Latest News

Better Collective Interim report January 1 – December 31, 2020

Highlights fourth quarter 2020

- Q4 Revenue increased by 88% to 36,714 tEUR (Q4 2019: 19,579 tEUR). Organic growth was 32%. Revenue doubled from Q3 2020.

- Q4 EBITA before special items increased 92% to 13,670 tEUR (Q4 2019: 7,117 tEUR). The group EBITA-margin before special items was 37%. EBITA-margin was 52% in Publishing and 13% in Paid Media. In Q4, significant costs were added in Paid Media to shift the business model towards revenue share and new market openings.

- Earnings per share (EPS) increased by 143% to 0.18 EUR/share (Q4 2019: 0.07 EUR/share)

- Cash Flow from operations before special items was 10,148 tEUR (Q4 2019: 7,532 tEUR), an increase of 35%. The cash conversion was 71%. End of Q4, capital reserves were 43 mEUR consisting of cash of 28 mEUR and unused bank credit facilities of 15 mEUR.

- New Depositing Customers (NDCs) was above 153,000 in the quarter, a growth of 30%.

- Better Collective acquired the Atemi Group for 44 mEUR on October 1 and has completed a successful integration. Atemi Group is one of the World’s largest companies specialised in lead generation for iGaming through paid media and social media advertising. The acquisition is a major strategic move for Better Collective with significant synergistic opportunities.

Financial highlights full year 2020

- Revenue grew by 35% to 91,186 tEUR (FY 2019: 67,449 tEUR), with organic growth of 8%.

- EBITA before special items increased 34% to 36,604 tEUR (FY 2019: 27,231 tEUR). The EBITA-margin before special items was 40%.

- Cash Flow from operations before special items was 38,321 tEUR (FY 2019: 26,585 tEUR), an increase of 44%. Cash conversion rate before special items was 99%.

- Earnings per share (EPS) increased by 46% to 0.47 EUR/share (2019: 0.32 EUR/ share)

- New Depositing Customers (NDCs) exceeded 437,000 in 2020, similar to 2019. Performance was maintained despite the cancellation and postponement of major sports events due to the Covid-19 pandemic.

- During 2020, Better Collective completed acquisitions of approximately 80 mEUR:

- In March 2020, Better Collective established a strong position within the esports betting market through the acquisition of HLTV.org ApS. The purchase price was agreed at up to 34.5 mEUR on a cash and debt free basis.

- In October 2020, the acquisition of The Atemi Group was completed for 44 mEUR.

- In November 2020, the smaller acquisitions of Irishracing.com and Zagranie. com were completed for just above 1 mEUR.

- COVID-19 had a significant impact from the last part of Q1 as the pandemic set a halt on major sports events and thereby also online sports betting. Q2 was the most affected until some of the major sports in Europe resumed in June. In Q3, sports calendars were still affected with amended and reduced tournament formats, whereas Q4 has been largely back on track.

Significant events after the closure of the period

- January revenue reached 13 mEUR, a growth of 78% vs. 2020, of which 16% was organic growth. The organic growth was recorded despite a strong comparison towards January 2020 and was partly driven by the US business where total revenue in local currency almost doubled. In revenue from the affilliate business from sportsbetting and casino, the growth exceeded 200%.

- On January 1, 2021, Better Collective exercised its option to acquire a further 70% of the shares in Mindway AI for a total price of 2.3 mEUR (17 mDKK), bringing the ownership to 90%. Mindway AI specialises in software solutions based on artificial intelligence and neuroscience for identifying, preventing, and intervening in at-risk and problem gambling.

Financial targets 2021

With the expiration of the 2018-2020 targets and the introduction of segment reporting, the Board of Directors have decided on new targets for the financial year 2021: Revenue >160 mEUR, EBITDA >50 mEUR, Organic growth >20%, Net interest bearing debt/EBITDA <3.0. See page 13 of the report for more detail.

Conference call

A telephone conference will be held at 10.00 a.m. CET today by CEO Jesper Søgaard and CFO Flemming Pedersen. The presentation will simultaneously be webcasted, and both the telephone conference and the webcast offer an opportunity to ask questions.

Dial in details for participants:

Confirmation Code: 6573033

Denmark: +45 32 72 04 17

Sweden: +46 (0)8 56618467

United Kingdom: +44 (0)8444819752

Webcast link https://edge.media-server.com/mmc/p/msczk4rq

Jesper Søgaard, CEO of Better Collective, commented: “Looking back at an unusual year, I am pleased to see that our business has proven resilient and I am proud that we come out strong on performance. We have entered 2021 in great shape and are well-positioned for an eventful 2021”

Latest News

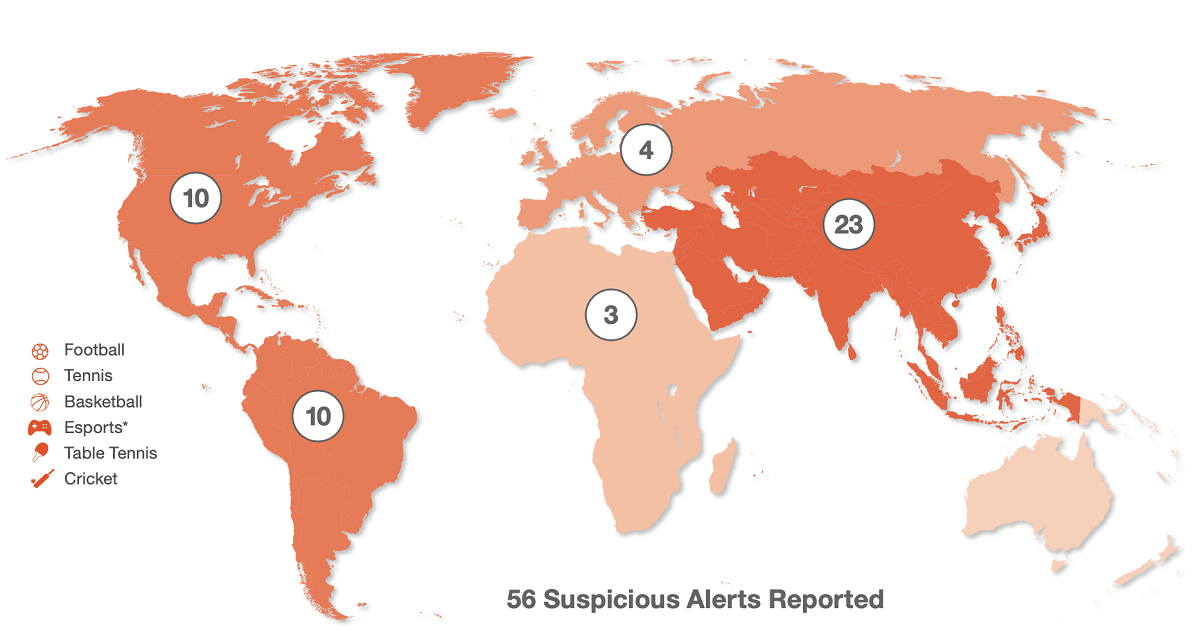

56 suspicious betting alerts reported by IBIA in Q1 2024

Football (soccer) and tennis accounted for 68% of cases

The International Betting Integrity Association (IBIA) reported 56 alerts of suspicious betting to the relevant authorities in the first quarter (Q1) of 2024.

The Q1 2024 total is an increase of 65% when compared to 34 alerts in Q4 2023 and an increase of 12% when compared to the revised Q1 2023 total of 50 alerts. All of IBIA’s alerts are identified using customer account data from IBIA members, which number over 50 companies and 125 sports betting brands, making IBIA the largest integrity monitor of its type in the world.

The 56 incidents of suspicious betting in Q1 concerned six sports, across 21 countries and five continents. Other key data for Q1 2024 includes:

- Football (soccer) had the highest number of alerts by sport with 24, representing a 50% increase on the 16 reported in Q4 2023 and a 60% increase on the 15 reported in Q1 2022.

- Turkey had the highest number of country alerts with 8 (five in football, two in tennis and one in basketball).

41% of all alerts in Q1 were identified on sporting events taking place in Asia, with North and South America joint second with 18% each. - There were only 4 alerts identified on sporting events in Europe, which represents a decrease of 76% compared to 17 alerts in Q4 2023.

Khalid Ali, IBIA CEO, said: “The first quarter saw an increase in reported alerts highlighting the ongoing challenge our members, sports and regulatory authorities face from corrupt activity, with football and Asia dominating our Q1 report. IBIA’s alerts are supported by detailed global customer account data only available to IBIA and its membership, which continues to grow, widening our world leading market coverage. That account data provides evidentiary information that is vital for advancing investigations and imposing sanctions. IBIA is committed to continuing to work closely with stakeholders and to providing this important evidence base.”

The Q1 report includes a focus on the availability of sports betting in Canada and a comparison between the licensing approach in Ontario and the monopoly approach in the rest of the country. IBIA recently released a report on the Availability of Sports Betting Products which highlighted Ontario as a leading regulated gambling jurisdiction, with an expected onshore channelisation for sports betting of 92% in 2024 forecast to rise to 97% in 2028. Whereas the rest of Canada combined is forecast to have an onshore rate of around 11% in 2024 becoming 13% by 2028.

IBIA currently represents over 60% of the private sports betting operators licensed in Ontario, with Glitnor recently announced as the latest operator to join the association in that province. IBIA is a not-for-profit body that has no competing conflicts with the delivery of commercial services to other sectors and is run by operators for operators to protect regulated sports betting markets from match-fixing. IBIA’s global monitoring network is a highly effective anti-corruption tool, detecting and reporting suspicious activity in regulated betting markets.

Through the IBIA global monitoring network it is possible to track transactional activities linked to individual customer accounts. IBIA members have over $300bn per annum in betting turnover (handle), accounting for approximately 50% of the global commercial regulated land-based and online sports betting sector, and in excess of 50% for online alone.

The post 56 suspicious betting alerts reported by IBIA in Q1 2024 appeared first on European Gaming Industry News.

Compliance Updates

Brazil’s Ministry of Finance Appoints Régis Dudena as Secretary of Prizes and Betting

Regis Dudena, a seasoned lawyer with expertise in Public and Regulatory Law, has been appointed as the new Secretary of Prizes and Betting at the Ministry of Finance in Brazil. Dudena’s appointment ordinance is signed by Rui Costa, Minister of the Civil House.

The new secretary had already been visiting the Ministry of Finance and getting closer to the entire group at the Secretariat of Prizes and Betting, until then led by Simone Vicentini, deputy secretary.

The appointment of the lawyer is attributed to the Executive Secretary of Finance, Dario Durigan. Dario and Dudena worked together at Palácio do Planalto during Dilma Rousseff’s government.

Both worked in the Legal Affairs secretariat of the Civil House. Dudena’s name is linked to other names on the left. He has good relations with Edinho Silva (PT), mayor of Araraquara (SP).

The SPA started operating two months ago. Since then, it had been without a permanent boss. Lawyer José Francisco Manssur, special advisor to the Ministry of Finance who coordinated the regulation of sports betting from the beginning, was the most likely to take on the position. But he was exonerated under pressure from Centrão politicians.

Bets representatives welcomed the name Régis Dudena.

From the beginning, the SPA was under the responsibility of Simone Vicentini, appointed as deputy secretary. Since then, it has edited the ordinances that defined requirements for laboratory accreditation and the sector’s regulatory policy.

Under her supervision, three laboratories have already been approved, GLI, eCogra, and BMM. Last week, the ordinance establishing the rules for payment transactions to be complied with by sports betting and online gaming operators was also published.

Debra Martin Chase

Gaming and Leisure Properties Appoints Debra Martin Chase to Board of Directors

Gaming and Leisure Properties Inc. announced that Debra Martin Chase has been appointed to the Board of Directors as a new independent director, effective immediately, to fill the vacancy created by the previously disclosed passing of JoAnne A. Epps.

The appointment of Ms. Chase to the Board of Directors brings the total number of directors to eight, seven of whom are considered independent according to the listing standards of the Nasdaq Stock Exchange. Ms. Chase has also been appointed as a member of the Nominating and Corporate Governance Committee of the Board of Directors, effective immediately. Ms. Chase will hold her directorship until the Company’s next annual meeting of shareholders or until her successor is duly elected and qualified or until her earlier death, disqualification, resignation, or removal.

Ms. Chase is the founder and Chief Executive Officer of an entertainment production company doing business as Martin Chase Productions. She is a two-time Tony Award winning, a Peabody Award winning, and three-time Emmy nominated television, motion picture, and Broadway producer. Ms. Chase is an entertainment industry trailblazer, being the first female African American producer to have a deal with a major motion picture studio. Her films have grossed over $500 million at the box office. She brings to the Company over 30 years of experience in motion picture and television production as well as a corporate legal background.

Peter Carlino, Chairman and Chief Executive Officer of GLPI, said: “I am delighted to welcome Debra to our Board as we believe her extensive entertainment industry experience, impressive legal background and broad board experience across public companies and the arts will serve GLPI well as we continue to drive growth in shareholder value. She brings a wealth of knowledge to GLPI, which we believe is a perfect complement to the existing strengths of the Board. I am confident that she will help expand the diverse set of viewpoints that ultimately shape our mission.”

-

gaming2 years ago

gaming2 years agoODIN by 4Players: Immersive, state-of-the-art in-game audio launches into the next generation of gaming

-

EEG iGaming Directory7 years ago

iSoftBet continues to grow with new release Forest Mania

-

News6 years ago

Softbroke collaborates with Asia Live Tech for the expansion of the service line in the igaming market

-

News5 years ago

Super Bowl LIII: NFL Fans Can Bet on the #1 Sportsbook Review Site Betting-Super-Bowl.com, Providing Free Unbiased and Trusted News, Picks and Predictions

-

iGaming Industry6 years ago

Rick Meitzler appointed to the Indian Gaming Magazine Advisory Board for 2018

-

News5 years ago

REVEALED: Top eSports players set to earn $3.2 million in 2019

-

iGaming Industry6 years ago

French Senator raises Loot Boxes to France’s Gambling Regulator

-

News6 years ago

Exclusive Interview with Miklos Handa (Founder of the email marketing solutions, “MailMike.net”), speaker at Vienna International Gaming Expo 2018