Latest News

From 3 days to 3 clicks: TrueLayer launches Verification API to deliver an effortless onboarding experience

-

Built on top of open banking, the new API delivers a significantly better onboarding experience, with 90%+ of good actors successfully verified in 3 clicks.

TrueLayer, Europe’s leading open banking platform, announced the launch of a new approach to account ownership checks with its Verification API.

Combining open banking with machine learning, the Verification API makes onboarding effortless with success rates that are over 20% higher than credit bureaus and returning a result in seconds, rather than days, compared to manual bank statement checks. By pre-verifying customer’s details, it also simplifies payments setup meaning no more failed transactions.

Multiple TrueLayer clients are using the Verification API, including Authologic, a Y Combinator-backed provider of identity verification solutions.

“Whether you are a fintech, a marketplace, or an ecommerce platform you want to deliver the best possible onboarding experience. We are aggregating different identity verification methods and we are big supporters of using open banking thanks to its ability to make the entire process more intuitive. Working with a market leader like TrueLayer to integrate its Verification API will help us to further strengthen the identity verification process for our customers,” commented Jarek Sygitowicz, co-founder of Authologic.

Traditional verification methods such as bank statement uploads are slow, error prone and create a poor user experience. While open banking offers another approach, existing providers provide access to raw data that requires businesses to then build and maintain their own logic to check that the customer’s name matches their name on file at the bank.

TrueLayer’s Verification API removes these issues. Rather than the time consuming and resource intensive task of building a matching engine, TrueLayer has developed a verification logic that sits on top of open banking rails. It matches the name supplied during the onboarding process with the name on file at the bank, providing a single feed that ensures an immediate and highly accurate response on whether their user’s account has been verified or not.

As a result, the Verification API delivers significant benefits, including:

-

An accelerated onboarding process from 3 days to just 3 clicks.

-

Coverage spanning all major banks, resulting in a 22.5% higher success rate compared to credit bureau checks.

-

Lower fraud risk through embedded Strong Customer Authentication within the bank verification flow.

-

An improved user experience, with a simple redirect to their banking app to confirm account ownership with a fingerprint or Face ID.

-

Reduced payment failures by using pre-verified account details.

-

Reduced burden on compliance teams by automating checks through a single API call.

-

Reduced burden on engineers who can focus on solving core business problems, rather than building and maintaining name-check logic.

“Verification is the first step to onboarding a new user and yet it can often take days to verify an account owner using traditional methods. Their security is questionable, they’re prone to errors and they take forever,” commented Ossama Soliman, Chief Product Officer at TrueLayer. “It doesn’t need to be that way. With the Verification API we’ve built on top of open banking to create a faster, more secure and more accurate approach to verifying a user’s account. It serves businesses across multiple industries, including financial services, PSPs, wealth management and trading, marketplaces, property and iGaming.”

Latest News

56 suspicious betting alerts reported by IBIA in Q1 2024

Football (soccer) and tennis accounted for 68% of cases

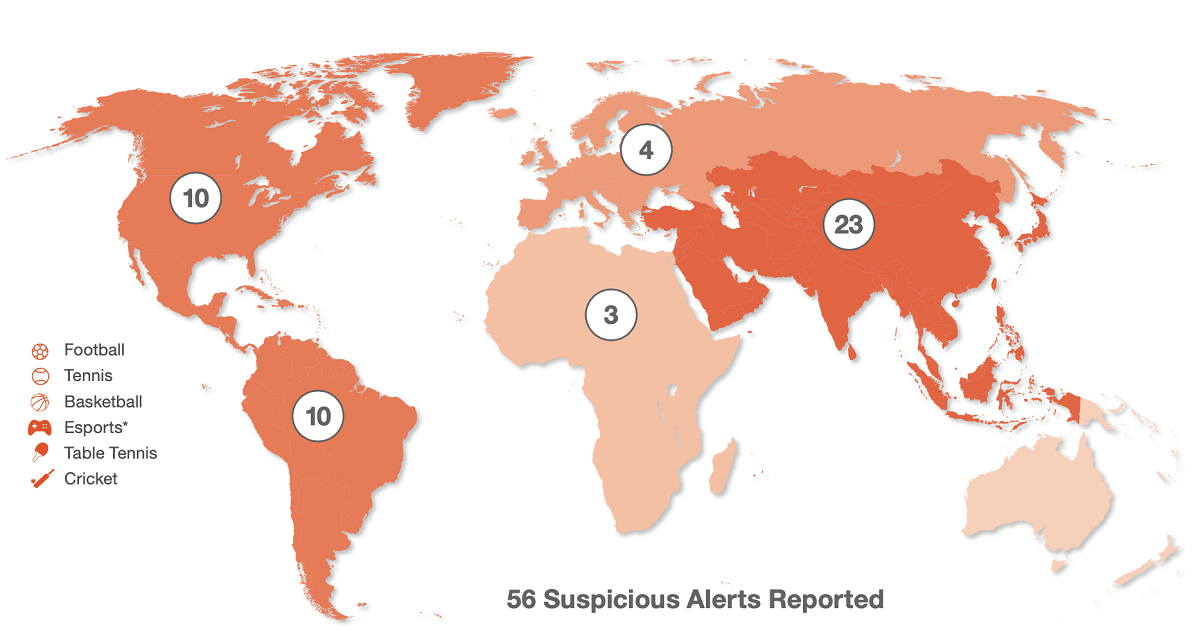

The International Betting Integrity Association (IBIA) reported 56 alerts of suspicious betting to the relevant authorities in the first quarter (Q1) of 2024.

The Q1 2024 total is an increase of 65% when compared to 34 alerts in Q4 2023 and an increase of 12% when compared to the revised Q1 2023 total of 50 alerts. All of IBIA’s alerts are identified using customer account data from IBIA members, which number over 50 companies and 125 sports betting brands, making IBIA the largest integrity monitor of its type in the world.

The 56 incidents of suspicious betting in Q1 concerned six sports, across 21 countries and five continents. Other key data for Q1 2024 includes:

- Football (soccer) had the highest number of alerts by sport with 24, representing a 50% increase on the 16 reported in Q4 2023 and a 60% increase on the 15 reported in Q1 2022.

- Turkey had the highest number of country alerts with 8 (five in football, two in tennis and one in basketball).

41% of all alerts in Q1 were identified on sporting events taking place in Asia, with North and South America joint second with 18% each. - There were only 4 alerts identified on sporting events in Europe, which represents a decrease of 76% compared to 17 alerts in Q4 2023.

Khalid Ali, IBIA CEO, said: “The first quarter saw an increase in reported alerts highlighting the ongoing challenge our members, sports and regulatory authorities face from corrupt activity, with football and Asia dominating our Q1 report. IBIA’s alerts are supported by detailed global customer account data only available to IBIA and its membership, which continues to grow, widening our world leading market coverage. That account data provides evidentiary information that is vital for advancing investigations and imposing sanctions. IBIA is committed to continuing to work closely with stakeholders and to providing this important evidence base.”

The Q1 report includes a focus on the availability of sports betting in Canada and a comparison between the licensing approach in Ontario and the monopoly approach in the rest of the country. IBIA recently released a report on the Availability of Sports Betting Products which highlighted Ontario as a leading regulated gambling jurisdiction, with an expected onshore channelisation for sports betting of 92% in 2024 forecast to rise to 97% in 2028. Whereas the rest of Canada combined is forecast to have an onshore rate of around 11% in 2024 becoming 13% by 2028.

IBIA currently represents over 60% of the private sports betting operators licensed in Ontario, with Glitnor recently announced as the latest operator to join the association in that province. IBIA is a not-for-profit body that has no competing conflicts with the delivery of commercial services to other sectors and is run by operators for operators to protect regulated sports betting markets from match-fixing. IBIA’s global monitoring network is a highly effective anti-corruption tool, detecting and reporting suspicious activity in regulated betting markets.

Through the IBIA global monitoring network it is possible to track transactional activities linked to individual customer accounts. IBIA members have over $300bn per annum in betting turnover (handle), accounting for approximately 50% of the global commercial regulated land-based and online sports betting sector, and in excess of 50% for online alone.

The post 56 suspicious betting alerts reported by IBIA in Q1 2024 appeared first on European Gaming Industry News.

Compliance Updates

Brazil’s Ministry of Finance Appoints Régis Dudena as Secretary of Prizes and Betting

Regis Dudena, a seasoned lawyer with expertise in Public and Regulatory Law, has been appointed as the new Secretary of Prizes and Betting at the Ministry of Finance in Brazil. Dudena’s appointment ordinance is signed by Rui Costa, Minister of the Civil House.

The new secretary had already been visiting the Ministry of Finance and getting closer to the entire group at the Secretariat of Prizes and Betting, until then led by Simone Vicentini, deputy secretary.

The appointment of the lawyer is attributed to the Executive Secretary of Finance, Dario Durigan. Dario and Dudena worked together at Palácio do Planalto during Dilma Rousseff’s government.

Both worked in the Legal Affairs secretariat of the Civil House. Dudena’s name is linked to other names on the left. He has good relations with Edinho Silva (PT), mayor of Araraquara (SP).

The SPA started operating two months ago. Since then, it had been without a permanent boss. Lawyer José Francisco Manssur, special advisor to the Ministry of Finance who coordinated the regulation of sports betting from the beginning, was the most likely to take on the position. But he was exonerated under pressure from Centrão politicians.

Bets representatives welcomed the name Régis Dudena.

From the beginning, the SPA was under the responsibility of Simone Vicentini, appointed as deputy secretary. Since then, it has edited the ordinances that defined requirements for laboratory accreditation and the sector’s regulatory policy.

Under her supervision, three laboratories have already been approved, GLI, eCogra, and BMM. Last week, the ordinance establishing the rules for payment transactions to be complied with by sports betting and online gaming operators was also published.

Debra Martin Chase

Gaming and Leisure Properties Appoints Debra Martin Chase to Board of Directors

Gaming and Leisure Properties Inc. announced that Debra Martin Chase has been appointed to the Board of Directors as a new independent director, effective immediately, to fill the vacancy created by the previously disclosed passing of JoAnne A. Epps.

The appointment of Ms. Chase to the Board of Directors brings the total number of directors to eight, seven of whom are considered independent according to the listing standards of the Nasdaq Stock Exchange. Ms. Chase has also been appointed as a member of the Nominating and Corporate Governance Committee of the Board of Directors, effective immediately. Ms. Chase will hold her directorship until the Company’s next annual meeting of shareholders or until her successor is duly elected and qualified or until her earlier death, disqualification, resignation, or removal.

Ms. Chase is the founder and Chief Executive Officer of an entertainment production company doing business as Martin Chase Productions. She is a two-time Tony Award winning, a Peabody Award winning, and three-time Emmy nominated television, motion picture, and Broadway producer. Ms. Chase is an entertainment industry trailblazer, being the first female African American producer to have a deal with a major motion picture studio. Her films have grossed over $500 million at the box office. She brings to the Company over 30 years of experience in motion picture and television production as well as a corporate legal background.

Peter Carlino, Chairman and Chief Executive Officer of GLPI, said: “I am delighted to welcome Debra to our Board as we believe her extensive entertainment industry experience, impressive legal background and broad board experience across public companies and the arts will serve GLPI well as we continue to drive growth in shareholder value. She brings a wealth of knowledge to GLPI, which we believe is a perfect complement to the existing strengths of the Board. I am confident that she will help expand the diverse set of viewpoints that ultimately shape our mission.”

-

gaming2 years ago

gaming2 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory7 years ago

iSoftBet continues to grow with new release Forest Mania

-

News6 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News5 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry6 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News5 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry6 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News6 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018