins, Star Picks and Multipliers fill this Asia-inspired hit

Light & Wonder, Inc. Specialist slot provider Lightning Box has drawn inspiration from Asia for its latest release Divine Stars. This innovative title will enjoy an exclusive debut via the Rank Group on 27th July followed by a general release two weeks after.

Played across 3×5 reels, this 25 payline slot is home to high-paying symbols, including Chinese lanterns, lucky red letters and ancient coins. These are joined by a wild man symbol, which substitutes all other symbols in game except the scatter, which aids in the creation of winning lines.

A Hold ‘n’ Respin round is awarded upon landing two or more scatter symbols left to right in the base game. Three respins are activated with a goal of landing five scatters across the reels, each additional scatter landed resets these spins, allowing for additional opportunities to collect all five scatter symbols.

Upon collection, the player unlocks a star pick bonus, where they are presented with a mystery choice representing varying spin amounts. Any choice made can be kept or gambled for the opportunity of being awarded even more spins. This process is then repeated to determine the size of the multiplier present throughout these free spins.

This varying multiplier can climb as high as 10x and can be available across up to 10 free spins. This player choice is instrumental in awarding Divine Stars max win of 5,000x.

Divine Stars is available to customers of Light & Wonder’s industry-leading OpenGaming™ platform alongside popular new titles such as Chicken Fox Jr and Lightning Gorilla.

David Little, CPO at Lightning Box said: “Divine Stars positions the player’s interaction as a key part of its gameplay. We want our players to be engaged by the title’s lovingly crafted theme and the max win available.

“However, we also want to provide players with an active role when playing Divine Stars and their choice based around risk and reward decisions have a huge impact on the free spins round.”

Rob Procter, VP Game Development at Light & Wonder said: “We are delighted to welcome Divine Stars to our stable of games. The combination of a huge max win present in a popular Asia themed title will be a hit with slot enthusiasts and we look forward to seeing the reception the game receives upon release.”

Latest News

Sportradar Names New CFO, Craig Felenstein

Sportradar Group AG today announced that Craig Felenstein has been named Chief Financial Officer of the Company, effective June 1, 2024. Felenstein joins the Company from Lindblad Expeditions where he most recently served as Chief Financial Officer. He will report directly to Sportradar Chief Executive Officer Carsten Koerl.

Felenstein brings nearly 30 years of senior finance and operating experience for US publicly listed companies across the media, entertainment, experiential and digital content industries to his new position at Sportradar. Most recently, Felenstein served as Chief Financial Officer at Lindblad Expeditions, a global leader in expedition cruises and adventure travel, where he oversaw the company’s global finance organization, as well their corporate development, information technology and human resources functions. In his role as Sportradar’s Chief Financial Officer, Felenstein will lead the company’s global finance, accounting and investor relations functions. Felenstein has a unique blend of financial rigor and operational insight and will partner with the rest of the executive leadership team to advance the company’s key strategic initiatives and grow the business while maintaining strong relationships with the investment community. He will be based in New York.

Carsten Koerl, CEO, Sportradar said: “With Craig’s deep international experience and successful track record building finance organizations as a CFO at US listed public companies, I am confident that he will be a strong addition to our team. His track record of helping drive financial strategy and building shareholder value will be instrumental to our continued success. We want to express our deep gratitude to Ger Griffin for his meaningful contributions to Sportradar during a transformational growth period for our Company.”

Prior to his tenure at Lindblad, Felenstein served as Senior Vice President of Investor Relations and Strategic Finance at Shutterstock where he oversaw all interaction with the investment community while leading the financial planning and analysis and corporate development functions. Prior to Shutterstock, he served in various management roles at Discovery Communications, LLC, including Executive Vice President of Investor Relations. At the same time, he was a member of the executive team for several of Discovery’s businesses including serving as the Chief Financial Officer of Digital, Chief Financial Officer of US Network Revenue and Chief Financial Officer of Animal Planet. Prior to Discovery Communications, he held senior positions at News Corporation, Viacom Inc., and Arthur Andersen & Co.

Felenstein said: “Sportradar has built an impressive leadership position in the rapidly growing global sports technology market and the Company is ideally situated to deliver sustained growth given their strong content portfolio, unmatched product offerings and commitment to industry innovation. I am excited to work with Carsten and the entire Sportradar team, as well as the Board of Directors, to capitalize on the significant growth opportunities ahead and deliver additional value to our clients, partners and shareholders.”

Bitcoin

Should iGaming Be Worried About 2024 Bitcoin Halving?

In its LinkedIn newsletter, ‘The SOFTSWISS Special’, SOFTSWISS, a global tech expert with over 15 years of experience in iGaming, delves into the impact of Bitcoin Halving on the iGaming realm.

The recent historical moment of Bitcoin Halving took place on 19th April 2024. SOFTSWISS, a pioneer in crypto-friendly iGaming software, shares its insights and forecasts for how this event may shape the future of iGaming, shedding light on potential opportunities and challenges for industry stakeholders.

What is Bitcoin Halving?

The Bitcoin halving is a scheduled event that occurs approximately every four years or every 210,000 blocks. During this event, the reward for mining and verifying new blocks is reduced by 50%, resulting in miners earning only half the number of BTC per mined block.

Since its launch in 2009, Bitcoin’s mining reward has halved four times, occurring in 2012, 2016, 2020, and 2024. The recent April halving reduced the reward to 3.125 BTC per block. Such events are crucial for Bitcoin’s scarcity and inflation control, ensuring that the total supply never exceeds 21 million coins and aligning with its deflationary principles.

Historically, each halving event has resulted in a rise in Bitcoin’s price. This is attributed to the reduced supply and increased scarcity, although other market factors have also influenced these outcomes.

Exploring the Impact of Bitcoin Halving on the iGaming Industry

To provide an in-depth analysis of the Bitcoin Halving impact on iGaming, SOFTSWISS invited Bradley Peak, blockchain expert and tokenomics adviser, to share its anticipations.

- Bets rise: The halving is expected to lead to an increase in Bitcoin’s value. If the trend of impressive price surges persists, Bitcoin-friendly iGaming brands could see a positive impact.

- Crypto adoption increase: Implementing crypto-friendly models has the potential to boost player trust and transparency in iGaming. Additionally, it could rejuvenate unique gaming experiences like provably fair games and decentralised casinos.

- Regulatory frameworks improvement: The recent Bitcoin halving could prompt regulatory bodies to reassess their stance on cryptocurrency gambling. This could lead to new regulations ensuring fairness, responsible gambling, and anti-money laundering measures in the crypto-driven iGaming sector.

Bradley Peak, blockchain expert, comments on the recent changes: “Any transformation will not be without its challenges. It is important to adapt – invest in employee learning and development, onboard crypto processing, and make sure your platform remains secure in the process.”

Explore the influence of the 2024 Bitcoin Halving on the iGaming industry in the fourth edition of The SOFTSWISS Special newsletter on LinkedIn.

About SOFTSWISS

SOFTSWISS is an international tech company supplying software solutions for managing iGaming projects. The expert team, which counts over 2,000 employees, is based in Malta, Poland, and Georgia. SOFTSWISS holds a number of gaming licences and provides one-stop-shop iGaming software solutions. The company has a vast product portfolio, including the Online Casino Platform, the Game Aggregator with thousands of casino games, the Affilka affiliate platform, the Sportsbook Platform and the Jackpot Aggregator. In 2013, SOFTSWISS was the first in the world to introduce a Bitcoin-optimised online casino solution.

The post Should iGaming Be Worried About 2024 Bitcoin Halving? appeared first on European Gaming Industry News.

Latest News

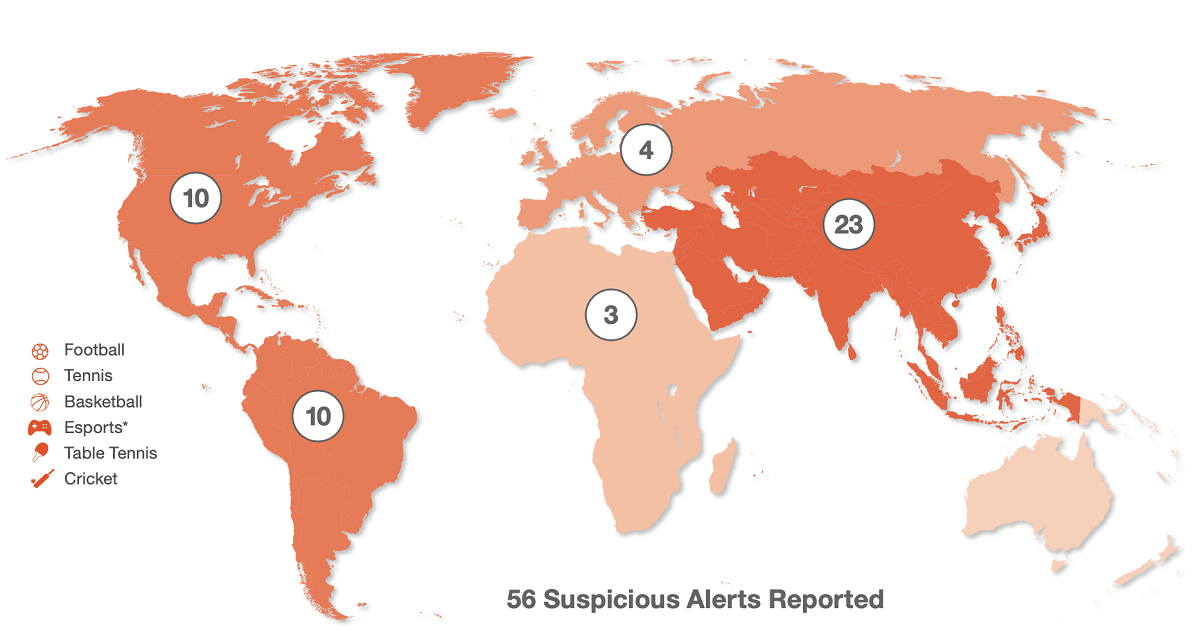

56 suspicious betting alerts reported by IBIA in Q1 2024

Football (soccer) and tennis accounted for 68% of cases

The International Betting Integrity Association (IBIA) reported 56 alerts of suspicious betting to the relevant authorities in the first quarter (Q1) of 2024.

The Q1 2024 total is an increase of 65% when compared to 34 alerts in Q4 2023 and an increase of 12% when compared to the revised Q1 2023 total of 50 alerts. All of IBIA’s alerts are identified using customer account data from IBIA members, which number over 50 companies and 125 sports betting brands, making IBIA the largest integrity monitor of its type in the world.

The 56 incidents of suspicious betting in Q1 concerned six sports, across 21 countries and five continents. Other key data for Q1 2024 includes:

- Football (soccer) had the highest number of alerts by sport with 24, representing a 50% increase on the 16 reported in Q4 2023 and a 60% increase on the 15 reported in Q1 2022.

- Turkey had the highest number of country alerts with 8 (five in football, two in tennis and one in basketball).

41% of all alerts in Q1 were identified on sporting events taking place in Asia, with North and South America joint second with 18% each. - There were only 4 alerts identified on sporting events in Europe, which represents a decrease of 76% compared to 17 alerts in Q4 2023.

Khalid Ali, IBIA CEO, said: “The first quarter saw an increase in reported alerts highlighting the ongoing challenge our members, sports and regulatory authorities face from corrupt activity, with football and Asia dominating our Q1 report. IBIA’s alerts are supported by detailed global customer account data only available to IBIA and its membership, which continues to grow, widening our world leading market coverage. That account data provides evidentiary information that is vital for advancing investigations and imposing sanctions. IBIA is committed to continuing to work closely with stakeholders and to providing this important evidence base.”

The Q1 report includes a focus on the availability of sports betting in Canada and a comparison between the licensing approach in Ontario and the monopoly approach in the rest of the country. IBIA recently released a report on the Availability of Sports Betting Products which highlighted Ontario as a leading regulated gambling jurisdiction, with an expected onshore channelisation for sports betting of 92% in 2024 forecast to rise to 97% in 2028. Whereas the rest of Canada combined is forecast to have an onshore rate of around 11% in 2024 becoming 13% by 2028.

IBIA currently represents over 60% of the private sports betting operators licensed in Ontario, with Glitnor recently announced as the latest operator to join the association in that province. IBIA is a not-for-profit body that has no competing conflicts with the delivery of commercial services to other sectors and is run by operators for operators to protect regulated sports betting markets from match-fixing. IBIA’s global monitoring network is a highly effective anti-corruption tool, detecting and reporting suspicious activity in regulated betting markets.

Through the IBIA global monitoring network it is possible to track transactional activities linked to individual customer accounts. IBIA members have over $300bn per annum in betting turnover (handle), accounting for approximately 50% of the global commercial regulated land-based and online sports betting sector, and in excess of 50% for online alone.

The post 56 suspicious betting alerts reported by IBIA in Q1 2024 appeared first on European Gaming Industry News.

-

gaming2 years ago

gaming2 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory7 years ago

iSoftBet continues to grow with new release Forest Mania

-

News6 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News5 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry6 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News5 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry6 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News6 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018